German shipping shrinks from the global stage

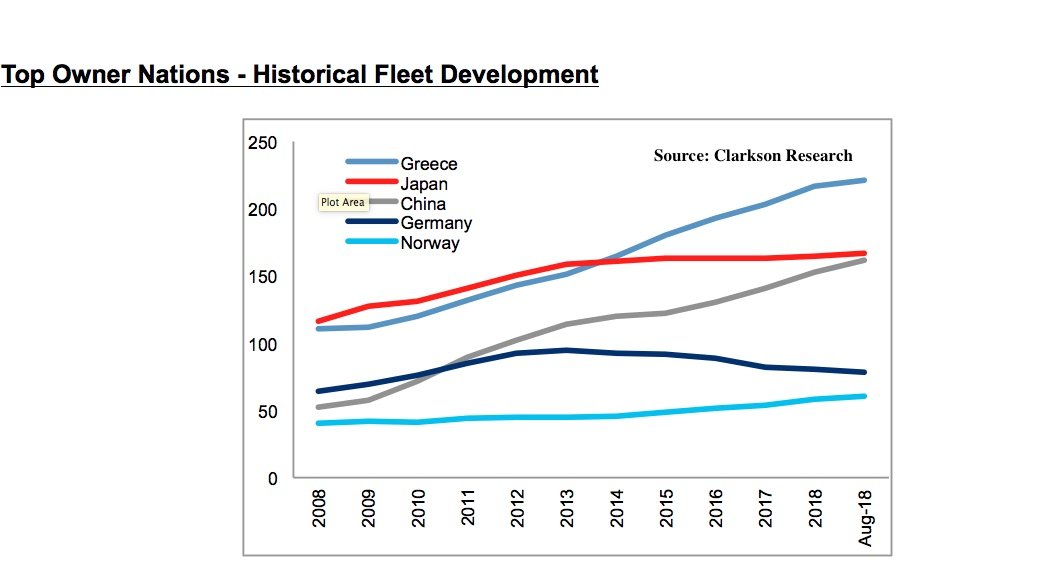

The German market share of the world’s merchant fleet has dropped from 8.3% in 2008 to 5.9% today. Will it continue to slide?

Red ink has sunk many blue ribbon names in German shipping in the past couple of years as banks have finally sought to get their balance sheets into order. The huge clear-out and consolidation has seen famous brands such as Rickmers Shipmanagement, Conti Group and Ahrenkiel Steamship all sink without trace.

The German fleet has contracted by one third in terms of ships in the space of the past six years and many experts contacted by Maritime CEO suspect the consolidation period is far from over.

Christian Nieswandt, head of shipping at HSH Nordbank, reckons the tonnage clear-out for German owners will continue for a while as there are still numerous companies unable to service their debts in a new, stricter environment where financiers are calling in their debts.

“This means that the financing institutions behind the projects have to look for better structures with stronger owners. Change of ownership in many cases goes hand in hand with change of management. Since most new owners are foreign investors, the clear-out of German owners continues,” Nieswandt says.

Nieswandt believes within the next five years the number of competitive German shipping companies in terms of ability to attract management contracts and/or to start new projects with their own or third party equity could shrink to just 20 to 30 companies.

HSH Nordbank, under new ownership, is finally looking to reinvest into the shipping sector.

Ralph Leszczynski, head of research at shipbroking house Banchero Costa, maintains the troubles of the German shipping sector stem from the general collapse of the ship finance sector in the country over the last decade.

“The KG system, which was very prominent 20 years ago, is gone,” he says, adding: “In the past there was an artificially inflated number of ships registered in Germany for purely financial reasons. This is now no longer the case.”

Leszczynski also observes that since German shipping was so focused on the containership sector, it has been the victim of market forces beyond its control. The container sector has experienced the most consolidation in shipping in the past few years, and in such a consolidated market, small independent tonnage providers have a smaller role to play.

Data from Clarkson Research shows that Germany’s largest market share by sector remains containerships at 19.3%, but this is down dramatically from 32.6% in 2008.

Despite the depressing ownership figures Banchero Costa’s Leszczynski is adamant that places such as Hamburg have a very deep pool of shipping talent, and will remain shipping hubs. “They will need to reinvent themselves to some extent,” Leszczynski suggests.

Fotios Katsoulas, the head of Affinity Research, is also of the opinion that consolidation is here to stay for German shipping companies, with the number of active players expected to further drop in the future.

Since 2013, the German fleet capacity has been decreasing by nearly 3% per year, while the global numbers have increased considerably. Germany’s global market share has plummeted accordingly, standing at just 5.9% today, according to Clarkson Research. Nevertheless, Germany is still a very significant ownership cluster, as the fourth largest shipowning nation globally with 78.3m gt.

Last year, there were a total of 10 German shipping companies with more than 50 vessels who exited the market.

Katsoulas believes there is still plenty of space for further consolidation, especially considering that around 77% of German ships are controlled by companies with less than 10 ships, and German shipping’s exposure to the liner sector.

“The number currently stands at 250 active companies, which could quickly drop closer to 50 companies within the next five years,” Katsoulas says.

The companies that will manage to survive, Katsoulas believes, will most probably be those that are still able to further expand their capacity by investing in profitable projects, mainly focusing on S&P transactions of distressed assets. Most of the existing German companies have been facing a lot of trouble as they only have limited remaining contracts for their nowadays less attractive, older assets, and limited capital available to invest in new and more competitive vessels.

Additionally, Katsoulas reckons the main key to success during the last decade – decreasing operating expenses – has proven more difficult for smaller companies, adding further pressure to them and more reasons to consider selling out to stronger players. As a result, their negotiation power becomes weaker as time passes by and contracts get lost.

“Bad memories related to loans to the KG sector in the country remain strong. Limited companies, such as MPC Capital, have been the only winners in the country’s shipping sector,” Katsoulas maintains.

“German owners are certainly making up a smaller portion of the global fleet than they have historically as bank and auction sales increased in 2017. Recovering asset prices in most markets seem to have halted the fire sales for now. German owners continue to sell ships, but its back in line with the historic norms,” concludes Court Smith, an analyst at VesselsValue.

This article first appeared in Maritime CEO magazine, published this week to coincide with SMM in Hamburg. Splash readers can access the full magazine for free by clicking here.