Ultra Deep Solutions: The art of subsea

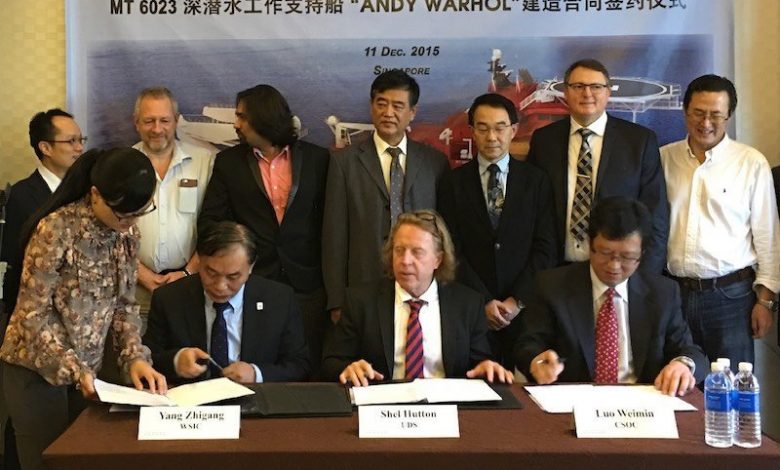

Shel Hutton: the man… the myth… the legend.” So gushes one contact of this dive veteran on LinkedIn, and indeed there is a sense that Hutton is rather different than your average shipowner. Just look at the picture and the name of the ship he’s signing for. Then there’s his educational background on LinkedIn: Hudson’s Bay College of Tequila.

However, do not be fooled, Hutton is whip smart and aware of a lovely niche in an otherwise saturated offshore market.

Armed with more than 35 years experience in the offshore industry Hutton founded Ultra Deep Solutions (UDS) in August 2014, having previously worked for many well-known names including Kreuz Subsea and Technip.

By 2014, Hutton had identified that the dive support sector was a rarity in offshore – with an ageing, limited fleet.

“The last company I came from was moving in the wrong direction,” he recalls. “Swiber/Kreuz were in a self-destruct period and I wasn’t liking what I was seeing.”

After Kreuz was sold to Headland Fund out of Hong Kong Hutton set about planning the creation of UDS to, as he says, “tackle a market that was getting old”.

Hutton explains there are 95 DSVs in the world. More than 30 of these are over 30 years old. Out of the 95 he found at least 15 others underpowered or poorly designed. This left just 55 to compete against.

“As long as we stuck to our business plan to build the best vessels, DNV-GL classed, and at the lowest cost we would be in good shape,” he recounts, adding that the plan was never to build for tomorrow but build for the future adding in the latest high tech to the vessels.

UDS now has four vessels on order and is looking to sign another three to four contracts in the coming 12 months. This includes subsea vessels not just dive support ones.

“UDS,” Hutton insists, “will have one of the youngest fleets in the world at the lowest cost.”

Moreover, he’s adamant that oil prices are ticking up. He claims to have called the oil price bottom correctly this February.

“Right now as the recovery is happening the new zero for oil is $45 to $50. Our turnaround will be mid-2017 to Q3 2017, when we will see oil at $65 to $70,” Hutton says.

The owner of the Andy Warhol among other vessels hopes for more than 15 seconds of fame.

“Our company’s strategy really has relied on timing and holding little debt,” he concludes.

This interview first appeared in Maritime CEO Magazine. To access the entire magazine click here.