Dry bulk braces for troubled end to the year

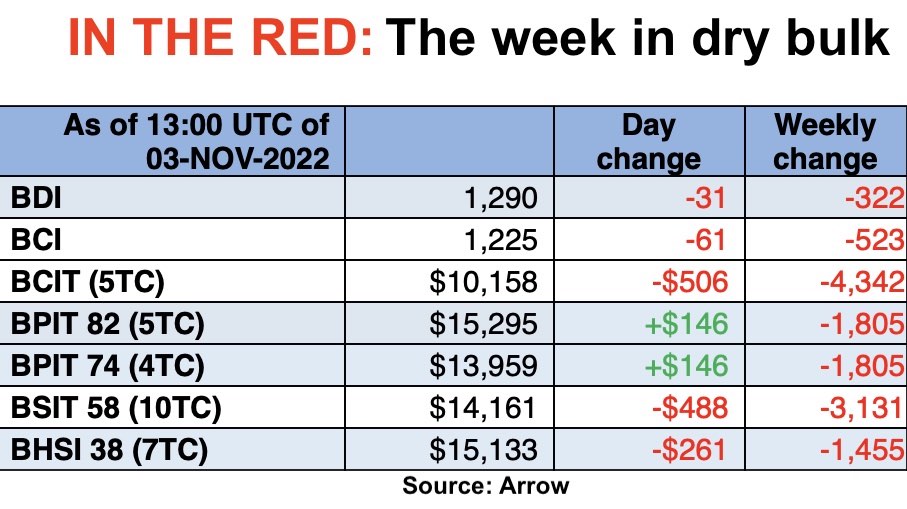

The last three weeks have been poor for dry bulk earnings, with the very real prospect the Baltic Dry Index could duck below the 1,000 point mark this month.

Capes are now working at roughly $5,000 a day below opex on the spot market, and are close to dropping below the $10,000 mark.

Dry bulk shares enjoyed a brief rally mid-week with online speculation that China would shortly ease its zero-covid policies, although no official word has materialised from Beijing, with China watchers now saying March next year looks the most likely earliest time for any relaxation in the nation’s strict pandemic rules.

The International Monetary Fund has said that China’s economy is slowing down. As a result, the agency cut China’s projected GDP growth forecast to 3.2% in 2022 and 2.7% in 2023. It is far from China’s goal of 5.5% GDP growth for 2022.

The World Bank, meanwhile, is expecting a lower growth rate of 2.8% for 2022. The bank also projected in a new update that China would fall from its 30-year reign as Asia’s top economic locomotive.

“The dry bulk sector remains under pressure with a soft steel environment impacting iron ore demand and overall Capesize activity,” analysts at Jefferies noted in a recent market report, noting how Chinese steel prices have dropped to levels not seen since the start of the pandemic in early 2020.

It could get very ugly in Q1

Fearnleys has warned of the potential for further cape drops in the near future, hand in hand with weak fundamentals.

The World Steel Association has released an update of its short-range outlook for 2022 and 2023, forecasting that steel demand will contract by 2.3% in 2022, while in 2023 steel demand is estimated to see a recovery of 1%. In China, steel demand is estimated to decrease by 4% in 2022, and remain flat next year.

Xclusiv Shipbrokers described the overall dry bulk market as being covered by a “grey cloud” since mid-October with freight rates in all the segments softening significantly.

The FFA cape markets have offered little support as both near and forward contracts continued to be sold down for the majority of the week, analysts at Braemar observed.

“The derivative curve certainly indicates we are going to be sub-$10k for a while with Q1 trading at $6,000,” one capesize broker told Splash, adding: “When Q1 seasonality kicks in and demand comes off it could get very ugly with the least efficient part of the fleet idling, unable to compete with the more efficient part .”

For panamaxes, Braemar discussed the “real sense of pessimism” on the physical market in its latest dry bulk update as the disparity between supply and demand hits home.

“Charterers appear to be holding all the cards with owners struggling to find and fix the dwindling numbers of cargoes that are entering the market,” Braemar noted, adding that period business remains largely obsolete.

Supramaxes, ultramaxes and handies have likewise softened this week in a very quiet market.

Looking at the market outlook, Danish shipping line Norden stated in a quarterly update yesterday: “A slowdown in the world economy is expected in line with widespread market uncertainty. The dry cargo market is therefore expected to face further headwinds, compounded by less container market spillover effect and lower growth in global commodity volumes transported.”

While China’s real estate and covid woes have made for a disappointing year in terms of steel output, other regions in Asia are providing a glimmer of hope.

At last month’s Maritime CEO Forum held at the Monaco Yacht Club, attendees were told of the strong growth in steel output coming from Southeast Asia and India this year.

In India, there are some extremely bullish projections. Speaking at the foundation ceremony for the expansion of ArcelorMittal Nippon Steel Hazira steel manufacturing facility in Gujarat this week, prime minister Narendra Modi outlined plans for the country to double crude steel production to 300m tonnes a year within the next decade.