BIMCO quashes talk of a supercycle

Analysts at international shipowning organisation BIMCO have attempted to answer the question many in dry bulk have been pondering all year – whether or not the sector is entering a supercycle similar to the record earnings seen in the first decade of the century. The BIMCO verdict? Far from it.

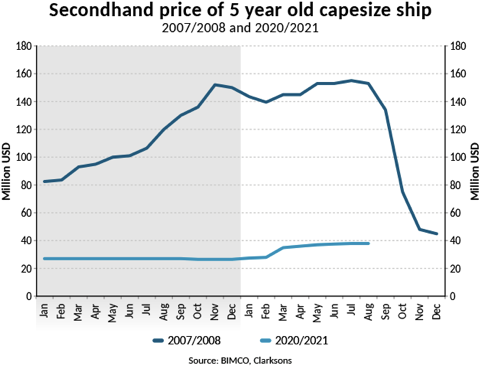

The most eye-catching chart issued by BIMCO yesterday in its analysis of the dry bulk market today compared to the highs experienced in 2007 and 2008 regarded ship values.

The value of dry bulk ships is far below the last supercycle levels. A comparison of the value of a five-year-old capesize ship today with August 2008 shows how big the difference is. In August 2008, the ship could be traded for around $153m. Today it could yield just $38m. Although well below 2008 levels, this is still the highest level since December 2014.

“Commodity prices have staged a comeback and are hovering around or above 2007 and 2008 levels. This has fuelled talk of a commodity super cycle. However, while dry bulk freight rates and ship values are currently high compared to the past 10 years, they are very far from earnings seen during 2007-2008 and there is little to suggest that they are heading that way,” commented Peter Sand, BIMCO’s chief shipping analyst.

Compared to the past 20 years, freight rates have been high during the first seven months of 2021, with all ship sizes averaging earnings that exceed $20,000 per day. However, compared to the first seven months of 2007 and 2008, the current rates are still far below.

In the first seven months of this year capesize rates have averaged $24,970 per day. In the same period of 2008, capesize rates averaged $147,475 per day. As a share of what they earned back in 2008, BIMCO analysis shows handysize rates come closest, but are still far below with average earnings so far this year at 55% of rates recorded in the first seven months of 2008. Panamax and supramax earnings stand at 36% and 41% respectively.

“Higher commodity prices are not the key to a supercycle in dry bulk shipping,” BIMCO argued.

The super-cycle of the 00s didn’t begin mid 2007 but long before, argueably end 2003. Therefore the comparison and BIMCO’s arguement doesn’t hold water, and is at best useless, at worst misleading.

Henrik, I could not have put it better

BIMCO is making a very poor comparison.

Part of the reason rates are so high today is that there aren’t enough ships to meet demand, but not only that, companies are not ordering enough ships to replace the global fleet. Steel prices are also high, which drives many shipowners to scrap some of the aging ships they do have, because they aren’t worth retrofitting to meet rising emissions standards. So you have high demos and low newbuild orders. The underlying reason heightened shipping demand isn’t driving a dramatic increase in ship demand (and therefore prices), is because there is too much uncertainty on what fuel is going to power our ships over the next ten to twenty years. Nobody wants to invest in newbuild ships if such a long-lived asset has the potential to be rendered obsolete long before the end of its useful life, and everyone is going to need access to capital to survive the transition. Adding to this, there is an ongoing consolidation in shipyards, of which there are arguably still too many.

The result of all this is a highly unusual combination of sustained high rates, with only a comparably modest increase in newbuild and used ship prices. Not only that, but this shortage is now locked in for several years because of the lead time to build new ships once they are finally ordered. It’s counter-intuitive because this runs contrary to historical correlations, and to my knowledge there isn’t really a one-for-one comparable time in the industry, at least not in modern memory.

Main reasons for what was happening in the mighty 00s and until Lehman collapse in September 2008 are two:

A. China joined WTO in December 2001 and her demand galloped like a frenzy horse.

B. Cheap credit boosted buying capacity of all to extends never seen before. People and companies were assigned to any sorts of loans from banks and financial institutions with very loose I’d say regulations, and were buying and trading like there’s no tomorrow.

“A” factor is still here but far away from the dynamics of the 00s era. “B” factor is gone. And this is good. It is healthy.