$34bn annual hole identified in global freight payment systems

A new white paper from consultants Drewry suggests that today’s antiquated liner invoicing and payment processes are costing the industry $34.4bn annually.

Among shippers and forwarders, the level of automation of invoice reconciliation and settlement is “very low”, Drewry stated, particularly among small and medium size players. For shipping lines, invoicing is largely a manual activity, except for a few large BCO setups where self-billing and/or EDI solutions are in place.

“The cost of today’s process inefficiencies and lack of trust represent $34.4 billion annually,” the white paper posited.

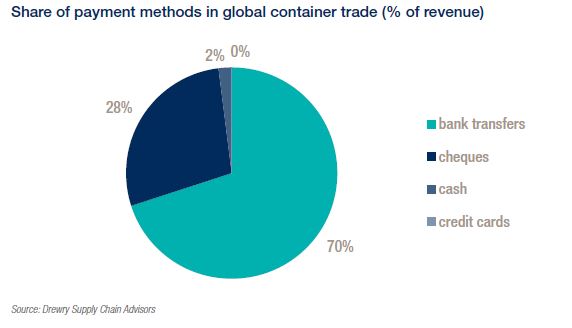

The most used payment methods in global container shipping are bank transfers and cheques (see chart below). Credit card payments are rare. There are established automated solutions for domestic freight payments in the US, but for ocean freight payments they are almost non-existent.

The use of payment platforms, where customers can apply for credit, is spreading, but is still in its infancy.

In order to address these pain points, Drewry believes that technological solutions are required that: support the simplification and/or automation of invoicing and payment practices, especially for small and medium sized shippers and forwarders; create trust or provide payment guarantees between stakeholders, so that ‘Cash Against Documents’ practices are no longer required; streamline and solidify the end-to-end workflows of quotation requests, quotations, booking requests, booking confirmations, fulfilment of the transport service as booked, in alignment with invoicing and payments across the transport chain without errors and re-work.

In Drewry’s opinion, large players within the container shipping industry can push to simplify and standardise some of these complex processes, but recent or new third parties have a unique opportunity to develop common platforms or technology-based services which shipping lines or forwarders cannot provide on their own.

Some of the types of solutions which Drewry believes are within reach or under development include: online marketplaces which should simplify and automate invoicing and streamline and solidify the workflows of booking requests and booking confirmations for spot shipments; technology-driven providers which should provide platforms to reconcile bookings, invoices and payments automatically, linking all stakeholders. To reduce the number of disputes, this should include not only the sea freight but also audits and payment of surcharges, detention and demurrage.

Automated reconciliation and payment, Drewry stated, can be a key benefit for checking ancillaries, surcharges, inland haulage, D&D, Invoices/PO references match, based on near real time shipment tracking and cargo monitoring. Indeed part of the issue with invoice auditing lies in these additional amounts which may be cumbersome to check, and labour intensive.

Other suggestions included in the white paper suggested financial or insurance companies or other companies working for the shipper or the NVOCC to provide automated payment guarantees to the providers and create trust, removing the need for ‘cash against documents’. They could also provide cheaper and ideally automated forms of payments for shippers linked to a system where the price has already been authorised at the time of booking or before booking.

Financial firms could collect the freight payment from many small shippers more efficiently than providers and then pay the providers, reducing the cost of collecting payables and bypassing complex payment processes.

Another idea mooted was the creation of a centralised shipping capacity platform operated jointly by shipping lines or by an independent party – similar to the airline capacity platforms – and updated in real time. This could one day provide full access and real-time bookings to customers to all ships, avoiding ghost bookings or roll-overs. Drewry pointed out that pricing would probably still need to be determined by the provider – shipping lines or forwarder – and subject to rules agreed directly between the customer and the provider.

Concluding, Drewry noted: “[T]he space for disruption in the booking, freight invoicing and freight payment practices is wide open.”