Cosco’s huge swathe of boxships still to deliver this year puts liners on edge

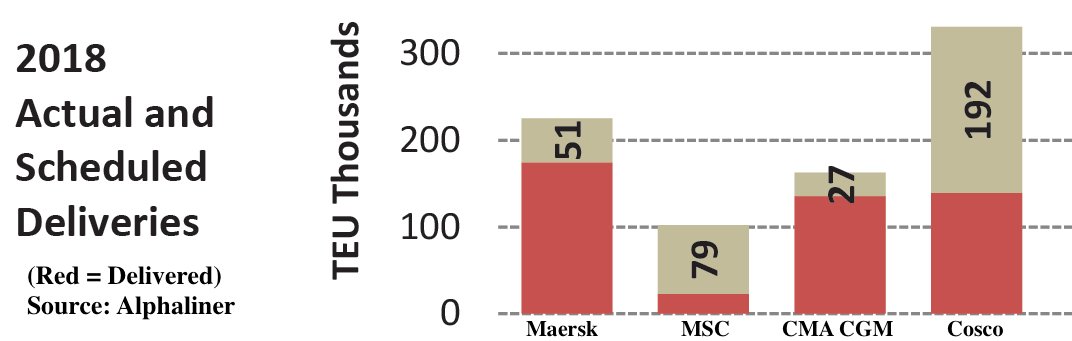

Amid declining freight rates and red ink for the world’s carriers attention is being turned to the huge volume of boxship deliveries between now and the end of the year due to swell the ranks of the Cosco fleet.

According to Alphaliner, the Chinese state-backed carrier is due to to receive a total of eleven 19,000 teu to 21,000 teu megamax ships, and seven ships ranging in capacity from 13,800 teu to 14,500 teu by the end of this year. All of these will be built in China, albeit by different shipyards.

Alphaliner’s latest weekly report carries a recent photo (pictured above) from Jiangnan Changxing Shipyard which shows three types of Cosco newbuildings at the outfitting pier.

They include 13,800 teu ‘flower’ class ships, 14,568 teu ‘mountain’ class vessels and one 21,237 teu megamax of the ‘universe’ class.

The vessel in the foreground is the Cosco Shipping Universe, delivered last week.

“That picture should be on board room walls in Copenhagen and Geneva,” one seasoned liner executive told Splash on condition on anonymity today, referring to the headquarters of Maersk and MSC respectively.

“Cosco’s ‘megamax’ program is made up of different vessel classes, since it is not only split across various shipyards (CSSC, CISC and COSCO-KHI), but it also originates from before the carrier’s merger with CSCL and each of the two hitherto separate shipping lines ordered slightly different vessel classes,” Alphaliner explained in its latest weekly report.

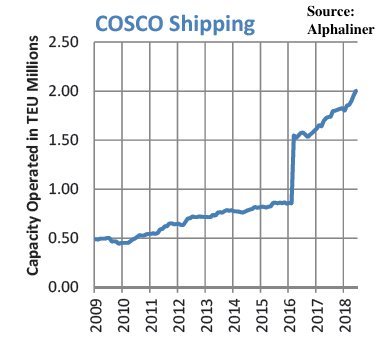

With its takeover of OOCL due to be completed very soon, Cosco is likely to leapfrog fellow Ocean Alliance member CMA CGM into third spot behind MSC and Maersk in the global liner rankings. The heads of both Maersk and MSC have hit out in recent months at Asian lines and their ability to tap state funds to expand their fleets.

With its takeover of OOCL due to be completed very soon, Cosco is likely to leapfrog fellow Ocean Alliance member CMA CGM into third spot behind MSC and Maersk in the global liner rankings. The heads of both Maersk and MSC have hit out in recent months at Asian lines and their ability to tap state funds to expand their fleets.

In a poll carried on this site earlier this year two thirds of Splash readers believed Cosco will overhaul Maersk to become the world’s largest containerline within the next 10 years. Cosco’s huge expansion this year comes at a time where loss making Maersk Line is actually reducing its operating capacity for the first time this decade.

Both Evergreen and Hyundai Merchant Marine have larger orderbooks than Cosco, but no carrier has such a heavy delivery schedule this year as the Chinese carrier.