Growing congestion poses threat as peak season gets underway

Congestion is growing at key box terminals around the world with shippers warned today to brace for another frustrating few months ahead as the peak season gets underway, even if western consumer demand does look to have eased in 2022.

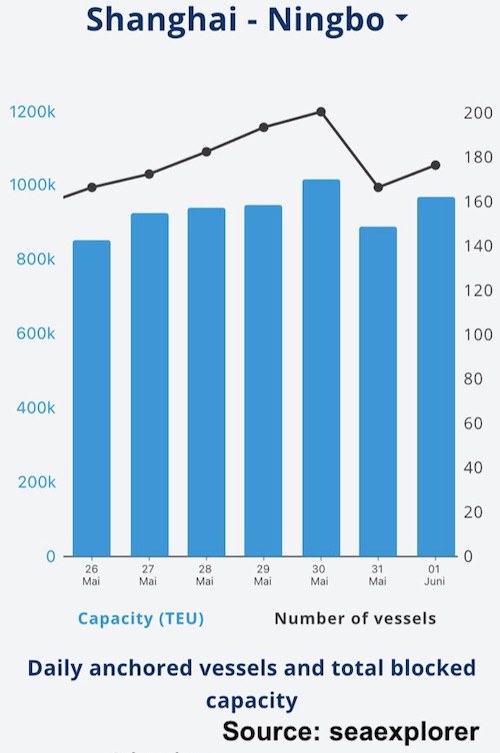

Kuehne + Nagel’s ocean freight platform seaexplorer shows that while congestion is better than it was compared to year-end, it has been getting worse over the past fortnight. The platform has developed what it terms as a Global Disruption Indicator, which tallies the cumulative teu waiting time in days based on container vessel capacity in disrupted hot spots.

We could be in for another roller coaster ride

The teu waiting days (twd) indicator works whereby, for example, one vessel with a 10,000 teu capacity waiting 12 days equals 120,000 teu waiting days. The global teu waiting days stands at close to 9m twd, with seaexplorer officials explaining supply chains will only get back to normal when that figure gets below 1m twd.

Global supply chains are having to factor in myriad headaches. High freight costs, congestion at terminals and inland, an earlier peak season, and the resumption of manufacturing at many Chinese locations where production has been severely disrupted this spring thanks to strict covid lockdowns.

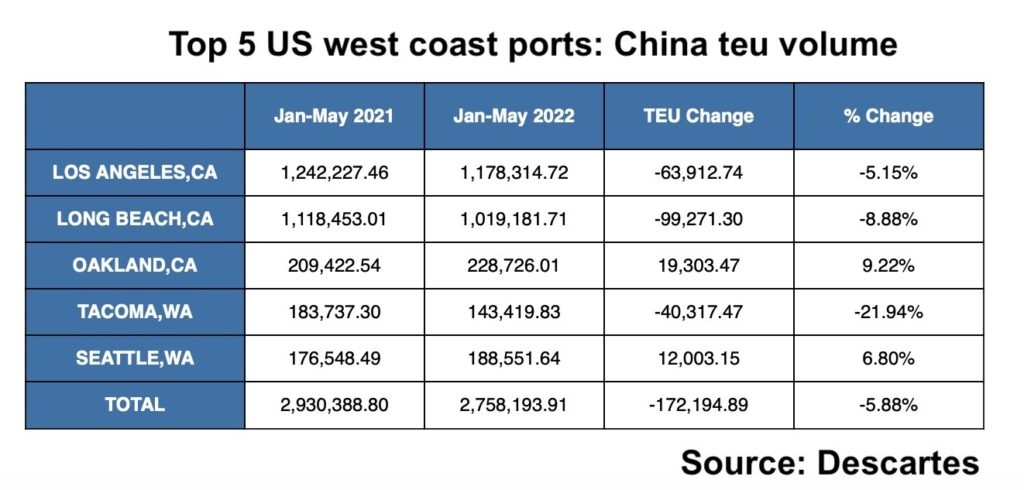

According to Descartes Datamyne figures, Chinese origin shipments declined almost 6% in this year’s January 1 to May 29 period to the top five US west coast ports, compared with the same months last year, clearly showing the impact of covid lockdowns on some of China’s largest industrial hubs. The knock-on effect saw the busiest US ports of Los Angeles and Long Beach experiencing China teu volumes drop 5% and 9% respectively. Both ports came in the last two places in a recent World Bank port productivity report which featured 370 ports from across the world.

Sticky congestion only prolongs the waiting time of lower shipping costs

“When major industrial Chinese cities come out of their covid lockdowns, thousands of factories will resume production. And as they do, there’s one thing they will likely be placing a priority on – they will be working to make up for lost time. That could have a major impact on global supply chains. With a significant number of these resurgent shipments hitting the US west coast, we could be in for another roller coaster ride,” commented Alfred Hille, director of product marketing at Decartes.

Mario Cordero, executive director of the Port of Long Beach, said on the sidelines of a Reuters Events logistics conference in Chicago on Thursday that he expected a surge of boxes coming his way from Shanghai.

The average time boxes wait at the ports of Los Angeles and Long Beach has surged recently, and reached 9.6 days in April, the highest level since July 2021, according to the Pacific Merchant Shipping Association.

While data from Freightos shows that average China – US ocean transit times have steadily fallen by 12% since the start of the year, the freight platform’s head of research, Judah Levine has warned this week of growing problems behind the quayside.

“With warehouse space already scarce and renewed rail backlogs a growing problem, there are fears that a new surge of containers could once again lead to packed container yards and erase the recent gains,” Levine said.

There is also the growing threat of strikes to contend with with dockworkers across the US west coast and in Hamburg in Germany putting pressure on sizeable improvements to their pay conditions this summer.

In northern Europe multiple data providers show that key ports are clogging up, just as Shanghai reopens.

“Congestion has worsened during the lockdown at major European hubs as warehousing and labour shortages have led to container yards clogged with imports,” commented Levine from Freightos.

The latest data from Copenhagen-based Sea-Intelligence shows that 10.5% of the global fleet is still unavailable due to supply chain delays, a figure that has dropped from 13.8% in January.

A research note from ING this week stated that supply chain pressures remain at historically high levels, with the Dutch bank not expecting supply chain disruptions to ease substantially this year.

“Although weaker consumer demand from China due to dwindling growth expectations and Covid lockdowns, and the EU, due to eroding purchasing power, will alleviate some pressure on supply chains, industrial production is holding up well thanks to high backlogs of work due to shortages which is enough to keep supply chains strained throughout the year,” analysts at ING suggested.

In conclusion, Peter Sand, chief analyst at freight rate platform Xeneta, told Splash today shippers should be “quite worried” as congestion would keep rates elevated, even if actual consumer demand was falling.

“If anything positive should come out of the rapidly increasing cost of living, and thus lower consumer demand for containerised goods, it could be a faster track back for normalisation. Sticky congestion, in whatever form and place, only prolongs the waiting time of lower shipping costs and improved supply chain reliability,” Sand said.

In line with the growing congestion and the arrival of the peak season, key freight rate indices such as the Shanghai Containerized Freight Index (SCFI) have recently started to nose back upwards after months in decline. The SCFI was up by 32 points yesterday, its second week of gains.