The Great Reversal: US crude and the diverse forces shaping tanker markets

Reduced floating storage, the high level of deliveries and mixed impact of increased US crude production are continuing to frustrate the tanker market recovery, writes Tim Smith from Maritime Strategies International.

The factor most often cited as the driving force behind a recovery in the tanker market – increased scrapping – so far appears to be having little effect on conditions, despite the high volumes of tonnage, particularly VLCCs, being removed from the fleet. This is partly because deliveries, though lower than in 2017, are still high, whilst scrapping has been volatile.

In the first four months of the year, 5.6m dwt was removed from the VLCC fleet, versus 3.6m dwt added, creating a net drop. However, the picture is less favourable elsewhere – Suezmax deliveries have greatly outweighed scrapping in the first four months of 2018 at 3.4m dwt and 0.6m dwt respectively.

What is missing from this picture is the effect of floating storage. Combining suezmaxes and VLCCs, data from Reuters indicates that the unwinding of floating storage returned about 5-6m dwt back into the market over the last year.

That is approximately half the scrapping seen over the same period. As emphasised in our last report, the result of this is that effective fleet capacity is higher than total fleet capacity. In the near-term this is detrimental to the market, but we also believe that over time the supply-side will have a positive effect on earnings.

This, however, also depends on the demand side and this facet of tanker market fundamentals is less often referenced, simply because it is much harder to get to grips with than the supply-side.

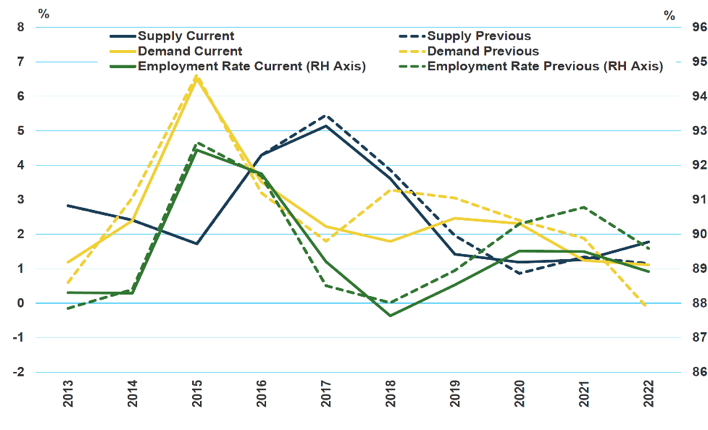

Chart 1 shows the results of the changes we have made to market fundamentals. The key change is the downward revision to demand growth in 2018. This drives a steeper negative gradient on our overall employment rate this year, marking a clear downshift in conditions, rather than the previous stabilisation (albeit at low levels) of our Q1 18 outlook.

We expect the growth profiles for crude and products trade to be quite different; where crude demand growth sees moderation through to 2020, products demand growth sees a sharp increase in 2019/20.

Crude deadweight demand growth sees a premium to seaborne trade growth, recognising the impact of increasing flows out of the Americas into Asia. Whilst we expect seaborne crude trade to flatten, suppressed by higher overland volumes, crude tanker demand will continue to expand.

On the products side, recent deadweight demand growth has been close to 2% and this is set to continue in 2018, at a similar level to seaborne trade. Intra-Atlantic and intra-Asian trades have been prominent contributors to growth, limiting both the tonne-mile impact on demand, and markets for larger product tankers, as Middle Eastern product exports slowed.

As we go forward we expect a number of themes to shape these profiles. In crude markets we will see a continuation of what could be described as the ‘Great Reversal’.

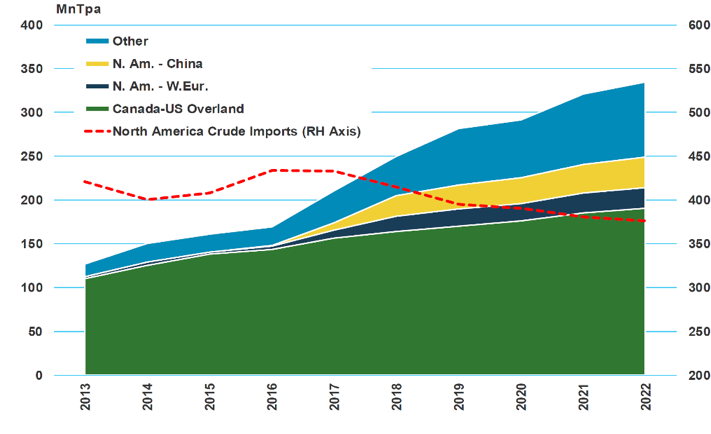

Historical flows into the US are reversing as the region increases its crude exports. This is one of the key changes happening ‘at source’, but it is not all good news for the crude tanker market. US crude imports are going to fall quite sharply this year, whilst the volumes of crude moving overland from Canada are expected to continue their upward trajectory, eating into the dwindling US crude import pool.

Chart 2 shows these flows, breaking down North American crude exports by flow, as well as showing total crude imports.

Historically, overland shipments from Canada have provided the vast majority of North American exports as US crude has been locked in. That changed as we saw the de-regulation of US exports, combined with rapid production recovery following the oil price crash. Now we see volumes on routes such as China and Western Europe growing sharply, with other destinations in Asia also taking in growing amounts of US crude.

Although there is some concern over the internal infrastructure needed to release US crude, we expect this seaborne element of US crude exports to grow. However, imports, shown on the same scale, are forecast to decline. This restricts the net demand growth impact of North America as a unit of the global crude trade system, and partly explains why our view on seaborne crude growth appears bearish. It also explains why rising US crude exports are having no visible, positive impact on tanker earnings.