Analysts at BRS are predicting a “crunch” on ice-class tonnage as Russia’s winter approaches, something that could drive premiums for this niche tonnage to “eye-watering” rates.

Last winter saw record earnings for aframaxes lifting Russian crude with ships on the now suspended TD17 from Primorsk to Wilhelmshaven hitting as high as $350,000 a day in early April in the opening weeks of Russia’s invasion of Ukraine. Aframax rates have been heating up again recently leading some experts to wonder if similar highs can be reached in the coming months.

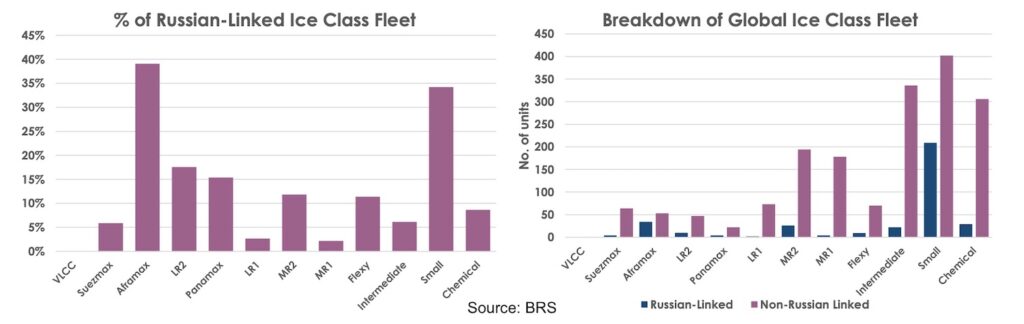

According to BRS data, there are currently 700 tankers of 34,000 dwt or above classed as ice-class IC or above which equates to 13% of the entire 34,000+ dwt tanker fleet.

“The relatively small size of the Russian ice class fleet and the requirement that Russia maintain its oil exports at as close to today’s levels as possible explains why ice class tonnage has been changing hands for extremely high sums recently,” BRS stated in its latest tanker report.

For example, a 15-year old ice-class aframax recently changed hands for $33m, twice what it was worth a year ago. Ice-class MRs have also changed hands for “startling” prices, BRS reported, suggesting there would be no scrapping of ice-class tonnage for as long as the war in Ukraine persists.

“[A]s Russian exporters become more desperate to maintain their exports as winter looms, there remains the potential for ice class tanker prices to firm further,” BRS forecast. Ice-class suezmaxes could be a target with BRS data identifying 30 such units which are 15 years or older.

While BRS sees Russia building up its crude ice class fleet, the French broking house believes Moscow has left it late to develop a suitable, sizeable ice-class fleet of clean LR and MR tankers.

With less than six weeks to go until a European Union tanker ban comes into place, many analysts are trying to piece together the scale of alternative capacity Russia will need to ship its oil overseas.

Analysts at Braemar, for instance, have calculated that Russia currently faces a shortfall of nearly 70 aframaxes and 35 suezmaxes.