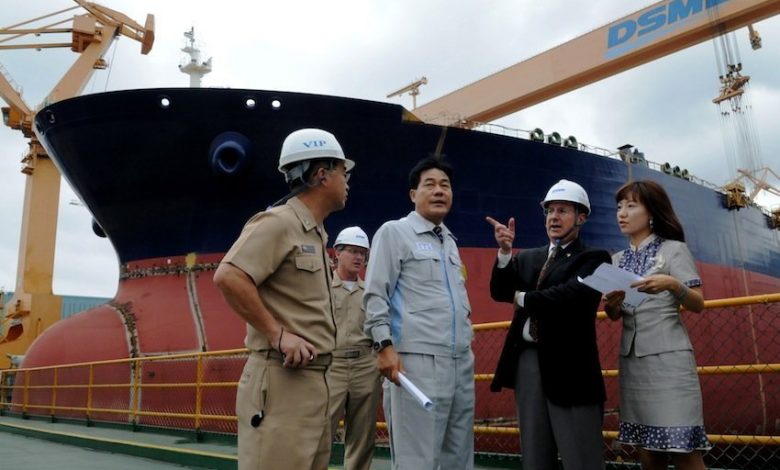

As financially struggling Daewoo Shipbuilding & Marine Engineering (DSME) tries to engineer a turnaround, vast swathes of the conglomerate have been put on the block, some of which could see senior management’s golf handicap worsen.

DSME has said among many assets for sale is a golf course, FLC, which it has already received three bids for.

The Korean shipyard has announced it wills sell all non-core assets and affiliates including its Seoul headquarters building. Romania’s largest shipyard, Daewoo Mangalia, is also part of the firesale as DSME aims to right its balance sheet which suffered losses to the tune of trillions of won in the second quarter.

Offloading golf courses when in financial strife is nothing new to Korean shipping companies, nor indeed for Asian shipbuilders. During one of its numerous flirtations with bankruptcy Korean line Hyundai Merchant Marine also sold a golf course, while Vinashin, now rebranded as SBIC, was forced to sell its golf course and hundreds of other subsidiaries when debts of billions of dollars were revealed in the Vietnamese shipbuilder’s books four years ago.