Containership owners toast a ‘sold-out’ Christmas season

Shippers are squealing, ports are creaking and box-building is booming, but owners of small and large ships are sitting pretty, says Daniel Richards, Maritime Strategies International.

At present the containership charter market is effectively ‘sold out’ across vessel sizes, and the limited remaining pool of idle tonnage represents the standard volume of capacity that is tied up in repair yards or repositioning work.

Liner companies have responded to both extreme pressure on their networks and the incentives offered by highly lucrative freight rates to add as much capacity as possible.

In effect the industry has faced a near-term bidding war for containership capacity of all kinds. There are also reports that liners locked out of the market have resorted to hiring MPP vessels with relatively high container intake capabilities. HMM in particular has chartered several such ships to trade between South Korea and Russia, having also been one of a number of lines on the receiving end of the South Korean regulators’ demands to increase capacity offered to the market.

An additional sign of the scramble for container shipping space has been an increase in the output of container box manufacturers, almost of whom are located in China, meaning Chinese exports of ISO containers act as a useful proxy for overall manufacturing activity. The major Chinese manufacturers, among whom CIMC is the largest, are reportedly operating at maximum capacity, with enough work to keep them busy for some way into Q1 21.

The Transpacific was important to the post-lockdown rebound in larger benchmark earnings and it remains a key market driver, critical to explaining why rates have increased so strongly since the start of Q4 20. The main difference now is that other trades are providing more competition to the Transpacific in terms of receiving capacity injections.

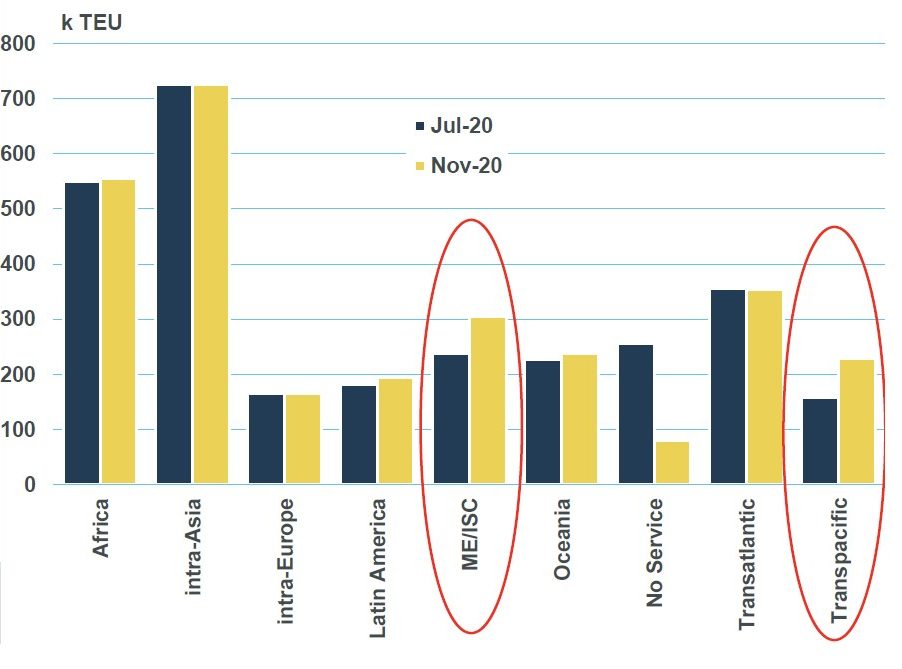

Recent shifts in the deployment of 3,900-5,200 TEU Panamax vessels illustrate this trend. Liner companies wanting to increase Panamax deployment on given trades have in the past month faced the alternative of paying very high timecharter rates or redirecting these vessels from elsewhere in the network. Chart 1 shows deployment of 3,900-5,200 TEU vessels in July 2020, before the rally got going, and November 2020.

An equally important source of increased demand for vessels of this size has been the Middle East/Indian Sub-Continent trades, where lines have responded to a sooner-than- expected rebound in Indian container trade in particular with hasty reversals of previous service cancellations. The net effect has been that lower-tier trades have been progressively starved of candidates for capacity injections in recent months, and this has driven a ‘trickle-down’ dynamic that has come to significantly tighten vessel availability in the feeder vessel segments as well.

And while trickle-down demand resulting from tight mid-size vessel timecharter markets is one component of the recovery, it is also likely that severe congestion around certain major hubs could be increasing short-term requirements for feeder tonnage.

Severe port congestion has seen thousands of containers originally due to be imported through Felixstowe in the UK have instead been deposited at either Rotterdam or Antwerp for subsequent transhipment. This dynamic creates a short-term need for extra feeder container capacity and is likely one driver of tight feeder vessel availability in Northern Europe at present. A similar dynamic is reportedly playing at out at the major transhipment hub in Colombo, where social distancing-driven delays to port operations have similarly seen containers diverted to other ports in the region.

While in general vessel demand benefits from disruption to supply chains and to inefficiencies, in certain respects feeder vessels in particular will stand to benefit from this kind of disruption. Further, given the shorter length of feeder time charters, when liner companies face a pressing need to add capacity and many larger vessels are tied up or engaged in longer-distance voyages, the large pool of feeder tonnage generally available for hire in the Far East and Europe presents itself as an obvious candidate. This presents obvious vulnerabilities when markets weaken, of course, but has been to the benefit of smaller vessels in recent months.

A general scramble for any kind of cellular capacity, made all the more desperate by supply-chain chaos, the continued booming Transpacific trade, and obvious incentives facing liner companies to increase capacity have combined to make it a white Christmas for tonnage providers.

The question, of course, is whether this dynamic is sustainable. The fact that the market is being driven at least in part by ‘non-standard’ supply and demand variables makes this unusually tricky to predict.