Carriers under pressure to take more decisive action to stem declines

It’s the topic that has sparked the most debate in the container sector all month – just where is the floor for rates?

Analysts seem divided on how much lower rates will head before settling at a new normal level.

According to SHIFEX, one of a host of container spot freight rate indices, freight rates for 40-foot containers moving from China to the port of Los Angeles fell to $1,825 in October, which is equivalent to the pre-pandemic peak season level.

The transpacific is the tradelane that has experienced the most dramatic falls in fortunes over the past few months, though this is something that is hurting smaller, new entrants on the trade far more than the established big names.

“I think it will be rougher seas for new carriers who entered the market driven by the high spot freight rates, compared to legacy carriers who have more contract rates and enough cash reserves to sustain the reduction in rates for a while,” said Shabsie Levy, CEO of Shifl.

The US housing market downturn is now official, a data point which has historically been a good leading indicator for container shipping demand.

With the rollover in the leading container headline indices moderating in the past couple of weeks, some analysts believe this is a sign the sector is getting close to bottoming out. HSBC is one of the companies maintaining this viewpoint, something it detailed in a new shipping report issued this week entitled ‘Less bad news is good news’.

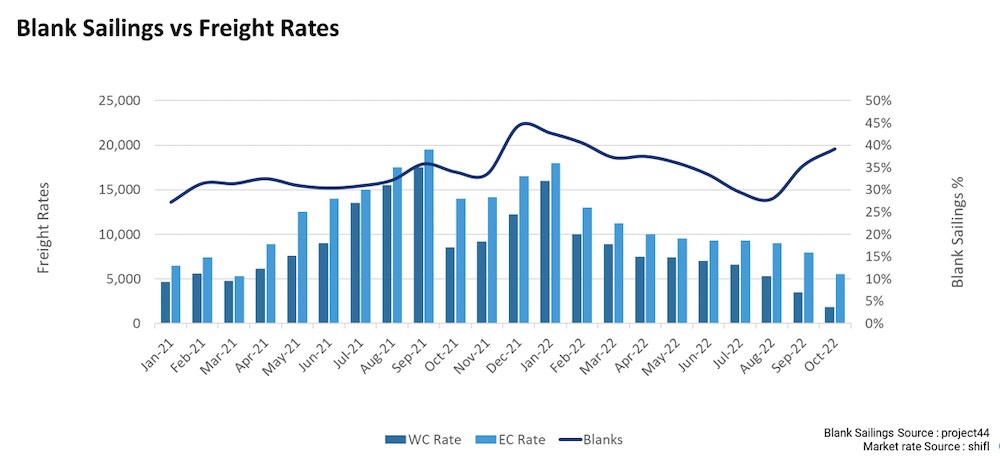

HSBC urged carriers to blank and suspend more services to stabilise spot freight rates ahead of the upcoming contract negotiations for the Asia-Europe route.

“The blanked sailings have been ineffective in preventing freight rates from sliding on all main trades, with the Middle East the only notable exception,” noted researchers at Linerlytica in their latest weekly reporter.

Container charter and secondhand prices are sliding too in tandem with the freight rates while the appetite to order new tonnage at yards in Asia has all but disappeared this autumn.

“With regards to values, in stark contrast to the exponential increase in asset values for container vessels seen in the first three quarters of 2021, values for 2022 have on the whole decreased significantly with the biggest fall in 0 year old Feedermax vessels, falling c.35% since the beginning of the year,” a new report from VesselsValue stated, adding that scrapping levels will likely rise in the coming months. VesselsValue also carried some forecasts on asset value drops through to 2026, with the UK firm predicting some containerships could nearly halve in value in the coming years (see chart below).

On the demolition side, a crucial lever for carriers as they adjust to altered supply/demand dynamics, Alphaliner has run the numbers on the proportion of the liner fleet becoming scrap candidates in the coming year.

Alphaliner data shoes there is a total of 655,149 teu of scrappable tonnage of 25 years of age and older, but a much bigger overall 2.5m teu of potential recycling candidates totalling 1,102 vessels which are 20 years of age and older.

“Although the removal of 2.5m teu of capacity aged 20 years and over would be instrumental in helping mitigate the impact of the 5.1m teu newbuild capacity to be delivered within the next two years, this is just not going to happen overnight,” Alphaliner warned in its latest weekly report, highlighting the record orderbook due to deliver soon.