Bulk carrier congestion on the wane as cape earnings slide

It has been a disastrous week for the big bulk carriers with capesizes sliding below opex.

One reason for the slump in rates to below $10,000 a day – alongside the traditional August slumber – has been the unwinding of congestion.

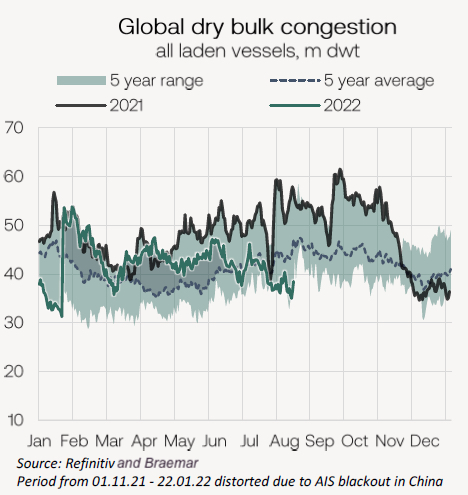

Last year, congestion, principally in China, sucked up a huge amount of tonnage. According to data from brokers Braemar, queues of laden bulk carriers reached as high as 61.5m dwt in September 2021, equivalent to 6.8% of the fleet.

Now queues currently lie at 38.5m dwt for the fleet, a 37.5% decline from the highs last year and 18.4% below the five-year average. Most notably, in China laden vessel congestion now amounts to just 11.8m dwt, a decline of 59.6% year-on-year as the nation desperately tries to get back on track after years of zero-covid policies stymieing the flow of goods.

“[B]ulk carrier congestion will not play as prominent a role in supporting the market going forward as it did in prior years, particularly since the pandemic began,” Braemar predicted in a new report.

Bulk carrier congestion will not play as prominent a role in supporting the market going forward

For capesizes, the C5 iron ore route from West Australia to China is the single largest route in terms of tonnes moved. Since the start of the year, the average laden leg duration has declined by what Braemar estimates to be 4.5 days, thanks mainly to a reduction in time waiting to discharge in China as well as improving average load waiting times in west Australia.

Norwegian broker Fearnleys described blood being spilled on the streets this week and the long-awaited autumn rally still being far off in its latest capesize markets report.

“Seasonal low demand for both coal and iron ore forces owners to accept below-opex levels,” Fearnleys noted, while Braemar suggested that many of the deals transacted this week were taking a view that this current portion of the cape cycle will need to be ridden out despite the diminished returns.