Japanese yards offer last available slots as China builds up its naval might

Japanese yards are the only ones in east Asia with any relatively prompt delivery slots, new analysis from Barry Rogliano Salles (BRS) shows, with South Korea sealing mega contracts this year, as has China, a nation that is shifting more dock space to build ships for its fast growing navy.

Asia’s three shipbuilding powerhouses together account for over 95% of the global orderbook in deadweight terms, according to BRS.

BRS subsidiary Alphatanker has carried out a detailed examination of shipyard capacity in Asia with results suggesting shipowners ought to build ties with Japanese yards if they want any new ships anytime soon.

Chinese shipyards remain reluctant to sign orders and discuss prices for long-term deliveries

71.8m dwt of tonnage – 967 ships – was ordered globally last year, a fall of 4.7m dwt on 2019 when 1,120 ships were contracted. In contrast, this year has already seen 67.6m dwt of tonnage has been ordered globally which already accounts for 94% of last year’s total. “[A]vailable slots in Asian shipyards are being rapidly exhausted,” Alphatanker pointed out in its latest monthly report. Alphatanker analysis suggests owners keen to order VLCCs or suezmaxes will now need to be patient, with the second half of 2024 being the earliest time available in China and South Korea, the world’s top two shipbuilding nations, where orders for big boxships and LNG carriers have flooded in of late.

Moreover, in China several state-controlled yards have a large number of slots reserved for the construction of military vessels.

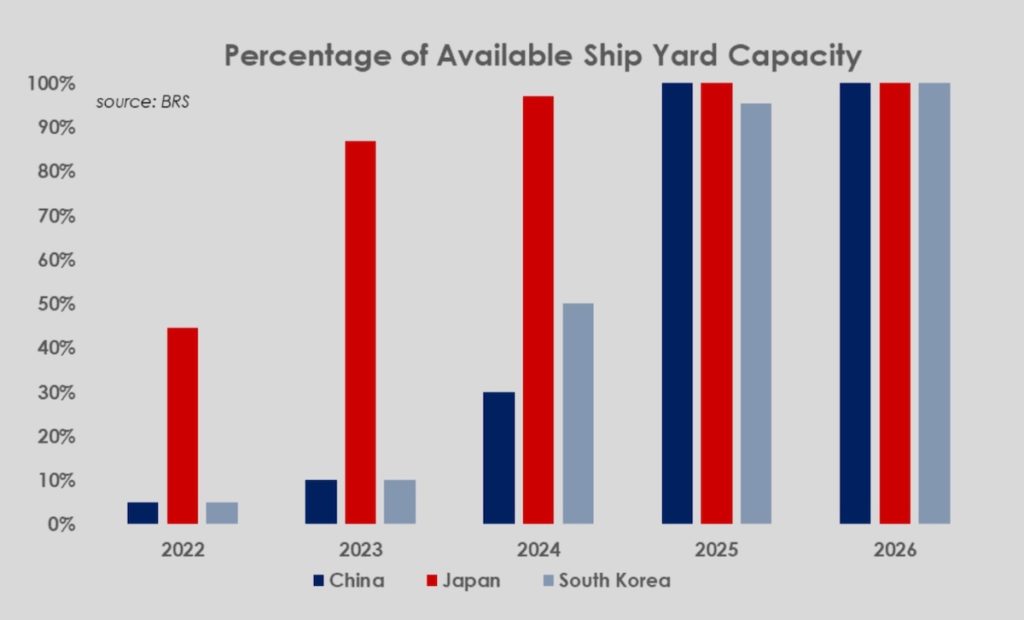

“Although the Chinese administration treats such construction as a state secret, we believe that this is an especially important issue during 2022 and 2023 when we believe that only 5% and 10%, respectively, of yard capacity remains available,” Alphatanker projected, adding: “Looking forward, Chinese shipyards remain reluctant to sign orders and discuss prices for long-term deliveries. This is due to the risks associated with steel price fluctuations.”

During a previous boom in shipbuilding from 2009 to 2014, Chinese yards lost money on much of their output due to the soaring price of steel.

Analysts at the Department of Defense in Washington conceded last September that China has already surpassed the US in securing the title of the world’s largest navy. The coming few years could see the naval gap increase between the two most powerful nations in the world. The United States Office of Naval Intelligence has confirmed that the People’s Liberation Army Navy (PLAN) has surpassed the United States Navy in total battle force ships, approximately 360 to 297, with future projections suggesting that by 2025, the PLAN will field as many as 400 vessels compared to the US’s projected 355 tally.

BRS data indicates that Japanese yards have not received the same volume of orders over the past year as their East Asian rivals, which leaves occupancy at 55%, 13% and 3% in 2022, 2023 and 2024, respectively. However, it should be noted that Japanese yards do not report their orders with the same gusto as yards in Korea and China.