Polarcus shares to trade ex-reverse split from tomorrow

Oslo-listed Polarcus Limited has turned around its reverse stock split in double-quick timing, and its shares will begin trading on a ex-reverse split basis from Friday.

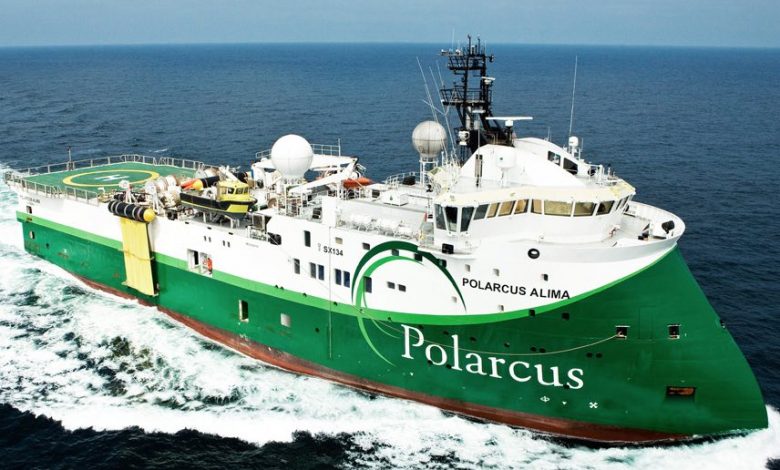

The owner of seismic research vessels currently has a market capitalisation of NOK 167.45m at its current share price of NOK 0.25. The minimum market cap of companies listed on the Oslo Børs is NOK 300m, which means Polarcus has technically been in breach of these requirements since November 6, when its share price fell below NOK 0.45. The Børs’ minimum share price is NOK 0.1.

When markets open on Friday, ten old Polarcus shares will give one new share. The company’s number of outstanding shares will consequently be reduced to 66,981,368 shares.

After the share consolidation, the nominal value of the shares will be $0.2 (NOK 1.73), Polarcus said in an earlier exchange filing.

The reverse stock split also affects the conversion price of Polarcus’ $125,000,000 2.875% secured convertible bond issue 2011/2016. The company said that as of Friday the conversion factor will be adjusted from $1.5476 to $15.476, in accordance with the bond agreement clause 15.2.

On Monday, Polarcus acquired 15,000 shares of its stock at a price of NOK 0.32 per share, which comprise the entirety of the company’s treasury shares. The company bought the tranche in order to facilitate the share consolidation, after which it will dispose of any treasury shares not needed for the reverse split.