Industry heavyweights applaud Hapag-Lloyd and UASC merger move

News that Hapag-Lloyd will move ahead with a merger with United Arab Shipping Co (UASC) has been greeted with approval by analysts and experts contacted by Splash.

UASC announced yesterday that its six shareholding states has approved a merger deal with the German line at an extraordinary general meeting on Wednesday.

The deal would see Hapag-Lloyd (which merged with CSAV 18 months ago) have a 72% holding of the new company with UASC holding the rest.

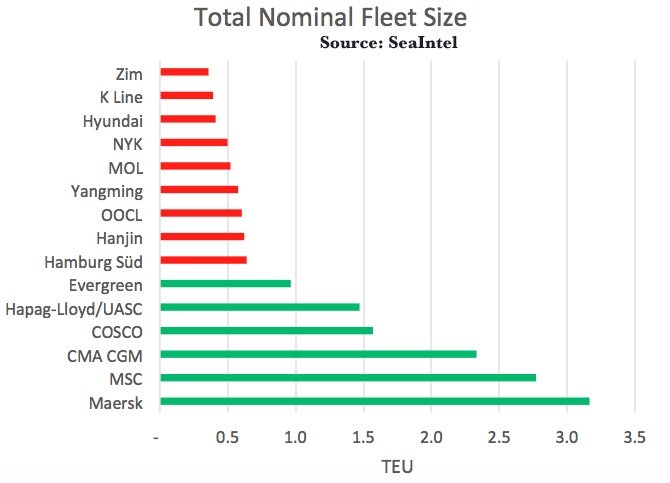

Lars Jensen from SeaIntelligence Consulting noted how this latest merger served to heighten the stratification between large and small carriers amongst the global players.

“Should the merger be approved, Hapag-Lloyd will become the fifth carrier to have a fleet exceeding 1m teu of nominal capacity, and in essence be almost on par with COSCO in terms of global scale,” he said. (See graph)

“The merger will be another step in what can be seen as both a consolidation and a globalisation in the industry,” Jensen continued, adding: “Six carriers are now becoming significantly larger than their competitors, a development which is sure to change the market dynamics and the strategic choices for the carriers involved in the coming years.”

He also pointed out that all the changes in the industry mean we will look at carriers differently going forward, as the national connotations for the carriers will become blurred. This is the same too for CMA CGM, which has just bought out Singapore’s flag carrier, Neptune Orient Lines (NOL).

Even though Hapag Lloyd will remain headquartered in Hamburg, it will have a much more diversified background in its ownership base, with now both strong Chilean and Arab ownership stakes – a diversification which Jensen said can be a significant asset if harnessed correctly, but also a risk if there is not consensus amongst the owners with regards to the long-term strategy.

“The merger of Hapag-Lloyd and UASC confirms that only by having the scale, a modern container carrier can survive the expected prolonged weakness of the container shipping market,” said Kris Kosmala, a Splash columnist and vice president for Quintiq Asia Pacific. “The true value of that merger, and its value in context of the realigned alliances, will be severely tested over the next 24 months,” Kosmala added. “I hope that the combination of Hapag-Lloyd and UASC will be sufficiently resilient to survive what is shaping to be the most challenging period of this industry in modern times.”

UASC tying the knot with Hapag-Lloyd will likely mean UASC will be absorbed into the new container grouping, THE Alliance, which also features NYK, MOL, K Line, Hanjin and Yang Ming.

Tobias Koenig from Lexington Maritime and another Splash columnist, commented: “The merger of Hapag-Lloyd and UASC creates a significantly stronger container line in an environment where both size and strong shareholders matter. I am happy to see Hapag-Lloyd growing and strengthening its position.”

Dagfinn Lunde from Dagmar Navigation told Splash the merger was “finally something sensible happening in the container industry”. He said it was a good follow-up to CMA CGM’s pursuit of NOL.

“UASC and Hapag-Lloyd have nice complimentary strengths. I hope the cultures can work nicely together,” Lunde concluded.