Lowest number of capesize deliveries since 2008

As well as the much reported scrapping in the big bulker sector Jeffrey Landsberg from Commodore Research points to limited newbuilds joining the fleet this year.

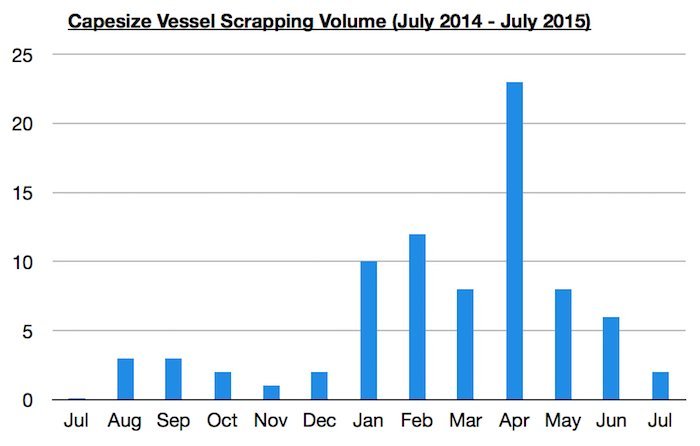

Capesize scrapping has received a great deal of attention this year, with scrapping volume having seen a dramatic shift in recent months. While the first four months of this year saw an average of 13 capesize vessels scrapped each month (with April seeing an amazing 23 capesize vessels scrapped), May saw “only” eight capesize vessels scrapped, June “only” six capesize vessels scrapped, and July only two capesize vessels scrapped.

However, what has still gone rather quietly under the radar is that capesize newbuilding delivery volume has been lower than the market anticipated when this year began. Before the year began, we saw predictions stating that as many as 150 capesize newbuildings would be delivered this year. That number appeared high to us, and at the beginning of this year we published our prediction that 105 to 125 capesize newbuildings would be delivered.

As this year has seen, however, only approximately 46 capesize newbuildings were delivered in the first half of this year. On an annualized basis, this works out to an annualized total of 92 capesize deliveries. However, there is a real chance that 2015 will end with having seen even less than 92 capes delivered. Historically, capesize newbuilding delivery volume (and all dry bulk newbuilding delivery volume) is largest during the first half of each year. Each year this decade has seen a larger amount of capesize newbuildings delivered during the first half of the year than during the second half of that year. 2014 saw approximately 59% of the year’s capesize newbuildings delivered in the first half of the year. 2013 saw approximately 60% of the year’s capesize newbuildings delivered during the first half of the year. 2012 saw approximately 69% of the year’s capesize newbuildings delivered in the first half of the year. 2011 saw approximately 53% of the year’s capesize newbuildings delivered in the first half of the year.

Overall, it is not being mentioned much that capesize newbuilding deliveries are a good deal lower than what was anticipated by the market at the start of this year. Changes in scrapping have been getting most, if not all, of the attention. However, we believe very strongly that there is a solid chance that even the low range of our 105 – 125 estimate for capesize newbuilding deliveries will not be seen this year. There is also a real chance that this year‘s total will come in at 92 or fewer capesize deliveries, which would mark the fewest amount of capesize newbuildings delivered seen since 2008.

Relatively low capesize newbuilding delivery volume, combined with this year’s robust capesize scrapping activity (we count 70 capes as having been scrapped so far this year), and the expected second half of the year surge in Brazilian and Australian iron ore exports all point to capesize rates seeing even more support in the second half of this year – particularly in Q4. We continue to expect that iron ore exports from Brazil and Australia’s Big Three (Rio Tinto, BHP, and FMG) will jump in the second half of this year by at least 78m tons from H1 2015’s total (2014 saw an H2 versus H1 jump of 71.2m tons). We remain bullish for Q4 capesize rate prospects as a result of this year’s smaller than expected newbuilding delivery volume, robust scrapping, and the anticipated seasonal strength in Australian and Brazilian iron ore shipments.

This article first appeared in the most recent issue of Maritime CEO magazine. Readers can access the full magazine for free online by clicking here.