Good news in short supply

Craig Jallal from VesselsValue.com looks at sales and values changes in the second quarter.

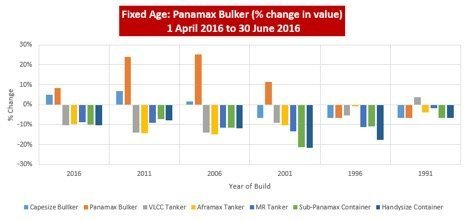

Starting with the good news first, mapping, vessel search and valuation provider, VesselsValue, reports that in the second quarter of 2016, five-year old (2011-built) and ten-year old (2006-built) panamax bulkers fixed age values rose by over 20% in the second quarter of 2016. Figure 1 illustrates the upsurge in values. So what does this mean in reality? In March 2016, the 2006-built, 76,800 dwt Lowlands Camellia was sold for $6.2m. At the end of June 2016, the same vessel (now called Nenita), has a market value of $7.7m, according VesselsValue. In theory, a sale of the vessel could realise a gross return of 24%. Recent sales of a similar vessel include the 2006-built, 82,900 dwt panamax bulker, United Treasure, which was sold in early June 2016 for a reported $8.35m.

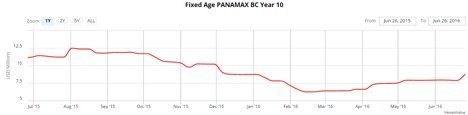

The chart below (figure 2) shows the recent development of values for fixed age 10-year panamax bulkers.

The lowest value recorded ($6.4m) was in March 2016, and the recent 20% or so increase to around $8m, is still a long way from the median value (1 January 2007 to 30 June 2016) of $22m for fixed age 10-year old panamax bulker values.

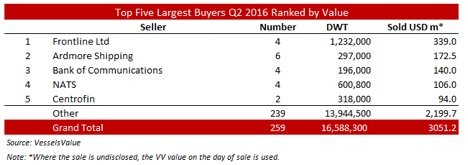

That was the good news. The not-so-good news is shown in Figure 3, which illustrates the total amount spent in the second quarter of 2016. This fell from $6.681bn in Q2 2015, to $3.051bn in the same quarter of 2016. On a quarter-by-quarter basis, the macro picture is not so gloomy, with total sales of $2.95bn and $3.051bn in Q1 2016 and Q2 2016, respectively. Of course, at the sector level, there were some predictable horror stories, such as capesize sales down by nearly a third from $670m in Q1 2016 compared to $230m in Q2 2016.

Alleviating the gloom is the VLCC sector, which saw a tripling of sales to nine VLCCs in the second quarter of 2016, compared to three in the first quarter. There was also a subsequent increase in the total amount spent quarter-on-quarter, from $135m to $534m.

VLCCs figure in the top five largest sellers of tonnage, ranked by total amount spent (see Top Five Largest Sellers).

Metrostar heads the list of VLCC dis-investors, having sold four VLCC resales for a reported $84.75m each. The tankers are due to be delivered at the end of 2016 and in early 2017. Frontline had also been divesting itself of tonnage, too, but the corresponding purchase of the Metrostar VLCCs mentioned above saw Frontline appear at the top of the top five buyers in the second quarter of 2016 (see figure 5).