CKYHE to be decimated by merger mania

Analysis from California-based BCO consultants 10xoceansolutions shows both the huge confusion shippers face as the transpacific renewal period closes in as well as the likely dramatic contraction in size of a leading container alliance if a number of containerline mergers go through.

Chas Deller, ceo and chairman of 10xoceansolutions, said shippers were in for a very tricky period deciding where to place their contracts for the transpacific this season.

“With the inevitable changes to alliance structures brought about by the CMA CGM purchase of APL/NOL and the China merger of CSCL and Cosco the new year has started with a new twist for shippers, especially on the major east-west trades,” Deller told Splash.

“With the transpacific contract season approaching how does a BCO choose who to use this season when the new alliance structure is so up in the air?” Deller mused. To add to their confusion Deller noted the potential of a South Korean merger between Hanjin and Hyundai Merchant Marine. “This makes all four major alliances uncertain. It is very confusing times ahead for major BCOs who like to spread their business across the alliances,” Deller said.

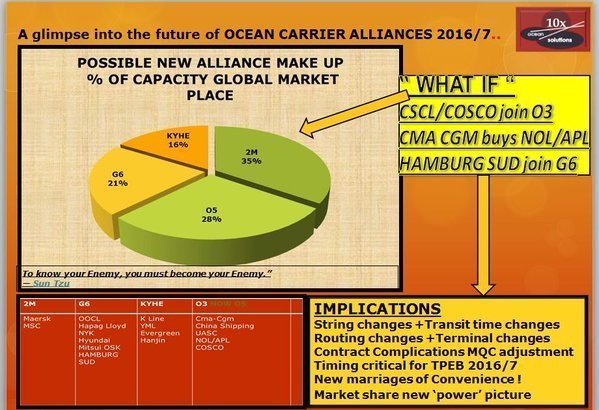

Data provided by 10xoceansolutions (see infographic below) shows the CKYHE alliance could be the biggest loser if all these mergers do take place. The consultant sees Cosco departing for Ocean3, where APL could end up as well. CKYHE would then comprise just K Line, Yang Ming, Hanjin and Evergreen and have a market share on the main tradelanes of just 16%. Hamburg Sud, meanwhile, is tipped to join G6, replacing APL.

Commenting on the alliance musical chairs, Lars Jensen from SeaIntel and a regular Splash columnist, said: “We are presently at a point where it is clear that some changes will happen to the alliance structure, and a number of different scenarios are possible. If the depicted scenario of a strong Ocean5 emerges, it becomes doubtful whether the G6 and KYHE alliances will continue as hitherto. In that case a more drastic change might happen, as the scale advantage of 2M and O5 becomes very significant possibly prompting a more fundamental rethink of the G6 and KYHE alliances.”

Another Splash columnist, Kris Kosmala from software firm Quintiq, commented: “All in all, everybody in the container business is expecting continuous consolidation over the next 24 months, so stability of the alliances will be at risk in the near term until we know who will be left standing.”

Splash is conducting an online poll for sister title Maritime CEO at the moment. One of the eight questions posed in the Future of Shipping Poll asks if container alliances are doomed. Of the more than 550 respondents so far, three quarters believe alliances are here to stay. The poll – which looks at finance, consolidation, bankruptcies among other topics – takes just two minutes to fill in and there is no registration needed. It can be accessed here.