Liners warned to brace for 17m teu drop in volumes this year

With cases of coronavirus outside China accelerating fast, container shipping experts are having to rethink the full scale potential drop in the trade for 2020, with one well-known analyst suggesting the disease could see a total loss of 17m teu this year.

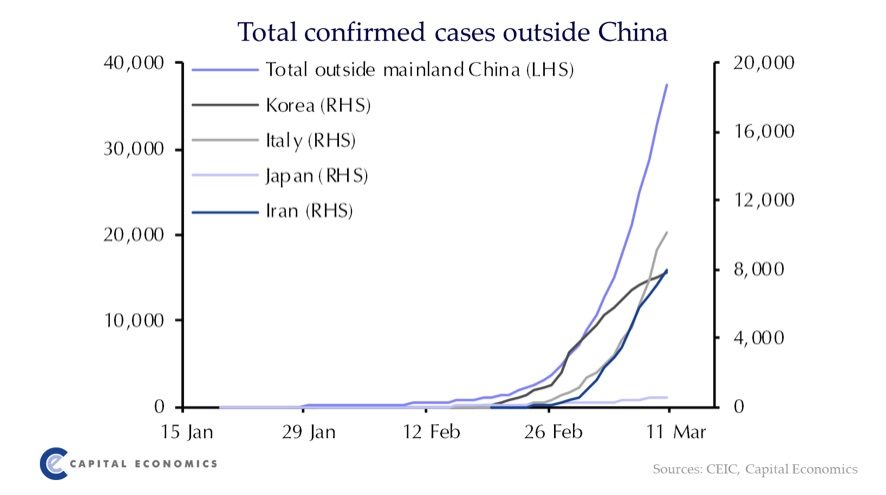

Latest data shows there are now 128,343 confirmed coronavirus cases, with an ever growing portion – now 37% – reported outside of China where the disease started.

Lars Jensen from Copenhagen-based SeaIntelligence Consulting wrote on LinkedIn yesterday of the potential 17m teu loss for liners and a consequent 80m teu loss for the world’s container terminals. Jensen made his forecast based on the industry suffering a 10% drop in business, as it did in the wake of the global financial crisis from 2008.

Andy Lane from CTI Consultancy backed the potential 10% shortfall, but reckoned the 80m teu figure for ports was around 10m too high. Also citing the 2008 financial crisis, Lane suggested the bounce back next year could be phenomenal.

“What we saw after 2008 was a huge spike in growth in 2010 to well beyond 2007 levels, and the effects of this current issue will ease faster,” Lane predicted, adding: “So it will be a tough year in 2020 for all, but maybe a nice 2021 ahead.”

Peter Sand, chief shipping analyst at shipowning organisation BIMCO, was more circumspect about the headline grabbing 10% figure.

“I don’t think that we will see a drop of 10%,” Sand told Splash. “Fingers crossed, the coronavirus will eventually stop, that point in time is likely to be faster than the financial crisis stopped terrorising the global economy. A cautious estimate could be anywhere between -1 to -5%.”

Splash columnist Kris Kosmala, a partner at supply chain advisory Click & Connect, reckoned that due to the unprecedented nature of the disease, any predictions will most likely be proven wrong.

“Any comparison to the financial crisis of 2008 is not good guidance, as trade and trade financing are not ceasing,” Kosmala said.

Consumers might be reluctant to venture out, but temporary quarantine measures, Kosmala stressed, ought not to equate to collapsing banks and credit crunch caused by slow reacting central bankers. Kosmala said that the ongoing trade wars could ultimately be the biggest drag on container volumes this year, not coronavirus.

“As the effects of the ongoing trade wars and the epidemic overlap, we will have a hard time distinguishing what is dropping as a result of what,” Kosmala observed.

Well said, Kris!