Cape volatility here to stay: Alphabulk

Market volatility is not going away in the dry bulk sector, analysis from Alphabulk shows.

In its latest weekly report, Alphabulk argues that despite – or maybe as a result of – increased visibility into rates thanks to technology, the extreme volatility seen in dry bulk, particularly among capesizes, is actually accelerating, not easing.

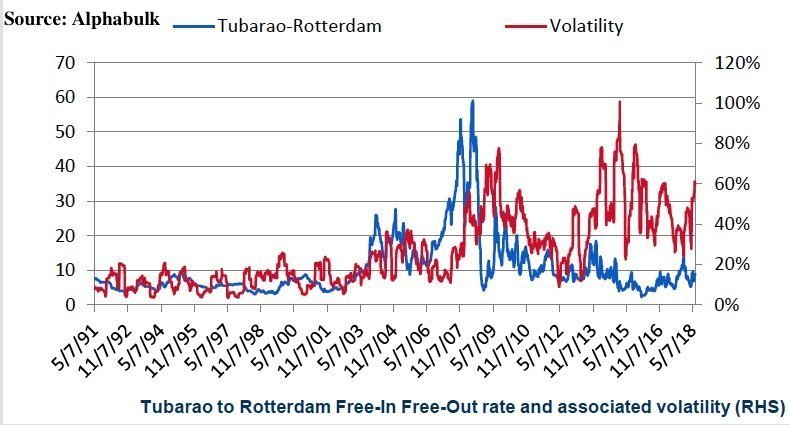

Defining volatility on key capesize routes as the trailing three months annualised standard deviation of daily returns, Alphabulk data shows that regardless of cape route or cargo carried cape rate volatility has risen dramatically since the start of the 1990s. Average cape volatility on voyage freight rates has increased about threefold since 1991, despite a substantial increase in liquidity as the capesize fleet has grown from 59m dwt in 1991 to 367m dwt as of June this year.

“This kisses goodbye to the theory that the high volatility shown by freight markets is partly due to a very low liquidity of the market,” Alphabulk stated, adding: “If that was the case, then surely volatility today would be sharply down compared to 20 or 30 years ago?”

The analysts at Alphabulk continued: “More disturbing is the fact that this increased volatility is happening as information becomes easier and quicker to obtain than ever before. Goodbye to another partial explanation for high volatility in shipping: the scarcity of information.”

Alphabulk maintained that while most in the market now have access to the last done deals, very few have reliable information about where the markets are actually headed.

“This asymmetry of information is about to get worse with the liquidity being split between traditional spot fixing, ie involving a broker, and web-based platforms,” Alphabulk predicted.