Hong Kong: How to build back trust

The city has slipped down the maritime hub rankings. There’s plenty of advice on offer to climb back in the second instalment of our brand new Hong Kong magazine.

“This is likely the most challenging time Hong Kong has faced in the last several decades,” concedes Matthew McAfee, who heads up local shipowner Fairmont Shipping. “But,” he adds, “this is an extremely resilient city.”

Few places on Earth are as resilient, capable of bouncing back and transformation. Nevertheless, the challenge Hong Kong faces to rekindle its covid battered maritime hub status is immense.

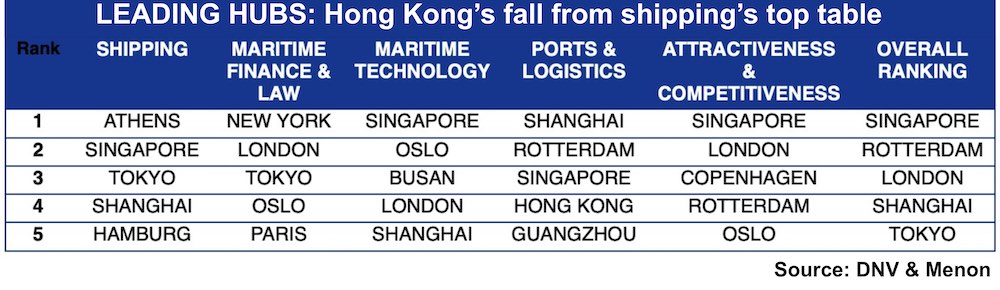

Hong Kong fell to seventh place among the top maritime cities of the world, according to the Menon Economics and DNV’s 2022 report published in January. The Special Administrative Region (SAR) was placed fourth in the last report released in 2019. Meanwhile, the Xinhua-Baltic International Shipping Centre Development Index Report released in July placed the city fourth worldwide, down from its silver ranking on the podium in the report’s previous edition.

Other shipping and financial hubs in the region such as Singapore and Tokyo have been heavily promoting their strengths to companies looking at exiting Hong Kong in recent years with a number of well-known Hong Kong shipowners looking at alternate sites.

“The last couple of years’ dynamic zero-covid policies have been extremely damaging to Hong Kong’s reputation as a place from which to do international business, and with that shipping,” says Bjorn Hojgaard, the CEO of Anglo-Eastern, the SAR’s largest shipmanager. “We are behind, and it’s no use pitching the return of Hong Kong until the policies for compulsory testing and isolation, social distancing, group gatherings and mask mandates are competitive with international standards.”

You should definitely not write off Hong Kong

This point of view is shared by Gautam Chellaram, the chairman of dry bulk owner KC Maritime.

“Hong Kong needs to focus on rebuilding trust that despite the lengthy covid restrictions it still is an international, vibrant shipping hub which can provide shipping services at the doorsteps of China operating within a constitutional principle of one country, two systems,” Chelleram tells Splash.

Hong Kong is the fourth largest flag state in the world, offers a very attractive tax regime and enjoys a first-class reputation in international shipping, Chelleram notes.

The city, he says, needs to identify key unique selling points such as having a digital registration and finding cost-effective solutions where other leading cities are behind the curve to make Hong Kong the flag of choice.

Hong Kong has overcome many challenges before, points out Vinod Seghal, the head of SeaQuest Shipmanagement, listing the Asian financial crisis, SARS, bird ‘flu, and the 2008 financial crisis as examples. There’s no reason the current administration cannot overcome today’s challenges, he reckons.

Hong Kong needs to focus on rebuilding trust

Under Carrie Lam and her successor John Lee, the city has been good at providing tax perks to make the city more attractive to maritime companies.

In July, the new Lee administration introduced half-rate profits tax concessions to ship agents, shipmanagers and shipbrokers, which together with 2021’s enactment of the Ship Leasing Bill ought to attract more commercial interests to Hong Kong.

Applauding the latest tax cuts, Angad Banga, chief operating officer at The Caravel Group, tells Splash: “This tax environment incentivises companies to set up and retain entities in Hong Kong, and provides increased scope and flexibility to companies to invest in other areas of their business, such as hiring more people or allocating more resources to R&D. This supports the continued building of this maritime industry ecosystem in Hong Kong.”

The strength of Hong Kong’s industry ecosystem as well as its geographical position are its greatest assets, Banga reckons. The key to Hong Kong’s continued success as a leading maritime hub according to the Caravel executive lies in its agility to move with and support industry cycles of peaks and troughs, as well as periods of unexpected challenges or turmoil.

“While we welcome the recent tax concessions, further tax incentives, facilitation of more friendly working visa procedures and expat families support would all encourage movement of the commercial principals and talents into the city,” suggests Hing Chao, the chairman of one of the city’s most famous shipowner brands, Wah Kwong.

Another plus from government this year has been the establishment of a dedicated Transport and Logistics Bureau to support and formulate policies to strengthen the maritime cluster’s development.

This tax environment incentivises companies to set up and retain entities in Hong Kong

Concluding on an optimistic note, Caravel’s Banga says that while Hong Kong may get caught up in this current geopolitical environment of increasing tension and deglobalisation, where countries are looking inwards rather than outwards, the city’s pro-business approach to free and fair trade – as well as position within Asia and as a key gateway to mainland China – provides it with a “significant competitive advantage”.

“You should definitely not write off Hong Kong, despite the difficulties of the last couple of years,” says Anglo-Eastern’s Hojgaard, one of the most fierce shipping critics of the territory’s handling of covid. “Hong Kong has rebounded resoundingly before, and can do it again,” he says, adding: “But it’s fair to say that this is probably the biggest test ever of confidence in Hong Kong as a vibrant international business centre in Asia.”

This article appears in Splash’s Hong Kong Market Report 2022, distributed across multiple events at Hong Kong Maritime Week. Splash readers can access the full magazine for free by clicking here.