Scrubbers are a good investment: DNB

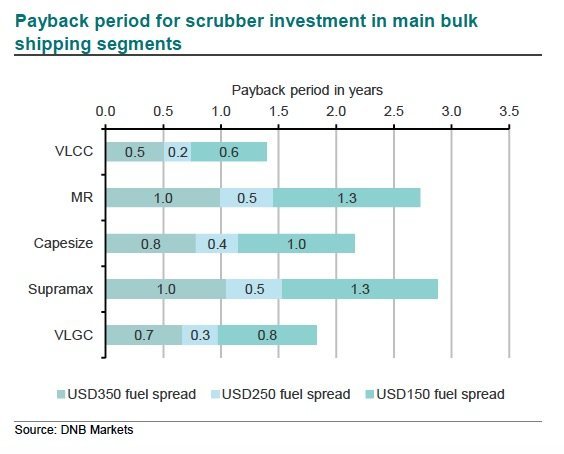

Norway’s DNB Markets has published an in-depth report on scrubber uptake across the shipping industry and is forecasting the technology add-on to vessels is a good investment and should pay back in less than 18 months after the global sulphur cap kicks in on January 1, 2020.

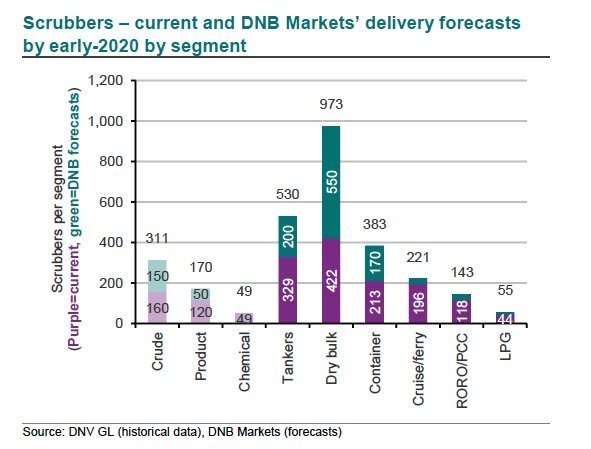

Scrubber uptake is accelerating towards 2,300 units by 2020 by DNB estimates – covering 15% of pre-2020 heavy fuel oil (HFO) demand – and largely offsetting potential positive effects of higher fuel costs on vessel speed and supply. Sector-wise DNB is predicting scrubber installations reaching 973 in dry bulk, 530 in tankers and 383 in containers by 2020 with larger ships more likely to have the exhaust gas cleaners installed.

DNB is calculating the most fuel-hungry 5% of the global fleet consume about 38% of all marine fuels, and the top 2.5% account for 24%. It is these larger ships that will be targeted for scrubbers, DNB states, predicting 23% of the VLCC fleet could be equipped with scrubbers entering 2020 versus 14% for suezmax and 7% for aframax vessels, and 35% of capesizes in the dry bulk fleet compared to 9% of panamaxes and 3% of supramaxes.

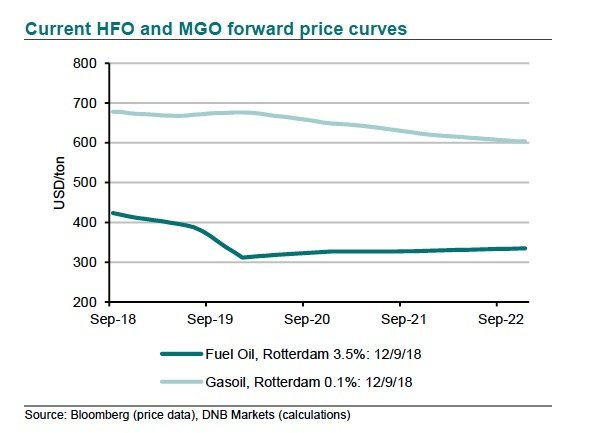

“Put simply, scrubbers look a good investment,” DNB Markets stated, explaining: “Assuming a USD250/tonne fuel price spread between HFO and a compliant alternative, we estimate a scrubber investment payback period of nine months for a VLCC, 12 months for a VLGC, 14 months for a Capesize, 17 months for an MR and 18 months for a Supramax.”

DNB has calculated the average payback time across the main asset classes is likely to be less than 18 months, even for a supramax bulker.

Fuel decisions for shipowners will be under the spotlight in a special 2020 Vision panel at next month’s Maritime CEO Forum in Hong Kong, which will be covered by Splash.