The global dry bulk orderbook is experiencing lows not seen since the start of the sector’s greatest ever bull run.

Theodore Ntalakos, an S&P broker at Greek firm Intermodal wrote in the company’s latest weekly report that the current dry bulk orderbook stands at record lows. While subsequent data provided by BIMCO disputes the “record” description it is nonetheless at a point not seen since the fourth quarter of 2003, the beginning of the epic dry bulk supercycle that would run through to the collapse of Lehman Brothers in September 2008 and see capes regularly earn six-digit daily dollar figures.

“2020 did not offer the best conditions or stability needed for dry newbuildings and as such there has been little order replenishment of bulk carriers in 2020 so the orderbook is today smaller than what it was a year ago by about 200 vessels,” Ntalakos wrote, going on to highlight the growing tranche of ageing bulk carriers approaching 25 years of age.

Intermodal is projecting the dry bulk fleet will grow by “substantially less than 1.5%-2.0%” in the next couple of years, the broker wrote.

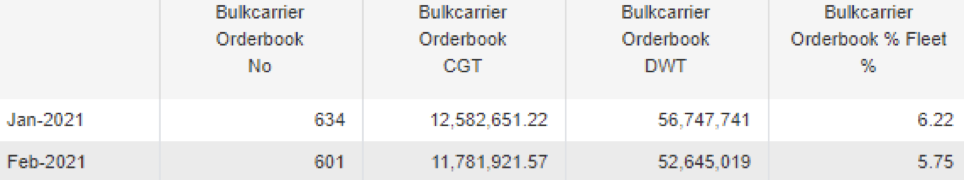

Providing firm statistics on the global dry bulk orderbook (see data below), Peter Sand, chief shipping analyst at BIMCO, said today’s 52.65m dwt on order, representing just 5.75% of the extant fleet, was the lowest seen since October 2003.

Ralph Leszczynski, global head of research at Banchero Costa, said the dry bulk orderbook was both low and short, given that three quarters of the current orderbook is for delivery in 2021.

“The reason there is so little future cover is that there is not that much money available, as owners are coming from a number of years of disappointing earnings, and there was and still is a lot uncertainly about fuels and regulations,” Leszczynski told Splash.

Looking at future demand trends – with reduced global coal demand and China hitting peak steel production – Leszczynski questioned the need for a continually growing and expanding dry bulk fleet in the coming years.

While the orderbook looks hopeful – as does China’s current commodity buying binge – the spot markets have been enduring a torrid week, cancelling out all the gains seen in January.

“With only scattered fixtures being done yesterday, developments make for a difficult read, but clearly levels are under solid negative pressure,” brokers Lorentzen & Stemoco said of the cape markets in an update to clients today.