India’s energy mix in 2022 continues to throw up plenty of curveballs for those involved in the dry bulk and tanker trades.

Braemar is reporting the Asian nation has been on a huge coal buying binge, which looks set to continue.

Indian power stations have been replenishing inventories with thermal coal imports up 45.1% last month, totalling 20m tonnes.

Liftings from Indonesia increased by 165.4% year-on-year to 14.7m tonnes, while from Australia volumes totalled 2.2m tonnes, falling by 20% year-on-year.

“This rise in coal demand was driven by a 26.58% year-on-year increase in coal power generation in June and stockpiling by power stations amid a global energy shortage,” Braemar noted in a new markets commentary.

The country experienced widespread power outages in April and May, when the easing of covid lockdowns and a severe heatwave led to a surge in power demand.

The coal buying uptick looks set to continue. According to data from the Central Electricity Authority, coal stocks at 172 reporting plants totalled just 27.5m tonnes on July 10, 49% of target inventory levels. Meanwhile, 42.4% of plants continue to operate at critical stock levels, defined as being 25% below their targets, which Braemar suggested will likely mean these imports levels may be sustained in the months to come.

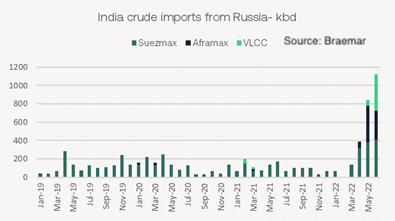

On the tanker front, the big story this year for India has been its massive purchasing of Russian crude, a product that the west has shunned in the wake of the war in Ukraine.

India’s June crude imports from Russia hit a record high of 1.12m barrels per day, versus an average of 103,000 barrels per day in 2021.

“Indian refiners have been snapping up Russian crude sold at hefty discounts, where cheap Russian oil reduces losses for state-run refiners selling fuel at lower prices on the domestic market while adding profits to private refiners which export refined products,” Braemar noted.