Capes pick themselves off the canvas

As predicted yesterday on this site by Dr Roar Adland from the Norwegian School of Economics, the cape market finally displayed signs of bottoming out.

Having suffered one of the worst Augusts on record, capesizes showed some twitching of muscle yesterday, the key 5TC route firming by $1,382 a day to $3,887.

“The tide seemed to change yesterday, with the physical market bottoming out and the paper boys buying on improved outlooks, despite dark clouds still weighing heavily on the market,” a market update from Norwegian broker Lorentzen & Co suggested this morning.

With weeks to go until the Chinese leadership meets in Beijing for the likely rubber stamping of president Xi Jinping’s third term in office, focus is turning to how China can fix its economy, which has stumbled badly this year thanks to covid lockdowns and the implosion of the real estate market.

Traditional infrastructure projects are hard to come by

The Chinese housing market is currently plagued by high debt among developers, a drop in sales, falling housing prices, and an increase in mortgage payment defaults. Residential housing accounts for 10-12% of China’s GDP and is one of the main uses of steel in China.

An update from Joakim Hannisdahl-led Cleaves Shipping Fund in Oslo yesterday discussed the “continued stream of negative news” on the Chinese economy. The fund warned it is now cautious towards the dry bulk sector for the next six to 12 months due to problems in the Chinese construction sector and continuous covid-related lockdowns with Chengdu, the sixth-largest city in the People’s Republic, entering another big lockdown.

“Chinese stimuli will likely have a positive effect on dry bulk shipping demand from late 2022/early 2023, depending on how extensive the crisis in the construction sector becomes,” the fund predicted.

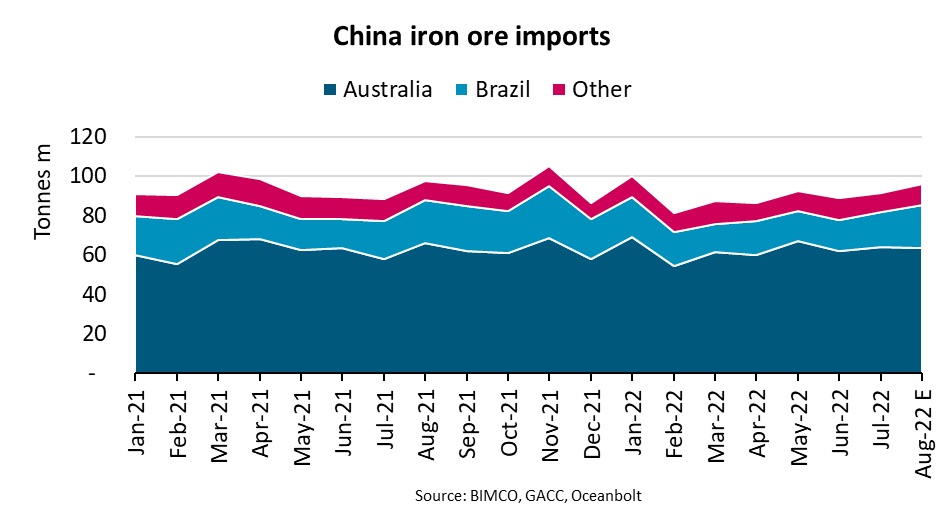

Preliminary shipping data from Oceanbolt showed a 1.7% year-on-year drop in Chinese iron ore import volumes in August. The volumes are, however, the highest since January and follow a 3.1% year-on-year increase in July. Year-to-date, Chinese iron ore imports are down 3.3% year-on-year, making up around 20% of global dry bulk volumes, but could be in for a bounce, according to a new report from BIMCO.

On August 26, China’s State Council announced new stimulus measures targeting infrastructure. Quotas for infrastructure spending by its banks were increased by RMB300bn ($87bn), on top of a previous RMB300bn in June.

“We remain positive that demand from infrastructure projects should improve in the coming months, supported by China’s policies. However, China’s real estate crisis will remain an obstacle to iron ore and steel demand,” commented BIMCO’s chief shipping analyst, Niels Rasmussen.

Questioning this infrastructure spend, however, are analysts at brokers Braemar.

“[T]raditional infrastructure projects are hard to come by. In fact, investment in railways and road transport declined by 4.4% and 0.2% respectively in the first six months of 2022,” Braemar noted in a new report, suggesting that China has prioritised digital infrastructure schemes, water conservation projects, solar and wind power plants.

China has long planned to shift its growth engine from property-heavy investment to consumption. Such a reorientation of the economy means that Chinese stimulus packages will not generate dry bulk shipping demand to the same extent as previous ones, Braemar suggested, going on to predict that Chinese demand will be less steel-intensive in the future.

“China’s long-term dry bulk import growth is set to be more skewed towards aluminium, minor ores, minerals, and base metals, which are primarily used in advanced manufacturing. As a result, the geared ships are primed to benefit from this structural shift,” Braemar predicted.

“China’s zero covid policy has greatly affected business and consumer confidence in 2022 and that is clearly visible in the sluggish housing market. Any new and prolonged large-scale lockdowns could, however, threaten a recovery in the housing market and thereby a rise in demand for iron ore. The recent lockdown in one of China’s biggest cities, Chengdu, is proof that risks to recovery remain,” said BIMCO’s Rasmussen.

Discussing the counter-seasonal plummet capes have experienced over the last month, Mark Williams, founder of UK consultancy Shipping Strategy, told Splash: “I think that a hefty dollop of bearish sentiment is weighing down on this market, which should have another two years to run. But this is proving to be a weird year, even weirder than the last two years, and at the moment it looks like a perfect storm of macro bad news plus lower congestion plus weather in China plus energy shortages in China, etc are all combining to make a weaker freight market than I for one would expect.”