Danish Ship Finance warns on slowing growth in seaborne trade volumes next year

Danish Ship Finance has published its latest biannual shipping markets report with plenty of projections for shipping to digest.

Analysts at Danish Ship Finance expect growth in seaborne trade volumes to slow in 2022 to 3% from a projected 4% this year, with no support expected from longer travel distances. Container, dry bulk, product tanker and gas volumes are are expected to grow more slowly, while crude and chemical tanker volumes are tipped to experience higher growth in 2022.

The detailed report, covering many segments, has a strong focus on decarbonisation and projected timeframes to replace today’s fossil fuel guzzling fleet.

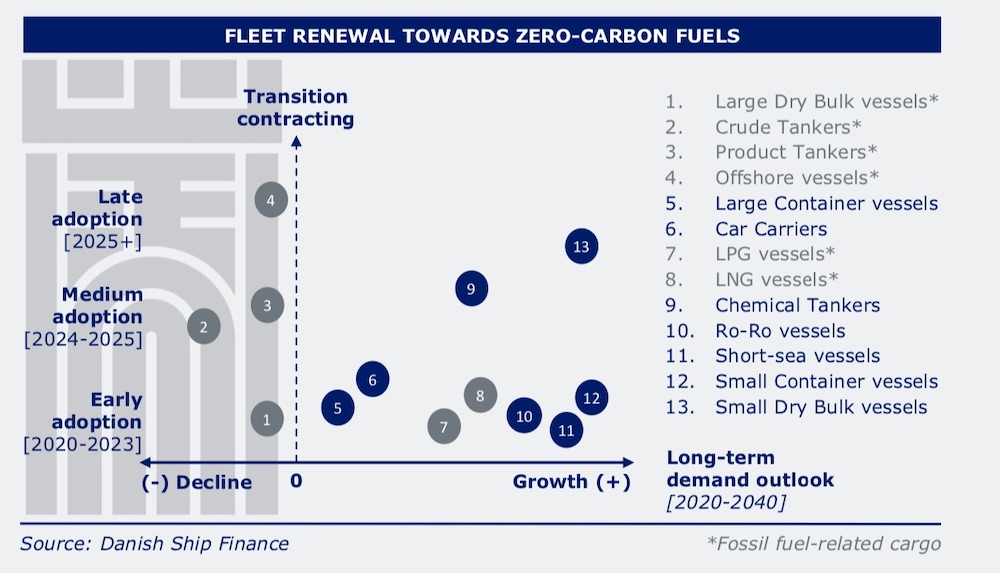

Some of the larger vessel segments, including tankers, gas carriers and offshore supply vessels are facing challenged demand outlooks that may reduce the need for significant fleet renewal after 2030, Danish Ship Finance suggested (see chart below).

As is customary with the output from Danish Ship Finance there is a strong shipyard focus in which the analysts look at the bifurcation of the sector with fewer names hoovering up the majority of orders, leaving other yards on the brink.

Ten yard groups currently account for nearly 70% of all orders, while 30% are divided among the remaining 185 yard groups, Danish Ship Finance data shows.

Not only are orders being placed at fewer yards, they are increasingly dominated by larger vessels. The average vessel capacity in the orderbook has increased by 15% over the past 10 years, data from Copenhagen shows.

Danish Ship Finance has warned that 204 so called second- tier yards will start to see orderbooks thin out from next year and will completely run out of orders by 2024 if no new orders are placed. As such, 76 yards – amounting to 4.3m cgt – will run out of orders from next year. From 2023, 164 yards – amounting to around 13m cgt – will run out of orders. This also underlines the fact that the recent order spree is mainly concentrated among the largest first-tier yards.

The world fleet’s 100,000 vessels are estimated to have a combined capacity of approximately 900m cgt. Active global yard capacity is estimated to be around 53m cgt. If all vessels were to be renewed in sequence, the current yard capacity suggests this could be done within a period of 15-20 years, the report stated, a topic that was also discussed by Dr Martin Stopford, the non-executive president of Clarkson Research Services, at last week’s Asian Logistics, Maritime and Aviation Conference in Hong Kong.

It will take through until the end of the decade before owners can have confidence to use hydrogen and ammonia technology in deepsea trades. The problem with this time lag, Stopford said, is that there will be enormous pent up demand for these new ship types as replacement tonnage by 2030 and yet shipyards can only deliver a few percent of the extant fleet a year.

“The dynamics of supply and demand will be a massive problem and there has to be some sort of retrofitting,” Stopford stressed, adding: “When we build a ship today we need to build it to be retrofitted.”