Jury still out on 2021 container growth figures

Full year growth figures for the volume of containers shipped around the world are showing considerable divergence among analysts.

Clarksons Research Services is now projecting the global container trade will reach 206.8m teu in 2021, up 6.3% year-on-year.

Maersk, meanwhile, suggested last week that global trade volumes will grow 7% to 8% this year compared with 2020.

Charles Moret from container advisory CTI Consultancy put the annual figure in the 8% to 9% range when contacted by Splash today.

“Year to date we are above 10% and projecting 4% for the last four months,” Moret said.

Alphaliner is predicting 5.8% year-on-year growth. Overall, the top 20 container ports handled 13% more twenty-foot boxes in the first six months of 2021 compared to the same period in 2020, new analysis from Alphaliner shows.

The most startling figures from Alphaliner’s port data on the first six months come from the United States where Los Angeles/Long Beach and New York/New Jersey recorded year-on-year throughput growth of 41% and 31% respectively.

“American consumers are shaking up the lower orders of the global port throughput rankings as demand for goods soars in North America in the wake of COVID,” Alphaliner noted in its most recent weekly report.

Danish consultants Sea-Intelligence have used data published by the United Nations Conference on Trade and Development (UNCTAD) on port stays to shed light on the current bottleneck issues faced by the container shipping industry.

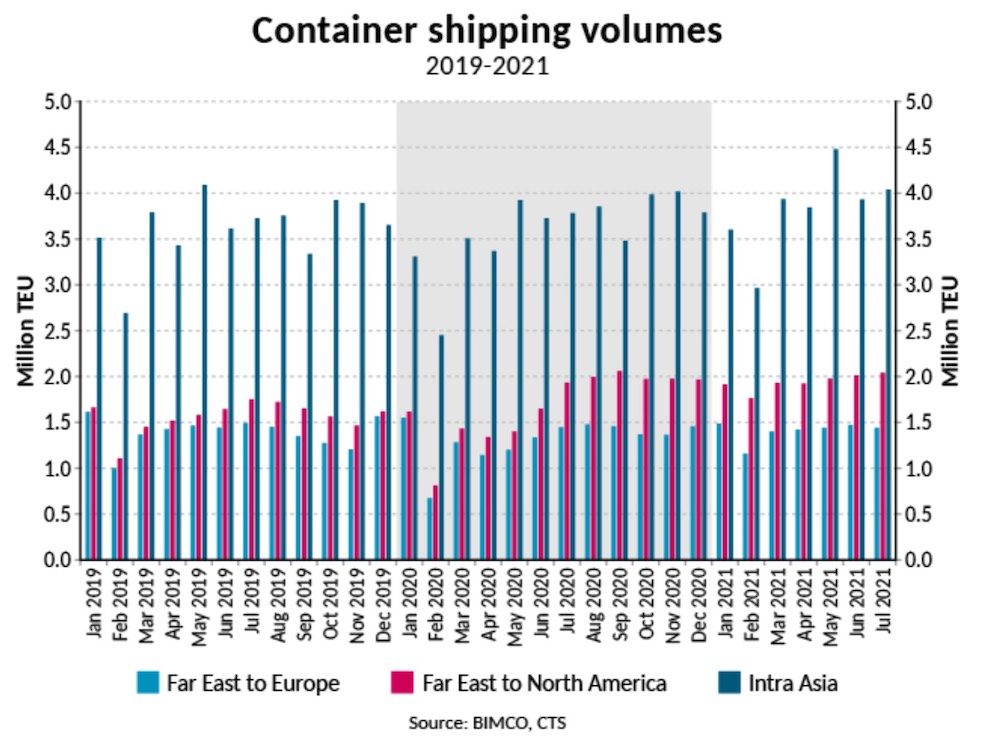

The median time spent by container vessels in port began to grow sharply in the second half of 2020, continuing into the first half of 2021. The median time spent in port in the first half of 2021 was higher by 11% compared to the pre-pandemic average time spent in port in 2018-2019, data from Sea-Intelligence shows. Global demand data published by Container Trade Statistics (CTS) was up 5.5% over the same period.

Flexport data yesterday showed that 16% of all ships on the transpacific are at anchor waiting for berth space to open up.

While the record queue outside the ports of Long Beach and Los Angeles – America’s two main maritime gateways – has received vast amounts of press coverage, the origin of much of these imports remains even more clogged.

Data from eeSea yesterday showed there were 168 container vessels waiting outside Shanghai and Ningbo, up from 137 vessels on Monday.

“Brace yourselves for the inevitable ripple effect through the system,” eeSea stated on a post on LinkedIn.