Shipping analysts have given the thumbs up to yesterday’s big tanker merger news between Euronav and John Fredriksen’s Frontline, while cautioning that the sector will remain highly fragmented. The two European giants plan to combine their fleets in all share deal to create the continent’s largest tanker firm in which Fredriksen will hold a leading 22% stake once the deal is approved. The $4.2bn entity would be called Frontline, and be headed by Euronav’s CEO, Hugo De Stoop.

In an update to clients yesterday, Evercore ISI analysts said the merger would create a “supersized tanker behemoth” in an industry where most company market capitalisations are lower than $1bn.

“The potential combination would create a truly investible tanker company with a meaningful and liquid market cap, which would also effectively become a bellwether for not just tanker equities but maritime transportation as a whole due to its enhanced scale,” Evercore ISI suggested.

The potential combination could become a bellwether for not just tanker equities but maritime transportation as a whole due to its enhanced scale

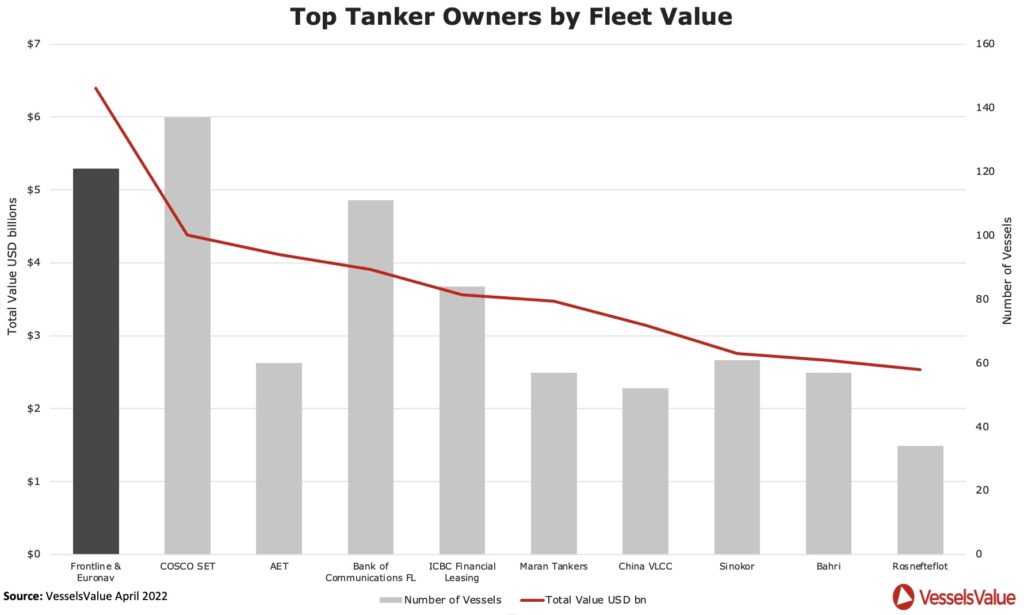

The merged company would become the largest owner operator of crude tanker tonnage, with a combined fleet of 69 VLCCs and 57 suezmax vessels and 20 LR2/aframax vessels. For perspective, DHT, which would be the second largest crude tanker company following the merger, has a total of 26 VLCCs.

Mark Williams, founder of UK-based consultancy Shipping Strategy, told Splash: “Regulatory and financial pressures, plus the prospect of us hitting peak oil demand in the lifetime of ships built since 2015, mean that consolidation is probably inevitable in the tanker markets. To move now while tanker rates are very underwater indicates that Frontline thinks the crude oil freight market is due a recovery.”

BIMCO’s chief shipping analyst, Niels Rasmussen, pointed out that the tanker market will remain very fragmented even after such a merger with data from Banchero Costa yesterday suggesting the combined Frontline/Euronav entity would command around 10% of the global VLCC and suezmax fleets.

Commenting on the mega merger news via LinkedIn, Roar Adland, shipping professor at the Norwegian School of Economics, said the larger market cap would give the merged firm better terms both in the equity and debt markets.

The Euronav brand, likely to disappear when the deal is concluded, has been around since 1989, coming under the control of the Saverys family in 1997. Talks between the Saverys family and Fredriksen over a possible tanker tie-up have been going on and off for many years, with first discussions on the matter reported 23 years ago.

For Fredriksen, 77, the richest man in Norway, the Euronav deal shows he still has an appetite for the big deals, having built a career on the back of audacious takeovers. It also signals that the worst is over from the restructuring of Seadrill, his drilling contractor, which has taken up much of his time in recent years.