Elderly suezmaxes soar in value shifting Russian crude east

Elderly suezmaxes have appreciated dramatically in price this year to fuel demand for Russian crude in the east.

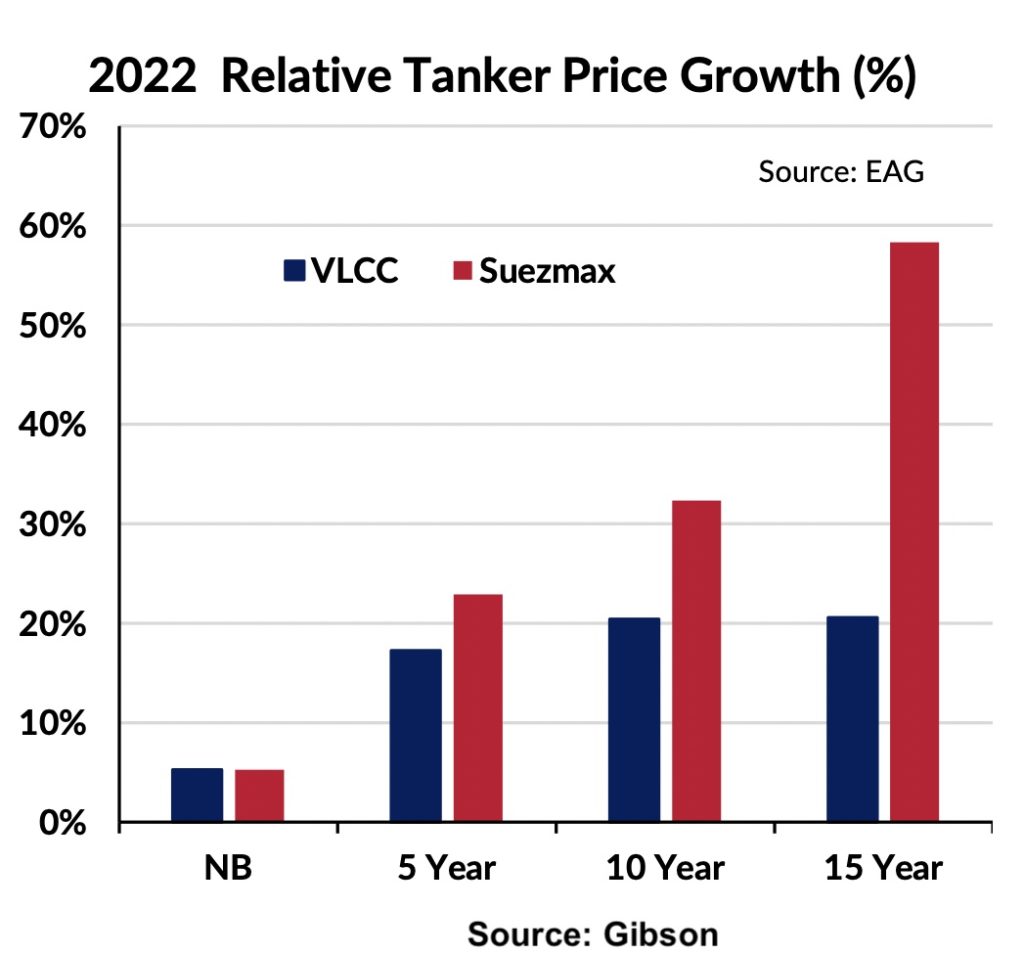

Data from brokers Gibson show that 15-year-old suezmaxes have jumped in price by an impressive 58.5% in the year to date, whilst 10-year-old VLCCs have increased by 20.5%.

“This has been driven by increased enquiry from mostly Middle Eastern, Russian, and Asian buyers, looking to build a fleet of older tankers to carry Russian crude,” Gibson noted in its most recent weekly report.

Such price rises also offer an attractive asset play opportunity for owners looking to dispose of older units ahead of a potentially tougher sales environment once European Union sanctions on Russian oil fully take hold, Gibson advised. It is also an opportunity to pursue more favourable fleet renewal by disposing of older vessels during a spike in values and reinvesting the proceeds into younger tonnage.

Also propping up older tanker values is the persistence of the illicit fleet, which continues to absorb older scrapping candidates to engage in sanctioned trade.

Newbuild VLCC and suezmax values have both increased by 5% so far this year, according to Gibson.