DNV GL picks ammonia and methanol as future fuels with hydrogen the surprise loser

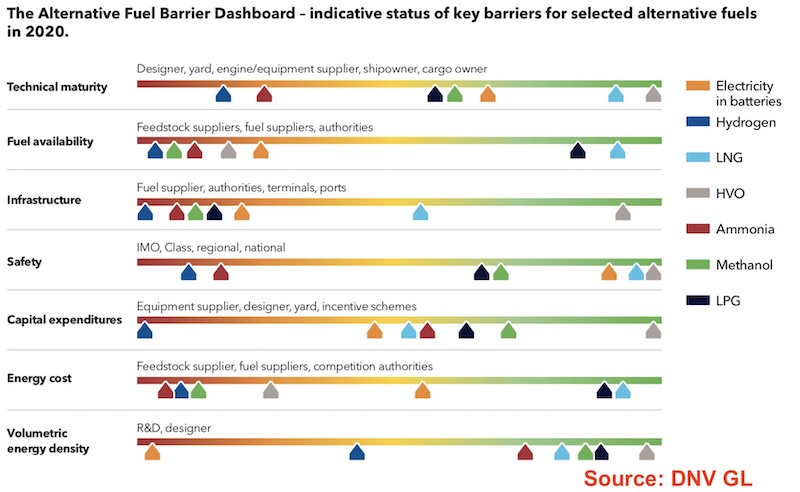

Class society DNV GL yesterday added maritime-specific details to its latest energy transition forecast through to 2050, the big takeaway being the prediction that hydrogen will not be among the leading fuels of the future for shipping.

DNV GL, which is more heavily invested in LNG as a future fuel than all other class societies, released the fourth edition of its Maritime Forecast to 2050 yesterday. The 106-page publication charts shipping’s possible paths to decarbonisation. Sixteen different fuel types and 10 fuel technology systems are modelled in the report.

The class society conceded it is currently hard to identify clear winners among the many different fuel options facing shipowners. Fossil LNG gains a significant share until regulations tighten in 2030 or 2040, DNV GL predicted. Bio-MGO, e-MGO, bio-LNG and e-LNG emerge as drop-in fuels for existing ships with a significant message from the report being the importance owners planning for dual-fuel engines in their newbuilds. By 2050, e-ammonia, blue ammonia and bio-methanol are tipped to end up with a strong share of the market and are deemed by the Norwegian firm to be the most promising carbon-neutral fuels in the long run.

Reducing GHG emissions is rapidly becoming the defining decision-making factor for the future of shipping

DNV GL suggested there would be a relative limited uptake of hydrogen as a ship fuel, as a result of both the estimated price of the fuel and the investment costs for the engine and fuel systems. Hydrogen, however, will play an integral role as a building block in the production of several carbon-neutral fuels such as e-ammonia, blue ammonia and e-methanol.

Planning for fuel flexibility could ease the transition and minimise the risk of investing in stranded assets

“The grand challenge of our time is finding a pathway towards decarbonisation,” said Knut Ørbeck-Nilssen, CEO of DNV GL – Maritime. “Reducing GHG emissions is rapidly becoming the defining decision-making factor for the future of the shipping industry. The pressure to act decisively is mounting. Perfect is the enemy of good, and so we mustn’t wait for an ideal solution to arrive and risk making no progress at all.”

The detailed report contains many important strands of advice for shipowners planning their future fleets.

“Picking the wrong solution can lead to a significant competitive disadvantage,” the authors of the report warned, adding: “Planning for fuel flexibility could ease the transition and minimise the risk of investing in stranded assets.”

The class society stressed that the uptake of carbon-neutral fuels will not happen until a “clear and robust regulatory framework” is put in place.

“To drive the development of new technologies, the framework must ensure global availability of large volumes of carbon-neutral fuels; enable their safe use; and, incentivise their uptake while retaining a level playing field,” the report posited.

I disagree with the statement

QUOTE

DNV GL, which is more heavily invested in LNG as a future fuel than all other class societies

UNQUOTE

the news may refer to Norway

The title is misleading. Ammonia is the hydrogen-based fuel NH3.

This title is poorly chosen, stating hydrogen to be the ‘surprise loser’ I think is misleading. Both Methanol (CH3OH) and Ammonia (NH3) are hydrogen carrying fuels thus hydrogen is a key component of each fuel, selected for many reason but primarily for their higher energy density than H2 alone, relatively simpler storage requirement than say liquid hydrogen and their ability to be used by combustion engines/developing combustion engines.