Contrasting volumes in the global energy mix could see more LNG carriers in operation than VLCCs by as early as 2025, new research from Clarkson Research Services suggests.

Record amounts of gas carrier deliveries this year and a surging orderbook look set to position LNG as one of the global merchant fleet’s fastest growing segments in the 2020s.

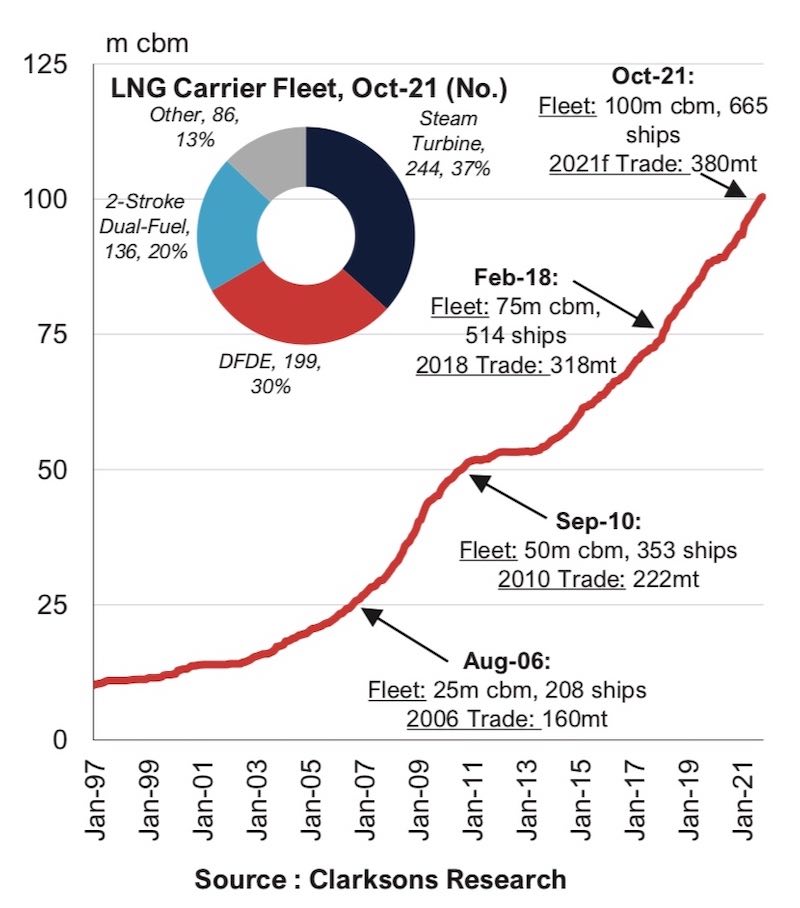

Data from Clarksons shows LNG carrier deliveries in the first nine months of this year reached a new high of 8m cu m, pushing the LNG carrier fleet capacity to more than 100m cu m for the first time, totalling 665 ships.

The LNG carrier fleet capacity has just surpassed 100m cu m for the first time

LNG carrier deliveries so far this year are up 78% year-on-year after robust ordering in 2018.

The 665 ships operating today combined with a massive orderbook led Clarksons to muse in its latest weekly report whether there would be more LNG carriers than VLCCs by 2025. VesselsValue data shows there are currently 837 VLCCs trading today.

LNG carrier capacity has been growing on average by 8% per year since the start of 2014. The LNG orderbook as a percentage of fleet capacity is the largest of all major shipping sectors standing at 25%, and further orders are expected in the short-term, including for Qatar’s approximate 100-ship requirement for which it has booked many slots at leading yards in South Korea and China.

Commenting on the LNG carrier versus VLCC fleet figures, Mark Williams, founder of UK consultants Shipping Strategy, pointed out that gas carriers tend to be used less efficiently than VLCCs.

“One LNG carrier, as a rule of thumb, moves about 1m tons of LNG per year. One VLCC doing six return trips from Ras Tanurah to Shanghai per year moves moves about 1.8m tons of oil,” Williams said.