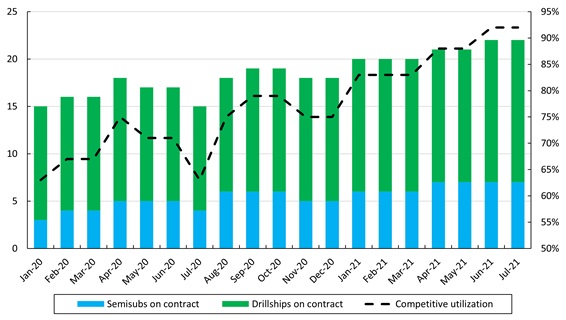

Competitive rig utilisation for Brazil-based rigs has increased by 9% in six months, reaching 92% in June. Based on the current rig demand outlook and domestic supply drying up, it is likely that operators will have to source more rigs from outside of the region.

Esgian Rig Analytics shows that there are 22 rigs currently drilling offshore Brazil, and oil and gas companies are expected to ramp up activity further with a recent surge in tendering activity.

According to Esgian, from January 2021 to the current day, there have been 50% more rig days contracted in Brazil than the entire total awarded during 2020, with a total of 22.2 years of backlog added so far.

International oil companies have been increasingly active in the country and account for approximately 35% of the total rig contract backlog awarded this year. Meanwhile, there are still several active rig tenders in the market, mainly from Petrobras.

The Brazilian offshore rig market is one of a handful regions that are giving a glimmer of hope fo rig owners

At present, there is just one readily available rig in the region – Diamond Offshore semisub Ocean Valor, which Esgian believes is being bid on Petrobras tenders. The next units planned to become available are in early and mid-2022.

“The Brazilian offshore rig market is one of a handful of regions that are giving a glimmer of hope for rig owners, not just for those with rigs in the region or rigs that could be bid into the region, but for any company that could benefit from lower floating rig oversupply globally,” noted Hans Jacob Bassoe, offshore rig analyst at Esgian.