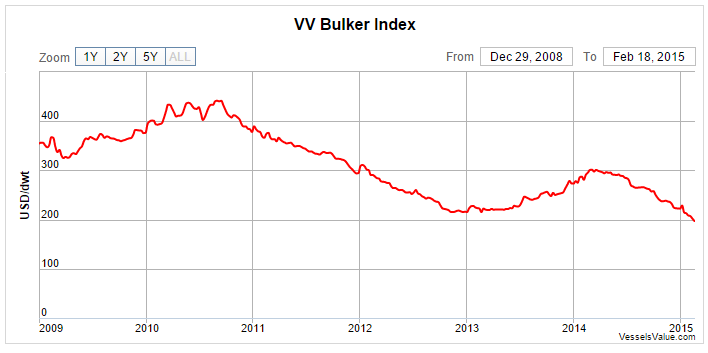

London: The Baltic Dry Index may have shown some slight improvement this week, but data shows the dire state of dry cargo shipping markets has taken its toll on bulkers’ resale contract values.

After a hitting a series of record-low levels, the Baltic Dry Index today saw a second consecutive day of growth, bouncing back to 513 points from 511 points yesterday.

Nevertheless, consistently low charter rates mean buyers are showing little interest in resale contracts for a vessels due for delivery in the next few months or years.

Handysize vessels have been worst affected. Resale contracts for 30,000-dwt bulkers for delivery between 2015 and 2018 have depreciated in value by around 25% today compared to January 1 this year, data from VesselsValue.com (VV) shows.

Although the cape market is currently the weakest performing dry segment, resale values have been hit to a lesser extent than smaller vessels. A cape due for delivery this year is today worth 15% less than its value at the start of 2015.

“However, a newbuild order that will be delivered in three or four years, when the rates may be better, would be the perfect time for a ship to be delivered,” analysts from VV told Splash. “Therefore we have seen these newbuild orders decreasing in value only slightly.”

Newbuild supramax vessels have even seen a jump in value. A 60,000-dwt vessel due for delivery in 2018 is worth nearly 10% more today than it was on January 1.

Although asset values for bulkers seem to be at rock bottom, VV says we won’t see a gold rush of private equity investment in distressed assets like we did back in 2013.

The last private equity player to buy a second-hand bulker vessel outright was distressed asset investor CarVal, which bought a cape for $42m on November 12, 2014.

“There will always be people out there to buy a distressed asset, it’s more a case of owners being prepared to sell at this low price,” VV analysts told Splash. “For private equity, shipping was more popular as a distressed investment as a few years ago as it was one of the only distressed industries to invest into. Recently, these funds have been lured away to other distressed industries such as oil.

“In short, they have had their fingers burned by how volatile this industry is and have been scared off, even if it is the time to get a good deal.”

While January saw a healthy S&P market, dry cargo vessel sales have been relatively infrequent this month. Only eight second-hand bulk carriers have changed hands since the beginning of February, mostly handys and panamaxes, VV data shows.