Maersk’s place in liner shipping post-divorce

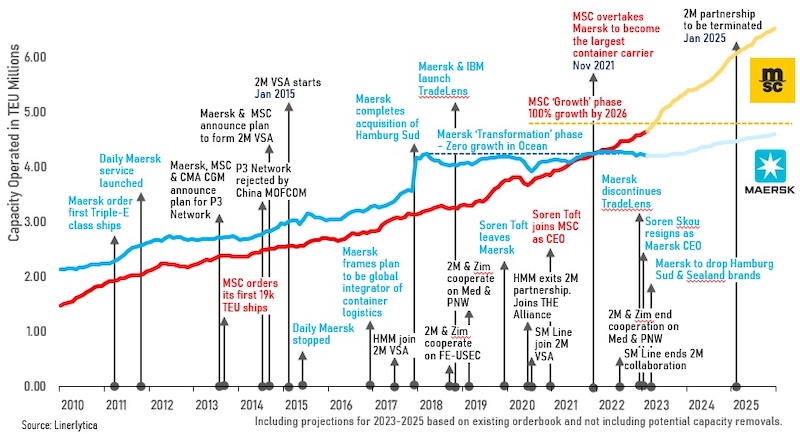

Maersk’s role on the main east-west tradelanes looks set to be as a lesser player once the dissolution of the 2M alliance with Mediterranean Shipping Co (MSC) comes into effect in January 2025.

Last month’s big container news that the two largest liners were to divorce has sparked plenty of conjecture about what 2M’s demise means for the wider alliance structure.

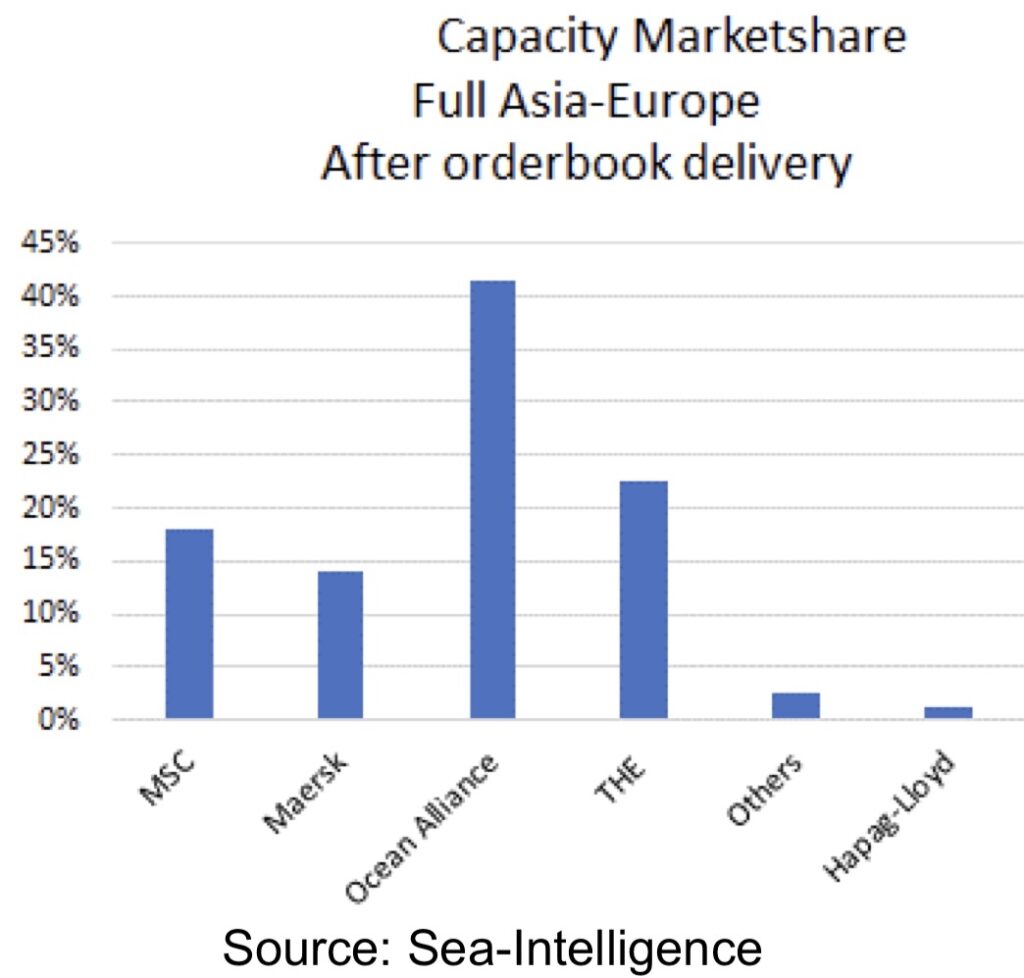

Analysts at Sea-Intelligence have crunched the numbers to show the operated capacity share based on the transpacific and the combined Asia-Europe/Mediterranean tradelanes.

Maersk has consistently said it aims to have a box fleet no larger than 4m to 4.3m teu. In the wake of the MSC split news, the Danish carrier has said it will not seek to join another alliance, rather pursuing certain vessel sharing agreements on some tradelanes.

On the transpacific, according to Sea-Intelligence, Maersk will clearly be the smallest of the major carriers and alliances, and with an operated capacity matching the combined niche carriers in the trade. MSC will be slightly smaller than THE Alliance while the Ocean Alliance will be in an “extremely strong position” in the market, according to the latest weekly report from Sea-Intelligence.

Looking at the Asia-Europe trade where North Europe and the Mediterranean are combined, there is a similar situation as on the Pacific, with the only exception that the small niche carriers play a very marginal role in this trade.

“It is clear that a separation of the 2M alliance will change the competitive situation,” Sea-Intelligence noted. “In very broad terms, we will see a market change from three major operators to a market of five operators, in which Maersk will clearly be the smallest player.”

Also busy analysing the 2M split has been British consultancy Drewry, who following interviews with Maersk, report in a new study that the Danish carrier has for some time been keen to get out of 2M, viewing it as incompatible with its five-year-old integrator strategy.

“The lack of autonomy on its network decisions was holding back progress of the masterplan,” Drewry noted.

As the focus has shifted from scale economies towards end-to-end solutions, Maersk said it needs to control its own network and have full ownership of service performance and reliability.

“If Maersk is right – that being an integrator within an alliance is unworkable – then companies with similar aspirations and in a similar situation, most obviously CMA CGM in the Ocean Alliance, will have to consider a break up of their own,” Drewry mused, suggesting the alliance era was coming to a close.

“It seems increasingly likely that the big-hitters will pursue single life, with the medium size operators remaining together out of necessity,” Drewry forecast.

Commenting via LinkedIn last month, former Maersk employee, Lars Jensen, who now heads up consultancy Vespucci Maritime, suggested the 2M news is only the beginning of a re-shaping of the alliance constellations on the major east-west trades.

“This will change the competitive dynamics on the major east-west trades for all major carriers, and clearly all carriers will take a close look at which threats and opportunities this will bring forth,” Jensen wrote, saying the joint announcement from Copenhagen and Geneva should be seen as the “first domino” of many to fall over in the next couple of years.