Energy market disruption sees coal cargoes fire up capesize demand

Europe’s ban on Russian coal is seeing cargo travel much longer distances, nearly doubling shipping demand and boosting vessel sizes, writes Plamen Natzkoff from Maritime Strategies International.

Capesize freight rates are set for a period of upside volatility as the fallout from the war in Ukraine continues to spread across the energy markets.

In its latest quarterly dry bulk market outlook, Maritime Strategies International (MSI) points to the re-routeing of Russian exports to new destinations as a result of the EU ban on imports. At the same time imports to Europe are also travelling longer distances to reach the bloc from other sources.

With Russian exports subject to the European Union’s import ban, Russia has re-routed those flows to other destinations, in particular China, India, Turkey a structural change to major coal trade that MSI believes will persist over its forecast horizon.

This is having a significant impact on the average distances over which Russian coal is being transported with the average laden distance for Russian coal cargoes increasing from 2,000-2,500km in 2018-20 to around 4,000km now. Away from any impact on Russian coal volumes, this suggests a near doubling of the shipping capacity required by the Russian coal trade.

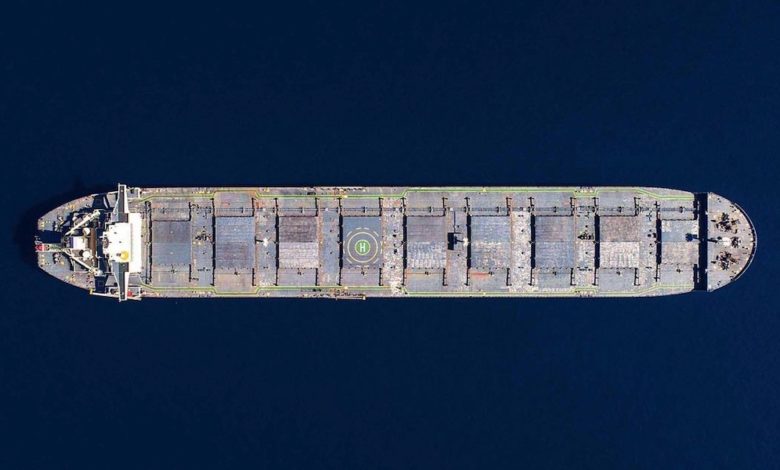

While this is significant by itself, the impact on the freight markets is likely to be further amplified by the shift of that trade towards capesize vessels. While only approximately 10% of the Russian coal trade was previously served by the capesize market, that proportion is now closer to 25%. Given the typical seasonality in the coal trade, and the potential for short-term geopolitical shifts in the Russian coal trade in particular, these factors are likely to contribute to an increase in the volatility of capesize utilisation rates.

With Europe at the epicentre of a global energy crisis since the withdrawal of Russian gas supplies, elevated demand for coal in Europe will persist for some time yet. MSI maintains an optimistic outlook for coal trade this year, forecasting growth of 2.7% year-on-year. Its expectations of a further increase in volumes is underpinned by persistent strong import incentives.