Japan’s Kawasaki Kisen Kaisha (K Line) has set out to become the world’s largest capesize operator, in the process reducing its exposure in the smaller bulker segments.

Japan’s third largest shipping line – with a total fleet in excess of 400 ships – held a global dry bulk conference at its headquarters in Tokyo recently where it mapped out a path to dominate the capesize sector.

At a press briefing in Tokyo covered by the Kaiji Press, Atsuo Asano, senior managing executive officer at K Line, said: “We will be looking to become the world’s number one capesize operator”.

On small to medium size bulkers, which have been losing the company money of late, Asano said the plan was to reduce the number of long-term fixed vessels from some 70 units at present to 30 units by around 2025.

The majority of the K Line cape fleet is on long-term charter at the moment with Asano saying he was keen to up the company’s spot exposure, something that is not typical of the conservative Japanese major shipping lines.

“Amid the declining demand for long-term transport contracts, we will respond more keenly than before to the demand for short- and medium-term transport demand,” Asano said.

At present, K Line operates about 110 capesizes of which 80 are either owned or long-time chartered vessels. The company currently charters about 20 vessels under contracts shorter than one year and about 10 vessels under spot contracts.

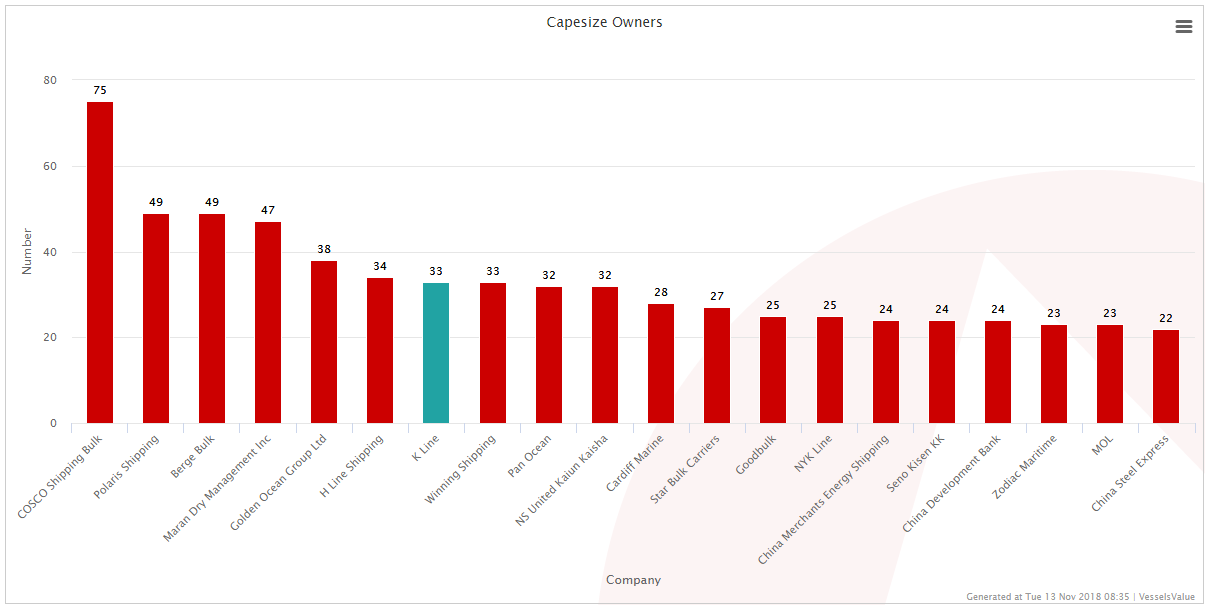

In terms of capes owned K Line is currently the largest name in Japan, but as the data from VesselsValue data below shows it is not even half the size of the world’s top cape owner, Cosco from China.