Offshore drilling rig empires emerging to take over the industry

Call them speculative, but the drilling companies and investors buying offshore rigs at today’s values could be dominating the industry soon, writes David Carter Shinn from Bassoe Offshore.

We’ve commented on all the offshore rig deals that have happened this year, and there have been quite a few of them. Borr Drilling, Northern Drilling, Shelf, Ensco, and most recently, Transocean have started acquiring offshore rigs at values which may never be seen again.

What do they know that nobody else does? If you’ve been following the market over the past few years, the answer should be nothing. Dayrates have fallen by at least 50% compared to their highs in 2013–2014. Values for modern (post 2007 built) rigs have declined to 50% or less of original construction cost.

The difference between the active players and those who remain idle is that the former believe in a material, sustained improvement in dayrates (and utilization) or simply have better access to capital compared to their debt-burdened peers.

Although one could argue that this year’s deals can be viewed as out of the money today, the conclusion is simple: if you think offshore rig dayrates are going to rise, then you should be buying new rigs.

The idea is that you don’t have to believe that the market will return to its peak to make money off acquiring rigs these days. You just need dayrates to go up enough to support your investment.

The risk, of course, lies in the curve (timing and magnitude) that rig dayrates will follow. But this risk seems to be diminishing as signs of improvement in the rig market become clearer.

According to comments made by Borr Drilling last week, “since the start of the year, marketed utilization for Independent Cantilever (IC) jack-up rigs that are less than 10 years old has improved by 3 percentage points to 72% today. During the same period marketed utilization for IC jack-ups older than 10 years has decreased 4 percentage points to 66%.”

Borr’s statement reinforces the point that demand for new rigs is rising. It’s also consistent with our views on old rigs versus new rigs where we estimate that up to 340 old rigs could be scrapped by 2020.

Borr acquired the Hercules Super A class rigs at $65m each, and the average price they paid for the newer Transocean jackups (not including those still under construction) can be estimated to be around $135m.

This compares to an average all-in construction cost of around $230m.

Northern Drilling paid $365m for the Norway-compliant newbuild semisub, West Mira. In August, Transocean paid around $350m for the four Songa Cat-D semisubs (also Norway-compliant) depending on how you value the rigs’ backlog. This compares to an average all-in construction cost of over $700m.

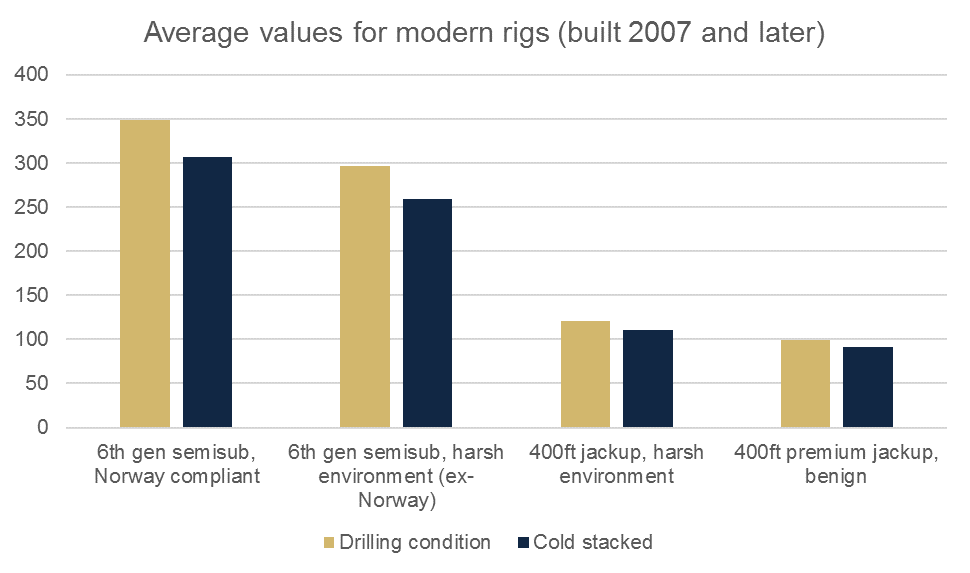

While current average Rig Valuation Tool (RVT) values for 6th gen Norway-compliant semis are at $350m, we already value the West Mira (including other ‘premium’ Norway-compliant semisubs) at $385m–$426m and the four Songa rigs at $350m –$389m.

On the jackup side, our average RVT values match with these transactions, but we see values rising further for 400ft premium and harsh environment rigs through next year.

Two highly simplified examples illustrate why rig acquisition deals are happening now.

Consider that a ‘premium’ newbuild 6th gen harsh environment semisub cost around $700m to build and can be purchased for around $400m today. With current dayrates of $225,000, a very basic measure of cash-on-cash investment payback comes in at 34.2 years based on newbuild cost and 19.6 years based on current value. If dayrates rise to $350,000 within the next two years or so, payback reduces to 10.9 years and 6.2 years.

A similar scenario plays out for jackups, where a rig purchased at $120m today can achieve a 6.6 year payback if dayrates rise to a conservative $125,000.

We don’t consider other variables like SPS costs, additional investments, and downtime between contracts as these are constants. Ceterus paribus, the numbers demonstrate that the magnitude of the investment advantage an owner gets by acquiring rigs at today’s values is significant. And that’s why – if the market develops as they believe it will – new owners and established owners who are systematically adding first class assets to their fleets will dominate the industry.

Empires are rarely built in a day, and the clock on this cycle’s downturn in the rig market won’t run forever.

If more rig acquisitions occur, rig values may rise ahead of the dayrate curve, so those who invest early will find themselves even stronger in the future. The risk of rig values falling further (for new rigs) seems outweighed by the likelihood that they’ll rise as oil companies continue to prefer modern, efficient rigs and the pool of supply becomes smaller.

Look for more transactions as the shakeup in the offshore rig market continues.

I would argue an entirely different vantage point for multiple reasons. The Transocean moves were incredibly defensive as they sold off the JU’s due to the liabilities associated with the new build contracts and then turned around to buy backlock essentially with almost no upside potential for the Songa rigs as they are all locked in to fixed term fixtures into the next decade. Ensco is making a terrible acquisition and there are many that believe this deal will not even go through in it’s current form due to the liabilities associated with the new builds that Atwood currently has. They would probably agree with your underlying thesis, but it is a very risky move to leverage as much as they are with almost no fixture approaching 200k in the DS segment into a protracted downturn. Borr, Northern, and Shelf can all be totally isolated from the rest of this argument as they are operating in a very different set of scenarios compared to the real long term players. These companies have Jack Up’s with very low margins in general. Especially Shelf as they have many low specification older JU’s that will not be able to demand the higher day rates moving forward. It’s almost ridiculous to not even mention Diamond Offshore as they have the best balance sheet in the industry and are the most able to go after assets or M&A opportunities and yet they haven’t. If the industry would have operated the same way they have over the course of the last decade, the industry would be in much better shape, but they didn’t sadly. Diamond is best in class and is tell you they don’t believe the prices are reasonable and that there is still further to go. You might want to listen.