DNV highlights the multi-billion dollar costs shipping faces en route to decarbonisation

As a curtain-raiser to the opening today of SMM, the world’s largest shipping exhibition, class society DNV has unveiled the sixth edition of its Maritime Forecast to 2050 report with a new focus on how to overcome the “ultimate hurdle” of fuel availability.

“No industry can decarbonise in isolation so global industries need to make the right choices together, and sustainable energy should be directed to where it has the biggest impact on reducing GHG emissions. The ultimate hurdle is fuel availability and to overcome it, supply chains must be built through cross-industry alliances,” commented DNV Maritime CEO Knut Ørbeck-Nilssen.

“Carbon-neutral fuels must be made available for ships already within this decade, in decarbonisation pathways assessed. By no later than 2030, 5% of the energy for shipping should come from carbon-neutral fuels. This will require substantial investments in both onboard technologies and onshore infrastructure,” he continued.

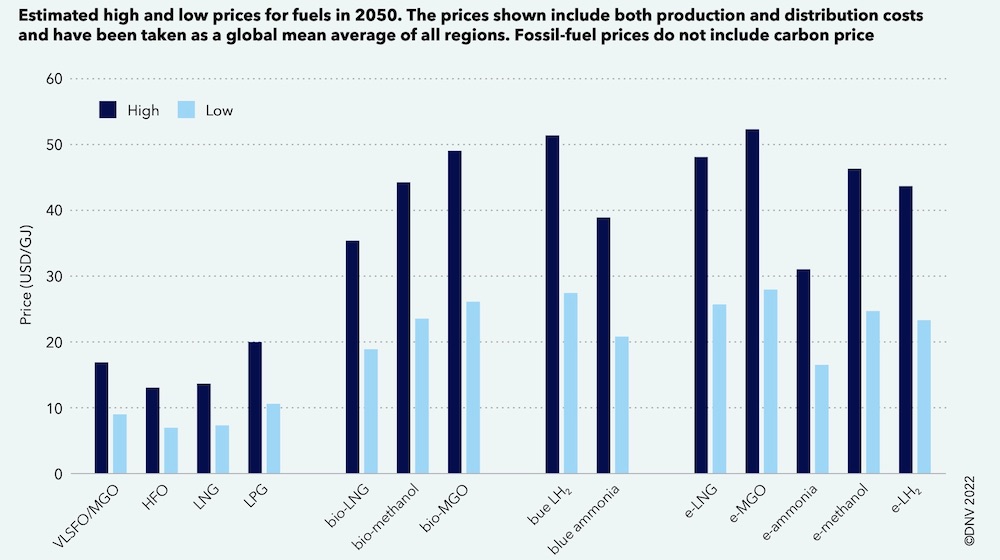

In terms of fuel choice, the authors of the DNV report wrote that uncertainties around future price and availability means that a clear winner among the many options – ammonia, methanol, diesel or methane, produced from sustainable biomass, renewable electricity or fossil fuels with carbon capture and storage – cannot be identified yet or in the near future.

The fuel transition has already started, with 5.5% of ships in gross tonnage terms in operation and 33% of gross tonnage on order today able to operate on alternative fuel, largely dominated by LNG.

DNV forecasts that onboard technology investments required for the decarbonisation by 2050 pathway scenarios will range from $8bn to $28bn per year depending on which fuel type has the largest uptake between 2022 and 2050. The largest investments come in scenarios with high uptake of ammonia or methanol, which require more expensive fuel systems, according to DNV analysis.

Investments of between $30bn and $90bn per year to 2050 are needed for the onshore fuel supply chains, DNV forecast.

“Two thousand ships are expected to be ordered annually to 2030 but there is still no silver-bullet fuel solution available,” said Ørbeck-Nilssen. “Against this uncertainty, the new Maritime Forecast to 2050 report can serve as a beacon of expert advice and smart solutions to ensure vessels stay commercially competitive and compliant over their lifetimes, underpinned throughout by the enduring need for safety,” he concluded.

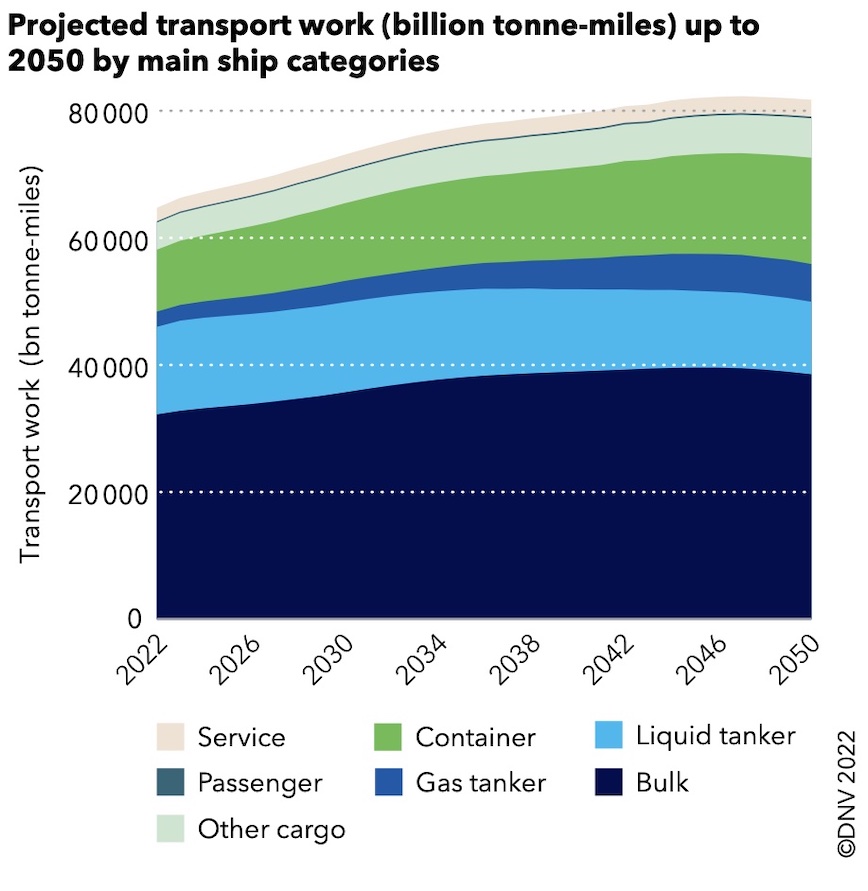

DNV’s updated projections for global trade predict an overall 29.55% growth between 2022 and 2050 in seaborne trade in tonne-miles. Most of the growth will come before 2030, after which DNV reckons global seaborne trade will stabilise.

“Growth in certain segments, especially gas and the container trade, will outpace the average rate. However, as the global demand for coal and oil peak, so will their trade, reducing their seaborne trade by more than two-thirds and one-third, respectively,” the report states.

Readers keen to access the full 84-page forecast from DNV should click here.

Splash will be bringing readers updates from SMM in Hamburg all week.