Global CO2 levy as the green driver for shipping

Kare Press-Kristensen, a senior adviser at Green Transition Denmark, writes for Splash today on how market-based measures could decarbonise shipping within the next 17 years.

In Denmark, levies are the driver of green transition in many areas. A levy is the most cost-efficient way to stimulate green transition next to transferable quotas. The basic idea is to put a price on emissions (here calculated as CO2-equivalents) and thereby incentivize reduced emissions. The polluter decides if it is best to reduce emissions or pay the levy – and the polluter decides how to reduce emissions.

Levies work if they are significant enough to motivate changes e.g. energy savings and/or switch to zero carbon fuel. Furthermore, levies need to be transparent prospectively to stimulate investments in green transition e.g. production of zero carbon fuels and development of new engines etc. In addition, levies should be adjusted over time in parallel to technological development. Finally, levy revenues can reduce green transition costs by reimbursing the revenue as financial subsidies to zero carbon fuels.

Business case without a levy

Green ammonia/methanol will probably cost around 1,500 $ per ton fuel oil energy equivalent (FO-eq).

The current price of VLSFO is around 500 $ per ton and HFO around 400 $ per ton (March 2021).

Price gap: 1,000 $ for VLSFO per ton FO-eq and 1,100 $ for HFO per ton FO-eq.

Result: There is no financial driver for green shipping fuels due to the price gap and other sectors will buy green hydrogen, ammonia and methanol (chemical industry, aviation, trucks etc.) when produced.

A levy-reimbursement system can close the price gap

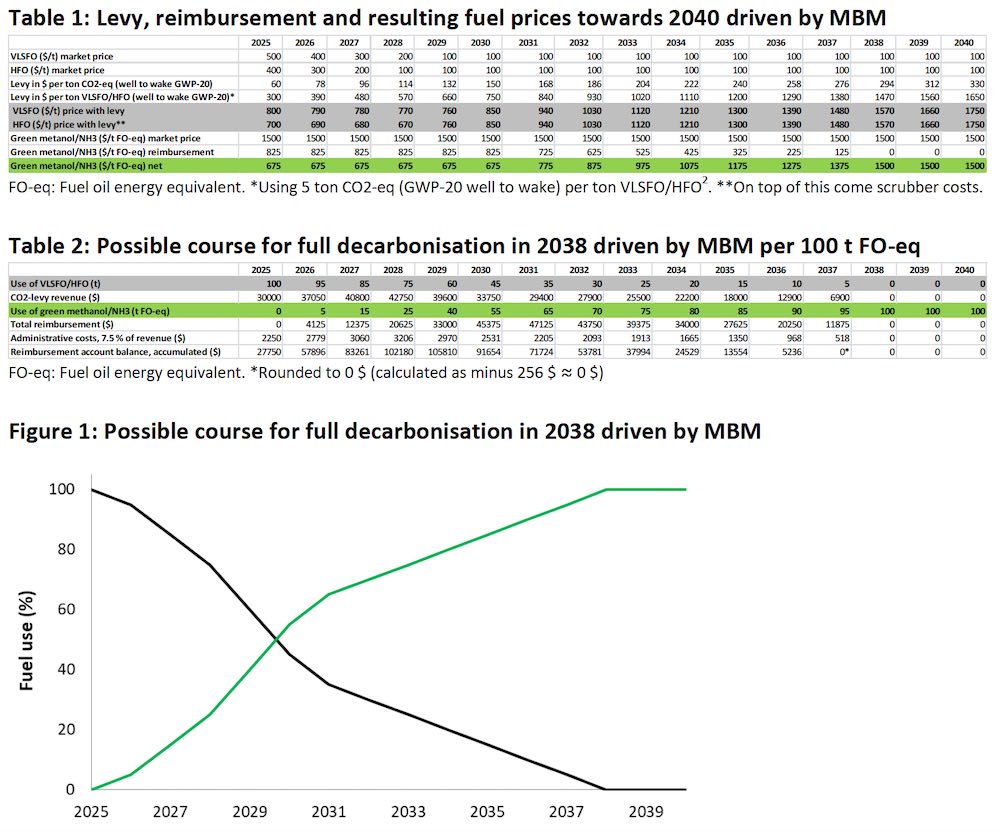

Introduce a basic levy of 60 $ per ton CO2-eq (GWP-20 well to wake) in 2025 (equals around 300 $ per ton VLSFO/HFO1) and subsequently increase the levy by 18 $ per ton CO2-eq per year reaching 150 $ in 2030 and 240 $ in 2035 (750 $ and 1,200 $ per ton VLSFO/HFO in 2030 and 2035, respectively). A similar levy should be introduced on natural gas, distillate fuels etc. The revenue should be reimbursed as support for fuel savings and green methanol/ammonia (table 1). This could result in decarbonisation of shipping towards 2040 (table 2 and figure 1) i.e. aligned with the Paris-agreement (1.5 °C goal).

Business case with a levy in 2030

Assuming green ammonia/methanol will cost 1,500 $ per ton FO-eq and that the price of VLSFO and HFO will drop to 100 $ per ton due to reduced demand. Levy cost for VLSFO/HFO: 750 $ per ton FO-eq. Reimbursement: 825 $ per ton FO-eq cf. table 1.

Result: Zero carbon fuels will be attractive since the price of VLSFO/HFO will be 850 $ (100 + 750) per ton and the reimbursement reduces the price of green ammonia/methanol to 675 $ (1,500 – 825) per ton FO-eq. Furthermore, huge fuel savings will be gained since many savings have reduction costs far below these fuel prices. Price increase for the end consumer will be negligible (around 1 %).

A similar principle should be used for natural gas, distillate fuels etc. providing same decarbonisation. In

reality the levy and reimbursement should, of course, be adjusted in relation to the actual development

in the price of VLSFO/HFO and green methanol/ammonia as well as other key factors. Thereby the

decarbonisation curve of shipping would look different from figure 1 which should only be seen as a

possibility based upon as quick back-of-the-envelope calculation to illustrate the key principle.

SO, assume you’ll be lobbying Danish govt to support RMI/Solomon’s at MEPC76 to get the only actual proposal available across the line.