Do we need a new canal?

Andy Lane and Charles Moret from Container Transport International Consultancy on the merits of the Chinese-funded Nicaragua Canal.

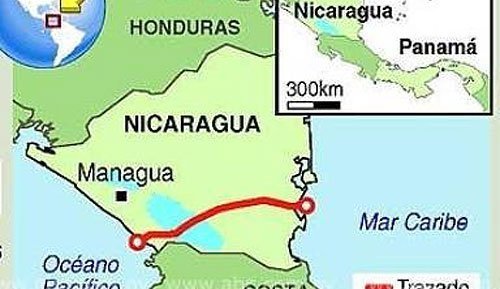

As controversy and speculation continues to surround the planned Nicaragua Inter-Oceanic Canal, we take a closer look at what this might mean to container shipping if it does in fact go ahead as planned with construction potentially starting later this year.

Canals – Profitable Business

In 2013, Panama Canal earned more than $1.8bn from ship tolls, of which around $1.4bn was the net contribution to the state of Panama, a highly profitable business. Of the total of 12,045 transits recorded in 2013, 26% (3,103) were made by container vessels, contributing a massive 52% of the total ACP revenue.

Liner Network Complexity

A container line’s network is highly complex, with multiple crossing rotations exchanging cargo between each other as they travel end to end in their respective routes. With canal passages being extremely expensive, lines make good use of transhipment points at the ends of canals, where they consolidate volumes to obtain maximum utilisation of the fewest possible ships which they need to transit canals to create their end-to-end products.

Designing a network based on two canals within the same region would mean a quantity of containers requiring an additional transhipment, adding both cost and also time to the product, so ideally a line (or alliance) will use just one.

Liner routes requiring a Central American canal transit

Presently the largest (by volume) is the Asia-US East Coast, followed by Europe-US West Coast trades, and these services will be able to gain some significant sailing distance reductions through using Nicaragua. The more emerging trades of West Coast Latin America to US East Coast and Europe are by contrast better routed through Panama. The vessel size, and thereby costs of the East-West routes outweighs their North-South brothers, although we will see over time some shifts in this equilibrium.

So which canal delivers to lowest cost to a global network?

If we then assess a global lines total cost of using either Nicaragua or Panama (assuming that tolls at each will be the same), then Nicaragua does deliver a marginal improvement, in the region of $6 per teu, which for a large liner, could aggregate up to around $15m of cost savings per year.

Putting that into context, taking the current ACP tolls, then we assess that Nicaragua charging a toll of $80 per teu (of capacity) would then create a breakeven for a line.

Will competition reduce tolls?

Canals today tend to price against alternative cargo routings, ACP will benchmark their tariffs against the alternatives of either land-bridge or Suez. We should probably not expect to see ferocious cost competition and cutting between Panama and Nicaragua as both have a vested interest to keep the market price as high as possible.

Canal Capacity – does the industry need more?

In the mid-term, additional capacity created by the new locks in Panama should provide sufficient supply. Are these locks large enough?

For container vessels, it is expected that 12,500 teu is the new panamax. The size of vessels needed on any trade will be governed by volume growth, coupled with sailing frequency and product needs. We are potentially many years away from the new panamax threshold being breached, but when it happens lines will essentially have only one option, Nicaragua.

An unknown at this stage is how wide the Nicaragua canal will actually be, reported as “230 to 520 m”. For two large containerships to safely pass, the top of this range is required, and for a distance of 75 nautical miles. Using Suez regulations, the passage from Lake Nicaragua to the Caribbean with one-way traffic only can accommodate just seven vessels in each direction per day, versus a market demand of above 40.

Conclusion

Container shipping is not likely to experience any major impacts, positive or negative, from a second Central American canal. Panama might lose some volume and therefore revenue, but it can potentially retain a good market share and continue to contribute positively towards its state.