The European Union’s decision to ban imports of coal from Russia could send energy prices soaring for its consumers, Norwegian energy intelligence firm Rystad has warned. The move would affect up to 70% of Europe’s thermal coal imports, with Eastern Europe and Germany taking a major blow.

According to the US Energy Information Administration, Russia exported 238m tonnes of coal in 2021, with 90m tonnes of this volume being destined for European OECD countries plus Ukraine. Europe’s total coal demand is estimated to have reached around 630m tonnes last year, meaning that the continent relies on Russia for around 14% of its total coal supply.

Once approved, the EU’s ban on coal will be the first on the import of energy from Russia since the start of the invasion of Ukraine, with all existing contracts permitted to carry on until mid-August and spot cargoes set to be completely restricted.

Unlike coal exports from other key producers, Russian volumes are predominantly purchased on the spot market rather than through long-term agreements, meaning a sudden drop in Russian coal exports to Europe is likely to happen if these measures are agreed, Braemar ACM noted. In March, European coal imports from Russia totalled 4m tonnes, declining by 3.6% year-over-year. Steam coal imports, which European countries currently have a strong demand for versus metallurgical, increased by 5.5% YoY totalling 3.5m tonnes.

Although Russian coal imports have yet to be halted, countries are scrambling for alternative sources of supply in a market where prices have more than quadrupled in the past year.

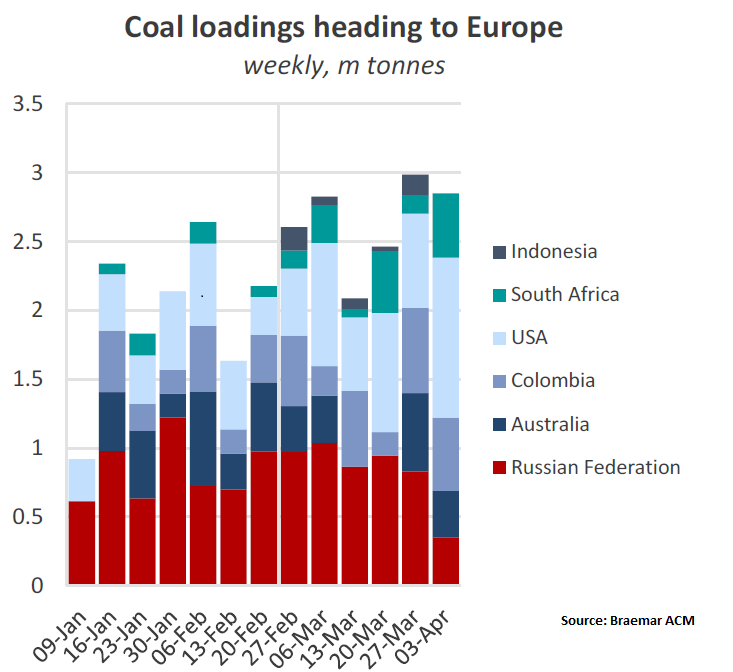

The latest data from Braemar ACM showed that in the week ending April 3, coal liftings in Russia bound for Europe totalled just 350,000 tonnes, falling from 830,000 tonnes in the week prior, and the lowest weekly total so far this year. On the other hand, shipments from the US and Colombia to Europe have hit their highest weekly totals in 2022 in the past couple of weeks, of 1.2m and 622,000 tonnes, respectively. Last week, South Africa surfaced with 466,000 tonnes loaded, also the highest weekly total so far this year.

“However, as power generators typically require a constant flow of coal supply, most volumes from Australia and the US, for example, are already fixed to long-term contracts. Therefore, the extent to which spare quantities are available for spot purchasing remains limited,” Braemar ACM noted.

Rystad warned that this market tightness makes it quite challenging to find alternative sources of coal supply readily available, meaning that European consumers will need to pay a premium to attract flexible sources of supply into their ports. “Suppliers into the seaborne thermal coal market are already maxed out in terms of export volumes, so there is a real shortage of coal available to fill the Russian gap.”

The energy intelligence firm estimated that prices are set to rise even higher as buyers compete for non-Russian coal – and the situation will be magnified if other countries or companies in the Asia-Pacific region also decide to impose sanctions on Russian coal imports.

“These latest sanctions are a double-edged sword. Russian coal exports are worth an estimated €4bn per year, and there is no easy like-for-like replacement for Russian coal in Europe’s power mix. European consumers – from large companies to households – should expect high prices for the remainder of 2022 as coal and gas are essential to meet the continent’s power demand,” said Carlos Torres Diaz, head of Rystad Energy’s power market research team.

Meanwhile, a separate Rystad analysis highlighted that, among other things, the EU’s goals of becoming less dependent on Russian supplies would catapult global energy spending this year to $2.1trn. The European Commission in March unveiled a plan to make Europe independent of Russian gas, and the Commission’s REPowerEU body has set out a framework to target a 45% share of renewables in primary energy by 2030.

Nevertheless, in the short term, upstream oil and gas spending is still leading the way and is now projected to grow by 16%, or $142bn, compared to last year as oil and gas producers around the world increase their investment budgets to boost output. For green energy in 2022, based on the current pipeline of projects, global capacity will grow to 250GW within wind and solar, driving green energy spending to grow by 24%, or $125bn.