2020 HSFO-MGO price differential likely to rise, but scrubber case still uncertain

Ishaan Hemnani from BunkerEx has investigated where existing 3.5% HSFO bunker demand will go, how this will be replaced and what this means for prices.

The future cost of 3.5% HSFO could go as low as $220 per metric ton. The only markets left for 3.5% HSFO are power generation, which currently uses LNG and coal (approximately $114/mt). In order to compete, 3.5% HSFO will need to be priced at parity with LNG and coal which results in a price of approximately $220/mt.

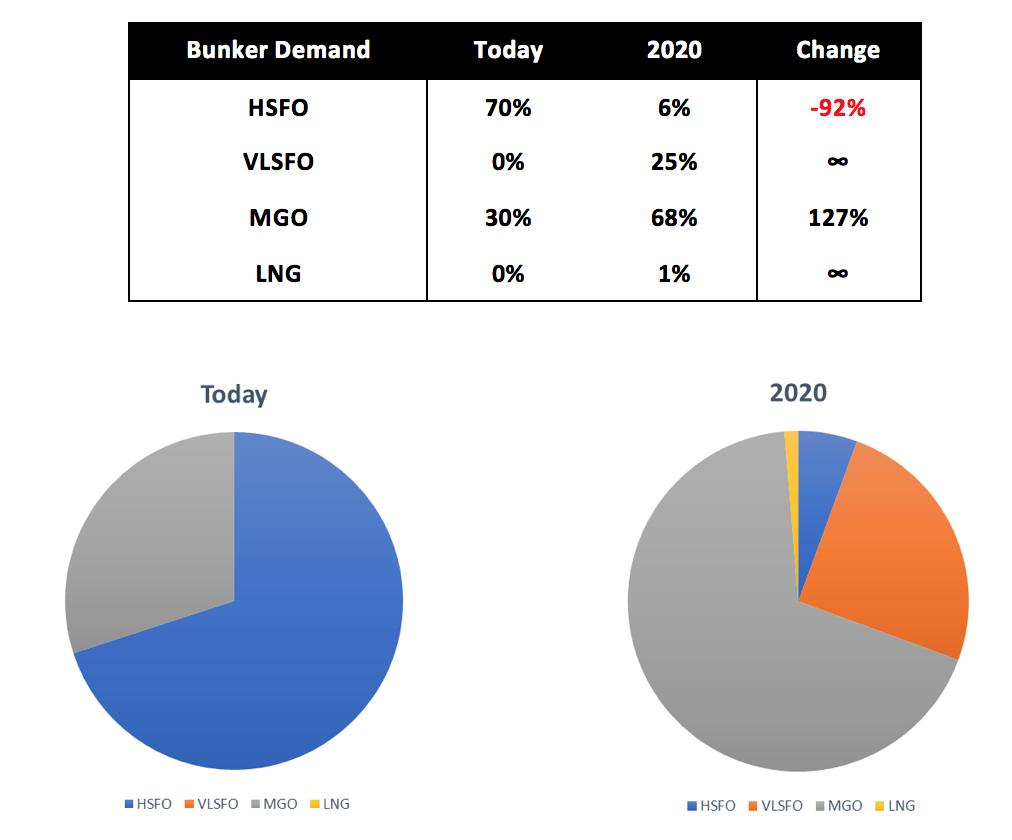

Even with the uptake in retrofit scrubber demand and the widespread installation on newbuilds, the most optimistic figures indicate that 3,800 ships will have scrubbers by 2020.

Various estimates put 3.5% HSFO demand from scrubbers anywhere from 5-33% of total bunker demand (300-1,050kbpd) meaning at best 66% of 3.5% HSFO bunker demand will disappear (assuming full compliance).

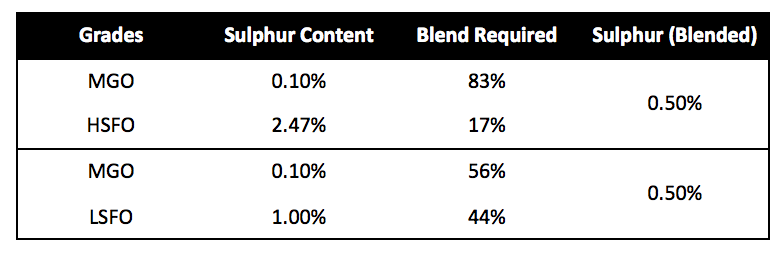

1% LSFO, although not compliant itself will be blended with 0.1% MGO to create a 0.5% VLSFO. The demand for 1% LSFO is already reflected in the high spread vs 3.5% HSFO.

Even using a [technically incorrect] assumption that sulphur blends linearly, the mixes required to turn a 2.47% HSFO (global average) to 0.5% would be 83% of MGO and 17% of HSFO.

Therefore the use cases for 3.5% HSFO are low outside of power generation and it’s difficult to see any support for prices of high sulphur products.

The cost of 0.1% MGO could go as high as $900/mt from current levels. This is not just because more ships will run on 0.1% MGO but also for its use in blending to a 0.5% VLSFO (see table above).

Several majors have already announced they will have 0.5% VLSFO blends available in the major ports, however current blends are priced at near-parity to 0.1% MGO. In addition, the quantities available (whether delivered or ex-wharf) are a major uncertainty.

The IEA assumes 1m barrels per day of bunker demand will move to 0.5% VLSFO (out of a total bunker demand of 4m bpd) – i.e. 25% of future bunker demand will come from new compliant fuels.

LNG has been touted as a potential solution, however even with a high prediction on the number of LNG vessels (600 by 2020 – source: DNV GL) it still remains at <1% of total bunker demand.

As a result, 68% of bunker demand has to be fulfilled by 0.1% MGO – more than double what it is now.

The increase in 0.1% MGO bunker demand:

With refining capacity already strained and distillate yields at near-max levels, it’s likely to result in an increase in 0.1% MGO price by at least $120/mt in order to compete with other end consumers and incentivise higher refinery output.

This would cause the total spread between HSFO-MGO to be $680/mt creating a large incentive for both shipowners and suppliers to find a solution.

Although an increasing price differential between 3.5% HSFO and VLSFO/MGO may significantly decrease the theoretical payback time on a scrubber, there are larger issues and areas of uncertainty.

Consider that the top seven ports account for 60% of bunker demand (Singapore skews this number significantly). This weakens the case for non-compliance as a higher concentration of supply points is easier to police. Now consider the supply chain for Singapore of 3.5% HSFO.

3.5% HSFO is typically sourced from the Baltics or Caribbean and then transported to Singapore via VLCC. The East-West (Rotterdam vs Singapore 380cst price) typically trades at $20-30/mt to cover this freight cost. Will there still be incentive for this arb to be open with a low 3.5% HSFO price and extremely uncertain demand volumes?

Furthermore, the cargoes are then stored, broken down and sold ex-wharf in small lots to barge operators: will there still be barge suppliers dedicated to delivering 3.5% HSFO fuel?

Given the recent bad press about open-loop scrubbers, closed-loop scrubbers are likely to be the only option. This means ships will need chemical additives onboard, plus a sludge removal plan which can complicate operations and increase costs.

34 industry leaders from companies such as Maersk, Cargill and Trafigura this week committed to zero-carbon emission fuels by 2030. This surfaces another big question: will scrubbers again have to change, especially with space on-board already constrained?

BunkerEx, a company focused on technology solutions for bunker procurement has already seen demand from shipping companies for EUA, CER and VER Carbon Credits as a hedge against upcoming regulations.

As the supplier landscape changes, existing products will need to find new homes and prices.

3.5% HSFO will find its way to power generation and storage from refineries who have to produce it (this might be good for dirty tankers as floating storage). Existing flows of 3.5% HSFO will likely stop. 3.5% HSFO barges will likely switch to 0.5% VLSFO or 0.1% MGO.

0.5% VLSFO will be attractive based on its price differential to 0.1% MGO. However, this has key ‘known unknowns’ such as specifications (currently no standards) and stability (can two different types of 0.5% VLSFO fuel be mixed?).

0.1% MGO will likely be the dominant bunker fuel of choice however refinery supply restrictions will make this much more expensive. Fuel efficiency will be key as bunker prices rise.

LNG, although much talked about will likely account for <1% of demand in 2020. Its impact will likely be felt closer to 2030 as many newbuild ships have dual fuel engines and the supply network has time to mature.

With rising fuel prices, BunkerEx records calorific values of all fuel supplies to monitor variations between suppliers, ports and fuel types. This assists in assessing the true energy cost to shipping companies and can be compared on a MJ/$ basis.

I think you’ve made an error in your analysis that 8.2% scrubber adoption would result in a 91.8% reduction in HSFO demand.

Scrubber adoptions have been overwhelmingly in very large vessels with high fuel consumption (500-1500+ mt/day). The payback period for such vessels is thought to be in the region of 1 year.

This small number of high-consumption vessels account for a dramatic proportion of the entire fleet’s HSFO fuel consumption. Goldman Sach’s analysis sees at least 1-1.4 million barrels a day demand remaining, down from 3.3 b/d peak (see: “IMO 2020 — Challenging but solvable”).

There’s a substantial degree of uncertainty, but at least 1/3 of today’s demand seems likely given the predicted numbers.

You can’t assume scrubber installations will be installed on the average , irrespective of vessel size/consumption.

…. except that all vessels do not consume the same share of the fleet!

most scrubbers will be installed on large vessels that consume much more bunker than the rest

Very poorly researched article.

There is a massive imbalance in the fuel efficiency of the global fleet, the “most fuel-hungry ” vessels – about 5% of the fleet – currently consume 38% of all marine fuels. The top 2.5% of that accounts for 24% of the consumption. Scrubber installations for IMO 2020 compliance are likely to be concentrated on these larger vessels with much higher fuel consumption. So even if only 8.2% of the global fleet use scrubbers, 45 – 50% of the marine fuel used post 2020 could still be high sulphur HFO, not 91.8% as suggested in this article.

It’s this kind of very poor analysis, that is causing confusion about IMO 2020. Considering these articles, and not just this one mind , are written by so called industry experts, then it’s no wonder that confusion reigns.

Nonetheless most estimates we’ve seen for 2020 HSFO scrubber demand are between 5-10% of the total HSFO pool (300k-800k bpd) – of course this is up for debate. Once we took those numbers however, demand of MGO dramatically increases and a large amount of HSFO demand disappears.

Agreed, this is highly dependant on that assumption. However we’re trying to illustrate that the HSFO-MGO 2020 differential still seems narrow, as a large portion of HSFO has to compete for power generation and there isn’t enough refining capacity to fulfil MGO demand.

Just to incorporate comments from above, even if we rerun the analysis and assume that 33% of HSFO demand remains, it still produces a 37% increase in MGO demand.

Looking at IEA data, distillate yields struggle to get >56% despite distillate cracks incentivising max production for some time. This also means to produce an additional 1mbpd of distillates, refineries need to run +1.79mbpd extra crude which is a significant increase in utilisation.

Additionally, distillate yields are highest from running ‘heavier’ crudes (API’s of 25-35). Most incremental crude (eg. from the US) is much lighter, with API’s >40.

Equally important as HSFO demand is the squeeze on MGO production and blending demand, hence why we’re predicting the Gasoil-Fuel Oil differential to widen further.

There is much ado about 2020. But while the financial impact of compliance is making headlines, it is worth remembering that cutting engine fuel consumption can also result in reduced emissions of oxides of sulphur.

Although fuel reduction is more commonly associated with fewer carbon emissions, a 10% reduction in fuel consumption can result in a corresponding reduction in SOx. And you don’t need to slow steam to achieve this. A hydrogen/methanol additive is available which can optimise fuel consumption even further, allowing shipowners to save costs while providing a return on the scrubber or LSF.