Liner shipping in 2022

Can liners improve their financials this year after a record breaking 2021? Is there a risk the market might implode? Splash asks the analysts for their container predictions.

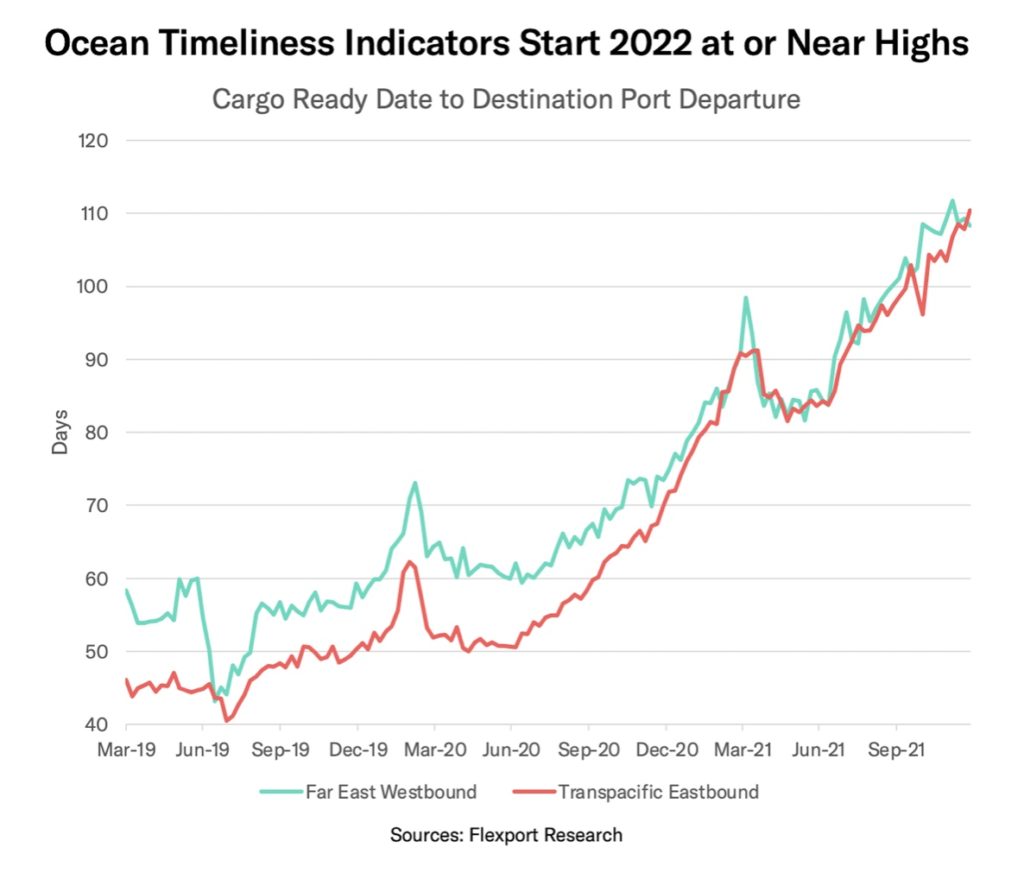

The opening days of the new year in the world of container shipping have been a continuation of the main themes that contributed to a record-breaking 2021. Covid-19-related delays, rates climbing to new highs and the general public increasingly conversant in all things shipping.

Can container shipping better its financial performance of last year where liners were tipped by consultants Drewry to have made a combined net profit in excess of $150bn?

Philip Damas, managing director at Drewry Shipping Consultants, says the volatility of spot rates will stay and that both spot and contract rates will not normalise until the current systemic market disruptions and crisis in container shipping, caused by the pandemic, reduce significantly.

I see a fundamental change in the DNA of the carriers

“The only certainty in the container shipping market today is that annual contract freight rates this year will be going up by more than 60% on the major routes, when compared with 2021 contract rates,” Damas predicts. Taking into account both spot rates and contract freight rates, average container shipping rates will see a further annual increase in 2022: the latest Drewry Container Forecaster expects an increase of 16% in 2022, following the doubling of rates in 2021.

In normal shipping cycles, rates would have eased post-peak season. Not today however as Alan Murphy, the CEO of Sea-Intelligence, points out. December 31 saw the Shanghai Containerized Freight Index (SCFI) pass the 5,000 point for the first time – and it has continued to rise in the first days of 2022.

“There are no indications that rates are dropping, placing a question mark on whether there is going to be a slack season at all,” Murphy says.

While global volumes are starting to slow, liner shipping still has to contend with very unbalanced flows dominated by US imports, and congestion getting worse.

Contract pricing

In terms of contract pricing, Murphy anticipates the spot/contract spread will remain “substantial” throughout 2022.

“Contract enforceability will be the name of the game,” Murphy says. “Even if shippers manage to sign contracts well below spot, the value of such contracts will be minimal if the carriers can drop them without serious penalty, in pursuit of a much more profitable spot market.”

Judah Levine, head of research at Freightos, expects spot rates to remain at current levels in the coming months.

“Even with a shift in consumer spending, low retail inventory levels will mean strong demand will keep volumes elevated between Chinese New Year and peak season 2022,” Levine predicts.

Peter Sand, chief analyst at Xeneta, warns that as container shipping remains pressed to the edge, any shocks could cause further increases either in base rates or surcharges.

“With the virus still spreading and China maintaining its zero-Covid strategy, more port shutdowns or other black swan events that would send spot rates upwards can’t be ruled out,” Sand says.

In terms of long-term contracts, Sand says shippers signing traditional contracts face two- and three-fold increases this year.

The long orderbook

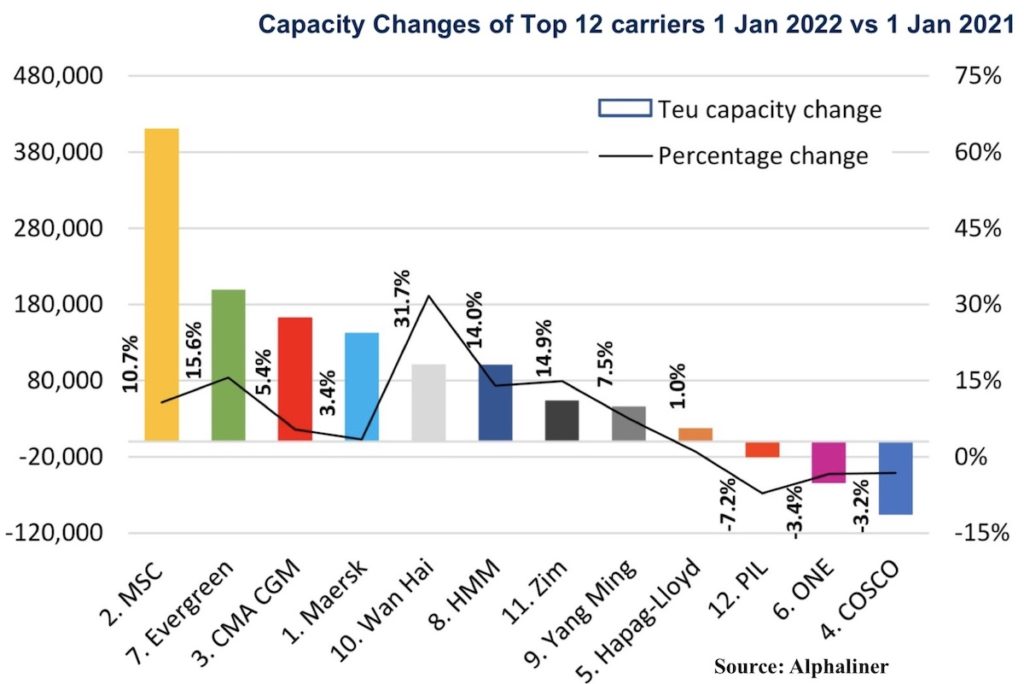

Much has been written of the record containership orderbook, but analysts polled by Splash are not concerned that this will dampen earrings prospects this year. 2023 is a different matter however.

The orderbook currently accounts for roughly 20% of the existing fleet, the same level seen before the market imploded in 2015-2016.

However, much has changed since then, most importantly the absence of competitive pressure from 20 global shipping lines, as well as a much greater level of carrier resolve.

Any meaningful impact is still 18 months away, argues John McCown, the founder of Blue Alpha Capital.

“Even with that orderbook, it would be a mistake to assume the market will swing back to excess capacity and do the things that have typically occurred in those situations,” McCown suggests, insisting carriers will be more disciplined in the future and more inclined to reduce capacity instead of reducing rates to fill that capacity.

The 2022 delivery numbers are likely to be similar to 2021, perhaps even less, says J Mintzmyer, lead researcher at Value Investor’s Edge, who goes on to point out that significant environmental regulations – EEXI and CII – will start kicking in by early 2023, which will synthetically reduce global supply by capping the engine speed limits of older tonnage.

“Nobody knows if the current supply challenges will have been resolved when the new vessels come on stream in 2023, but if carriers start to fear an oversupply situation, they have a long list of older vessels they can scrap to restore equilibrium, while arguing that they are doing so for sound environmental reasons,” says Murphy from Sea-Intelligence.

Brave new world?

So is this a brave new world for liner shipping, one where competitors do not destroy the party for everyone else or will the carriers revert to type when conditions ease up?

“As I look at all the data and facts now, I’m not sure that history will repeat itself as I see a fundamental change in the DNA,” suggests McCown from Blue Alpha, who worked with Malcom McLean, the creator of containerisation, for more than 20 years.

Quite so, concurs Murphy from Sea-Intelligence, a man who has often been quoted in the past, saying that carriers have an uncanny ability to snatch failure from the jaws of victory, something he concedes is no longer the case.

“For 10 years we have argued that carriers’ biggest challenge was a lack of resolve. I dare say they have found it now, and they have shown that they no longer have any reservation in dropping the ‘liner’ part of liner shipping if rates are coming under pressure,” Murphy says, referring to the dire schedule reliability of the carriers during the pandemic.

Drewry’s Damas is one analyst however willing to predict a crash of sorts, expecting the spot market to nosedive next year, albeit that the contract market will remain strong in 2023 given the new behaviour and capacity management of carriers.

For all the latest container shipping news from around the world, click here.