Have handysize asset prices peaked?

New tool providing quarterly assessments across all financial metrics suggests peak has passed for smaller bulk carrier prices, and canny owners are already divesting, writes Will Fray from MSI.

The dynamics that have supported earnings for smaller geared dry bulk vessels over the past 12-18 months have also supported asset values. Whilst newbuild contract and scrap prices have broadly moved in tandem across bulker benchmarks since the start of 2021, second-hand prices for smaller ships have far outperformed their larger counterparts.

Data from MSI’s latest quarterly Dry Bulk Report indicates that five year old handysize ships have more than doubled in value since January 2021, whilst capesize values are up by only 56%.

The relative changes to asset values since the freight market peak in October are remarkable. Capesize secondhand prices have broadly followed conventional wisdom since then: the positive impact of rising newbuild prices (up 3.3% since October) and scrap (up 10%) have been offset by lower earnings (down 11%). It is no surprise to see five year old capesize prices only 1% higher over this period.

Recent selling activity by some famous owners suggests MSI is not alone in adopting a cautious outlook

Whilst handysize newbuild and scrap prices have increased by similar amounts, since the start of the year (3.6% and 10%), and timecharter rates are also about 10% lower, the values of secondhand handysize assets are sharply higher. A five year old handysize vessel is now worth 17% more than in October. Is this an upwards correction to overly negative valuations in October, or are handysize vessels now overvalued?

A new feature on MSI HORIZON, providing more detailed financial analysis for shipping investments, helps to assess this question.

MSI’s new Project Financial Analysis tool is a financial model providing quarterly projections for P&L, balance sheet, cash flow, loan schedule, depreciation, and resulting financial metrics to evaluate investment return. It can be used for single vessels, or portfolios of ships across multiple sectors with each vessel subject to its own financing, chartering and operating cost conditions.

The outcome is revealing. Despite fundamental analysis showing that smaller vessels will be subject to better market conditions (stronger growth in minor bulks and grains trades, a smaller orderbook, a larger proportion of the fleet at scrapping age), and will have relatively stronger earnings potential when compared with history, the unlevered IRR for a purchase of a five year old handysize bulker today and sold in five years as a 10 year old, is 4.4%, lower than a capesize (5.9%).

This analysis suggests that handysize bulkers are now relatively overvalued when compared with capesize ships. But with investment returns of under 6% per year, it could be argued that both are overvalued in absolute terms, if shipping investments are to be judged against a typical cost of equity of around 8%.

This would go against the prevailing optimism amongst dry bulk owners, particularly for smaller tonnage. But recent activity by some owners, with Taylor Maritime, Pacific Basin and Swire (China Navigation) all selling vessels, suggests MSI is not alone in adopting a cautious outlook.

Perhaps the most prominent proponent of the investment case for smaller bulkers has been Taylor Maritime Investments (TMI), a UK-listed dry bulk entity spun out of the Hong Kong owner of the same name. Taylor Maritime’s IPO in May-2021 allowed the company to purchase 23 vessels at the time of inception; the fleet has since increased to 28 ships (27 handysize and one supramax) and the share price has risen by over 50% over the past year.

Interestingly, TMI’s fleet would have been larger but for selling four vessels since the end of December (generating IRR’s in excess of 100%). They have also sold another vessel in a sale-and-leaseback deal and have meanwhile committed a larger share of its fleet on longer term timecharter contracts. They have also diversified their exposure, by taking a stake in Grindrod shipping, which has a significant portfolio of supramax and ultramax ships.

This would suggest that the company has changed tack this year and now feels that there is more value in selling handysize assets in the current market whilst also taking a cautious view over longer term earnings. TMI are not alone amongst well-known names selling handysize tonnage. Pacific Basin has also sold four assets this year, whilst Hong Kong compatriot Swire (China Navigation) has sold six.

Nonetheless, given the sharp rise in prices, it would seem that the balance of view sits more on the optimistic side for investing in dry bulk ships, particularly smaller tonnage. But MSI’s outlook is more closely aligned with those selling assets, illustrated by the relatively low returns highlighted above.

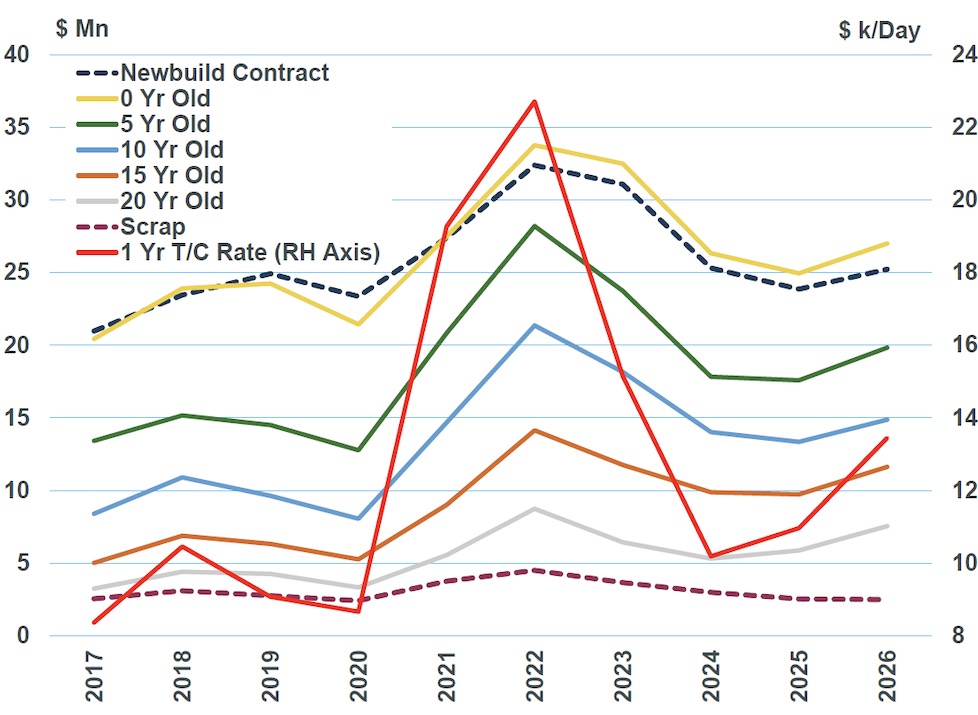

MSI’s view is driven primarily by the expected fall in bulker earnings in 2023/24, but the earnings cycle is closely aligned with the newbuilding and scrap price cycles – both of which are expected to deteriorate over the next two years (see chart).

Modern asset values next year will be supported by the newbuild replacement cost, which will only witness a marginal reduction – five year old handysize prices will fall by just 15% year-on-year next year, compared with a 26% fall for 20 year old values, for example. But in MSI’s base case, all drivers for asset prices weaken sharply in 2024. A minor deviation between the direction of earnings and newbuilding/ scrap prices in 2025 means that MSI’s forecast for secondhand asset values in that year is broadly flat, before an uptick in 2026.