American retail associations demand liner change

A coalition of 152 companies and trade associations representing US importers, exporters, transportation providers and other supply chain stakeholders has submitted a letter of support to Congress endorsing the Ocean Shipping Reform Act of 2021.

The bipartisan legislation was introduced last month by Congressmen John Garamendi and Dusty Johnson. The new bill, created on the back of a wave of anger among US agricultural exporters, will ban carriers from declining all cargo bookings for exports. It will also require liners include a statement of compliance with Shipping Act regulations. The FMC will also be required to post publicly all findings of false certifications by ocean carriers, as well as giving the FMC greater strength to ensure US exporters are not shunned by carriers. However, given the large amount of legislation facing Congress this autumn, any chance that the act will be passed in the coming weeks looks unlikely.

Where was all this respect for customers and differentiation in the market 12 months ago?

“Foreign markets are critical to American businesses, particularly US farmers and ranchers, with more than 20% of agricultural production going abroad. Problems obtaining ocean containers of any kind combined with difficulty securing vessel space at fair and reasonable prices, are jeopardizing livelihoods and economic recovery. The attention given these unreasonable practices and the reforms proposed in OSRA21 are critical to reversing those challenges facing not only US exporters but also US businesses that rely on imports,” the letter signed by most of America’s most powerful retail associations states.

Commenting on the growing support for the act, congressman Johnson said yesterday: “Foreign ocean carriers aren’t playing fair, and American producers are paying the price. It’s time for updated rules of the road. That’s what our bill does.”

Carriers have sought to play down American political posturing. The World Shipping Council, the Washington DC-based liner lobbying group, has argued that normalised demand, not regulation, will solve the supply chain woes that have bedevilled shippers all year.

“There is a lack of rail and truck capacity, warehouses are full, and ports are bursting at the seams,” the WSC observed in a release earlier in the summer.

“This is not the fault of any given supply chain actor. Supply chains simply cannot efficiently handle this extreme demand surge, thus resulting in the delays, disruptions and capacity shortages felt across the chain. All supply chain players are working to clear the system, but the fact is that as long as the massive import demand from US businesses and consumers continues, the challenges will remain,” John Butler, president and CEO of the WSC, said in July.

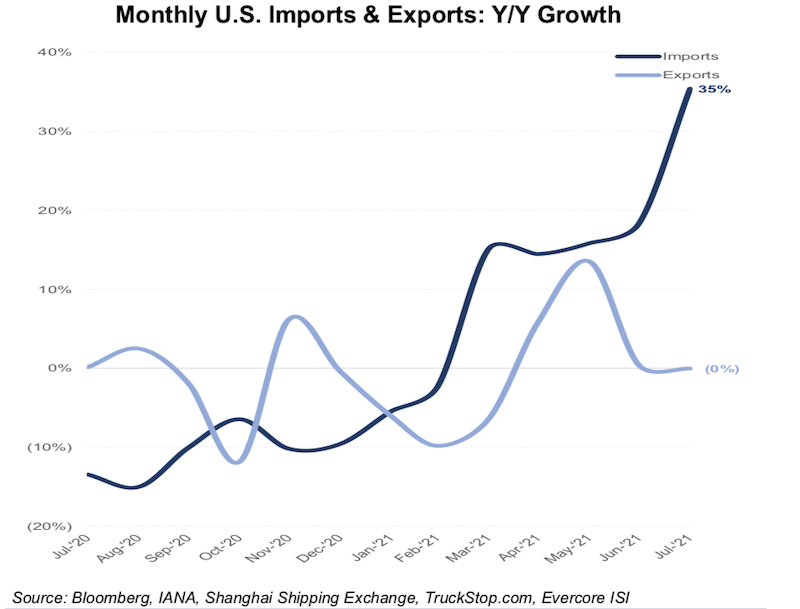

The WSC argument about import demand was something picked up by analysts at Evercore ISI this week.

“[T]he on-fire import growth (and de minimis export expansion) should share at least partial responsibility for the imbalances across the supply chain, in general, and containerships specifically. At some point these inefficiencies will ‘normalize’, but as long as a national powerhouse’s trade imbalance continues to widen, the congestion-related impacts on the entire supply chain are likely here to stay, providing robust support to fleet utilization and rates,” the Evercore report noted, illustrating its argument with a graph showing the huge growth in US imports (see below).

Foreign ocean carriers aren’t playing fair, and American producers are paying the price

Nevertheless, liners are clearly feeling the ire of their customers and have an eye on the potential fallout from regulatory intervention, helping in part explain the decision last week by CMA CGM, the world’s third largest containerline, to state publicly that it is capping all spot rate increases through to the beginning of February next year.

Reacting to the CMA CGM news, James Hookham, a director at the Global Shippers Forum, told Splash: “The biggest surprise for shippers is not that one shipping line has announced a price cap, but that one shipping line has acted independently of the consortia. Where was all this respect for customers and differentiation in the market 12 months ago?”

The legislative arrows aimed at global carriers who are on track to post combined profits of as much as $100bn this year come at a time where America’s two largest gateways – the ports of Long Beach and Los Angeles – continue to report record ship queues building at San Pedro Bay with the Marine Exchange of Southern California noting there were a total of 56 boxships at anchorages or drifting yesterday. The overall crunched supply chain situation in the US was likened last month to squeezing 10 lanes of freeway traffic into five lanes by Los Angeles port boss Gene Seroka.

Good to see socialist principles at work in the USA. Yet again.