Chinese New Year celebrated by product tanker owners

In scenes not experienced for three years, Chinese airports are rammed as Lunar New Year celebrations near with the sudden increased mobility registered in the world’s most populous nation after the axing of zero covid polices expected to offer great support to product tankers this year.

Pre-covid, Chinese New Year always marked the world’s largest annual human migration. While covid cases remain rife in the People’s Republic, 2023 marks a significant return to normality. China’s transport ministry has predicted passenger traffic volumes to jump 99.5% on the year during the festival migration, which runs until February 15, or a recovery to 70.3% of 2019 levels.

Analysts at BIMCO have been studying the likely growth in seaborne jet fuel trades this year on the back of China easing its covid rules.

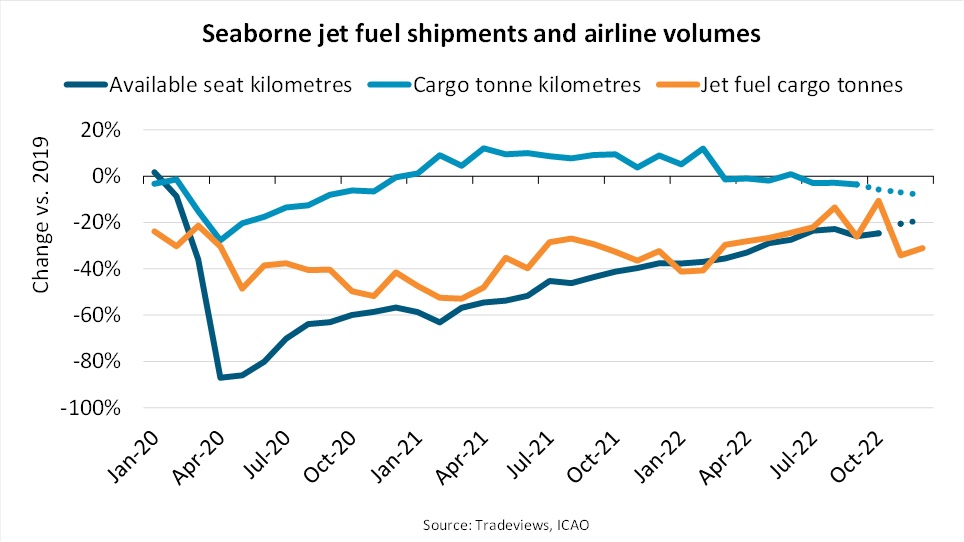

The International Civil Aviation Organization (ICAO) estimates that available seat kilometres were 25% lower than 2019 levels in October 2022, while cargo tonne kilometres were 4% lower than 2019 levels in September 2022. Tradeviews estimates that seaborne jet fuel cargo volumes in 2022 ended 27% lower than in 2019.

“In a recent report, Avolon, the world’s second largest jet lessor, predicts that the changes in Chinese covid policies will help air traffic return to pre-pandemic levels already in June 2023 and that half of all capacity growth during 2023 will be in Asia,” said Niels Rasmussen, chief shipping analyst at BIMCO.

In September 2022, available seat kilometres in the Asia-Pacific region were 48% lower than in 2019.

Combined, the Asia-Pacific region, Europe, and North America account for more than 80% of global airline capacity, and capacity in the latter two regions were down 17% and 7% respectively. A recovery in the number of travellers to and from China will not only help narrow the gap to 2019 capacity in the Asia-Pacific region, but in all regions. According to BIMCO, this could bring airline capacity back to 2019 levels as well as spur an increase in the seaborne jet fuel trade.

“If global airline traffic returns to 2019 levels by mid-2023 and continues to grow thereafter, global seaborne jet fuel trade could end 2023 just 5-10% short of the pre-pandemic level. That would mean year-on-year growth versus 2022 of 25-30% while adding as much as 2% to the overall clean petroleum products’ seaborne cargo volume,” said Rasmussen.

Product tankers are already predicted to benefit from an increase in average sailing distances in 2023 due to the upcoming European Union ban of Russian petroleum products. An increase in jet fuel volumes will further increase demand for product tankers while the fleet capacity is expected to grow only 1%.

“While an uncertain outlook for the global economy remains a cause for concern, the re-opening of China increases the likelihood that tonne miles demand for product tankers and freight rates will increase regardless,” said Rasmussen.

Meanwhile, the Energy Information Agency (EIA) in the US has recently issued a short-term outlook in which it forecasts 2024 will be a record-breaking year for global oil consumption. Demand growth is expected to be led by jet fuel, gasoline, diesel, LPG, and naphtha, according to the EIA. China is projected by the EIA to account for 60% of global demand growth as its economy re-opens.