Polarcus refinances, lays up vessel in tough market conditions

Dubai: Oslo-listed seismic vessel owner Polarcus has said that it has secured amended terms to its $410m fleet bank facility, and additionally received support from the majority of bondholders to amendments to its $125m secured convertible bond issue, most notably an extension of its maturity.

The company said the amendments to the banking facility will improve liquidity by $59m, with changes including its free cash covenant reduced by $10m to $25m, a six-month freeze in loan principal repayments, and a new one-year working capital facility of $25m.

In relation to the bond issue amendments, the company has proposed a two year extension and says that it expects the majority of shareholders to vote in favour of the change, which includes a bonus 1% consent fee.

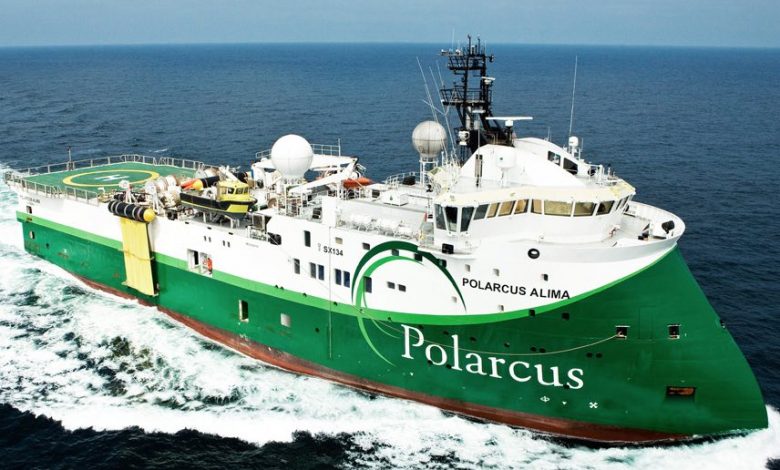

Lastly, the company has said that it will layup ultra-modern 12 streamer 3D/4D seismic vessel Polarcus Nadia with immediate effect to add to efforts to save cash.

Commenting on the raft of changes, Rod Starr, Polarcus ceo, said: “The new liquidity has been provided in order to increase the company’s operational flexibility in the current market environment, where the recent rapid decline in oil prices and consequent cautious spending by oil companies has negatively impacted the company’s earnings. This challenging market environment has led to a more uncertain outlook with pressure on vessel rates and client payment terms, and is also the reason for our decision to cold-stack Polarcus Nadia, the only remaining vessel in our fleet equipped with thrusters as the main propulsion system. Part of the Company’s backlog in the first half 2015 also comprises multi-client projects. While these projects are highly prefunded, the investments tie up significant net working capital due to the associated payment terms. The current visibility in the second half of 2015 provides a positive cash flow from operations with further cash flow improvements into 2016 when working capital is projected to be freed up.”