2018 expected to be a year of transition for tankers

Q4 has been a disappointment for tanker owners and consensus is for another poor year ahead; Maritime Strategies International has constructed a plausible scenario which could turn the tide faster, writes director for oil and tanker markets, Tim Smith.

After a step up in October, November saw little change in the overall tanker freight market; on a monthly basis earnings mostly deteriorated. The first half of December has seen a revival in some areas, but little to get excited about for owners.

Contrary to typical trends, VLCC spot earnings have dived in early December and with the clock ticking on 2017, Q4 will be seen as a weak period for the tanker market. Key to the market environment in 2018 is OPEC’s decision to continue its output restrictions across the course of next year. This does not come as a surprise, and is broadly aligned with the MSI Base Case oil market outlook described in its Q4 17 tanker markets report.

MSI forecasts tanker earnings levels in 2018 as comparable to 2017. The risk of lower rates remains but as we enter 2018, we can’t ignore some of the positive signs emerging for the tanker market.

Considerable oil demand growth, lower fleet growth, sizable drawdowns in stocks, rising seaborne exports from the US, a strong refining market and unleashed refineries in China have the potential to combine into a much better demand-side environment than we are envisioning for 2018.

Pushing global oil demand growth up to 1.8% versus the 1.4% in the MSI Base Case, generates higher crude import growth across key regions, shown in Chart 1.

The upside scenario is further emphasised in China where considerable uncertainty over import demand remains, particularly given the major role played by inventory builds. Higher crude imports driven by increased demand are exacerbated in the scenario by Strategic Petroleum Reserve builds and strong buying by independent refineries.

The latter presents an upside risk given generous quota allocations announced in Q4. SPR builds remain outside of conventional oil market demand and this scenario acknowledges the uncertainty surrounding China’s crude buying and implies an upside swing of about 25 million tonnes, or 500,000 b/d, versus our Base Case.

As such China’s incremental growth in crude imports is comparable to 2017, and the net global change more closely resembles 2015/16 rather than the markedly weaker conditions seen in 2017, helped by other parts of Asia.

The initial effect on the tanker freight market is a bounce of about 15%, and that is under our assumption for fleet dynamics.

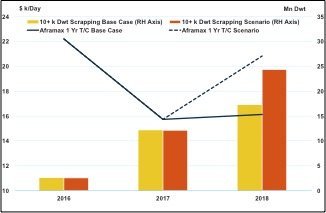

Scrapping will play a key role in determining market conditions next year and to exacerbate the positive effects we can also ramp up scrapping activity.

Pushing up our total scrapping in 2018 is feasible given the age profile of the fleet, increased propensity to scrap seen in 2017 and the volume of tonnage we have coming off the market in the years after 2018. Effectively we are frontloading this activity into 2018 in our scenario.

Scrapping has been pushed up by about 40% in 2018. This will affect all segments but for illustrative purposes Chart 2 illustrates the impact on an Aframax crude tanker. The one year T/C increases by nearly 30% from our Base Case, to an entirely plausible $20,800/day in 2019, accelerating the upswing which otherwise kicks in in 2019.