Liners brace for worst case scenario: $23.4bn combined full year losses

The latest Sunday Spotlight report from container advisory Sea-Intelligence paints a dark picture of the scale of losses the world’s top liners could suffer this year thanks to the spread of coronavirus.

As of yesterday, carriers had cancelled 212 sailings due to the pandemic – up from a mere two sailings only two weeks ago.

The actual number is likely to be higher as Sea-Intelligence does not have a detailed overview of blank sailings for smaller intra-regional services.

The volume loss alone from the blanked sailings will cost the top 15 carriers more than $6bn in 2020, rendering the industry loss-making in 2020, reversing the $5.9bn profit the top 15 carriers managed combined last year.

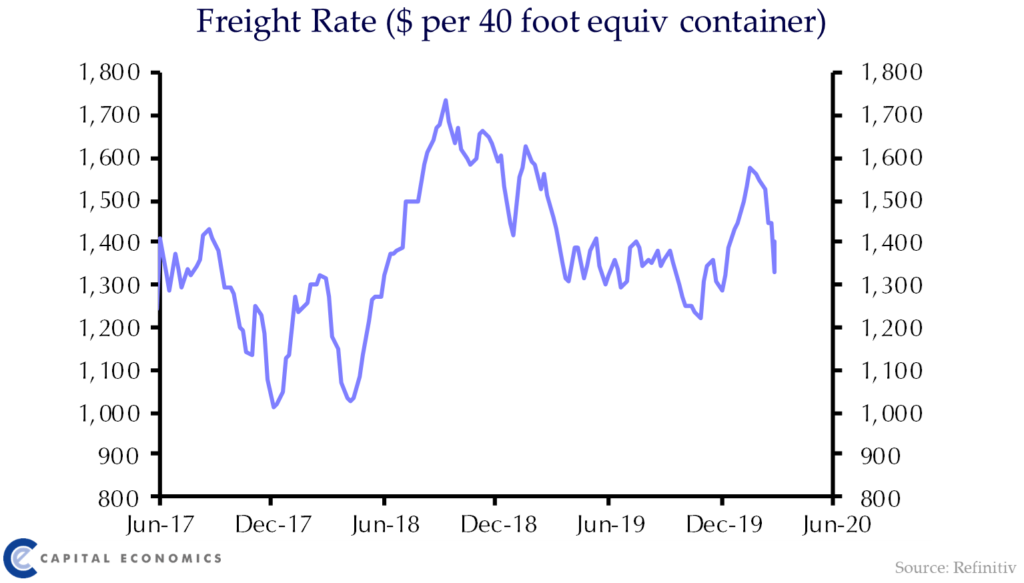

The report gets worse however with Sea-Intelligence warning that a failure to prevent a simultaneous rate collapse could lead to the liner industry losing a “staggering” $23bn in 2020.

In Sea-Intelligence’s worst case scenario where the 10% volume loss for the full year is combined with the same level of losses on rate levels as the carriers themselves reported in 2009, liners could lose an unprecedented $23.4bn in 2020. By comparison, the combined profits for the top 15 carriers for the past full eight-year period was $20.9bn.

A.P. Møller-Mærsk, viewed by many investors as a bellwether for shipping, has suspended its 2020 full year guidance over the unknown financial impact the coronavirus will have on the world’s largest container carrier.

Maersk had aimed for an EBITDA of $5.5bn this year, but despite a promising first quarter it has put annual projections on hold.

“The global COVID-19 pandemic severely impacts the global transport market and supply chains. This is leading to material uncertainties and lack of visibility related to the global demand for container transport,” the Danish company stated in a release on March 20.

Ratings agency Moody’s last month raised the spectre that liner shipping could be hit by another Hanjin Shipping style collapse.

In deciding on March 18 to change its forecast from stable to negative for shipping across all segments over the next 18 months, Moody’s said it expects the EBITDA of rated shipping companies to decline by around 6-10% in 2020 compared with EBITDA growth of almost 40% in 2019.

The EBITDA of shipping companies globally could decline by 25-30%, similar to levels last seen in 2016 when Hanjin Shipping went bankrupt in one of the largest bankruptcies experienced in shipping.

Container shipping was warned at the end of February, even before the full effects of the global coronavirus contagion had been factored in, that liner bankruptcies are highly likely. The potential for liner bankruptcy is at its strongest in the 10 years that US consultants AlixPartners have been tracking this specific data set in a report published on February 28.

In an ongoing poll carried on this site, container shipping is viewed by readers as the shipping sector set to suffer the most from the fallout brought about by coronavirus, with car carriers and dry bulk also polling high in the survey. Conversely, providing some succour to today’s hard-pressed liner executives, Splash readers believe the container shipping sector will be the shipping segment to experience the quickest recovery once the coronavirus outbreak recedes.

The coronavirus themed shipping survey is running though to the end of May. Voting takes as little as two minutes and there is no registration. To vote, click here.

In the short term will price be the major driver for shippers? For many i feel the capacity to get goods to destination with minimal delays / disruption will be key for many?

True sir

Working with PIL amongst top 10 shipping carrier